In macroeconomics, a sticky price refers to a price that does not adjust immediately to changes in supply or demand. For instance, wages in the labor market often exhibit sticky prices because contracts and negotiations prevent instant wage adjustments despite shifts in economic conditions. This rigidity can lead to unemployment when demand for labor falls but wages remain fixed. Another example of sticky prices is seen in the retail sector, where product prices are slow to change due to menu costs and customer expectations. Retailers may maintain stable prices even when input costs fluctuate to avoid frequent price adjustments. This behavior impacts overall inflation dynamics by causing slower price level changes in response to economic shocks.

Table of Comparison

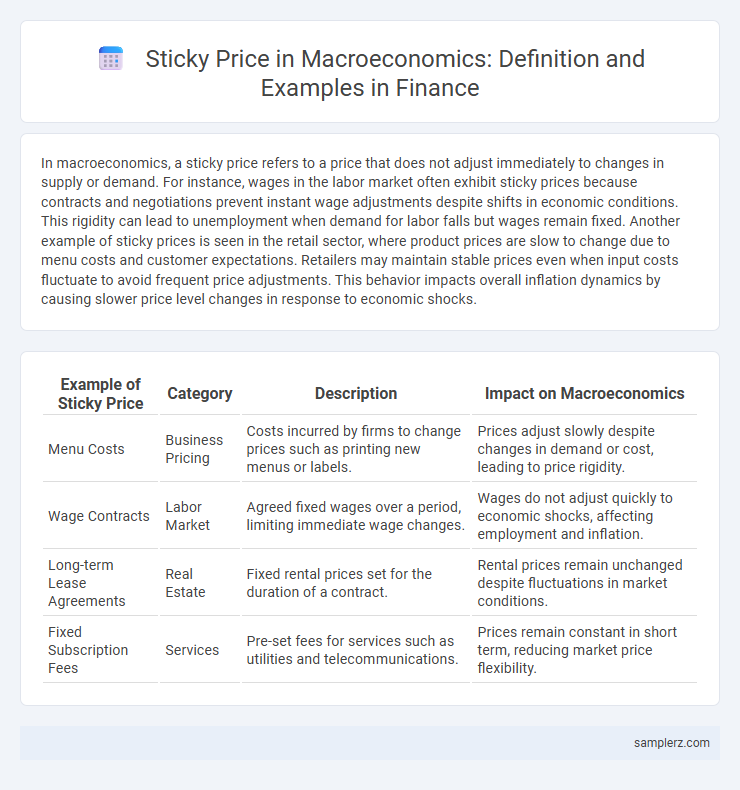

| Example of Sticky Price | Category | Description | Impact on Macroeconomics |

|---|---|---|---|

| Menu Costs | Business Pricing | Costs incurred by firms to change prices such as printing new menus or labels. | Prices adjust slowly despite changes in demand or cost, leading to price rigidity. |

| Wage Contracts | Labor Market | Agreed fixed wages over a period, limiting immediate wage changes. | Wages do not adjust quickly to economic shocks, affecting employment and inflation. |

| Long-term Lease Agreements | Real Estate | Fixed rental prices set for the duration of a contract. | Rental prices remain unchanged despite fluctuations in market conditions. |

| Fixed Subscription Fees | Services | Pre-set fees for services such as utilities and telecommunications. | Prices remain constant in short term, reducing market price flexibility. |

Introduction to Sticky Prices in Macroeconomics

Sticky prices in macroeconomics refer to the phenomenon where prices of goods and services remain rigid or slow to adjust despite changes in supply and demand. An example is wage contracts in labor markets, where nominal wages are fixed for a period, preventing immediate responses to economic shifts. This price rigidity can lead to market inefficiencies and affect monetary policy effectiveness.

Key Characteristics of Price Stickiness

Sticky prices in macroeconomics, such as wages and menu costs, exhibit key characteristics like slow adjustment and resistance to short-term market fluctuations. These prices tend to remain fixed despite changes in demand or supply due to contracts, information lags, and adjustment costs. Firms often face significant costs in changing prices frequently, leading to persistent price rigidity in sectors like labor markets and retail.

Menu Costs and Sticky Prices

Menu costs refer to the expenses businesses incur when changing prices, such as printing new menus or re-tagging items, causing firms to maintain sticky prices despite changing economic conditions. Sticky prices hinder market adjustments, leading to short-term non-neutrality of money and impacting inflation and output dynamics. Empirical studies show industries with higher menu costs demonstrate slower price adjustments, confirming the role of sticky prices in macroeconomic fluctuations.

Sticky Wages and Their Economic Impact

Sticky wages occur when nominal wages remain fixed despite changes in economic conditions, limiting labor market flexibility. This rigidity can lead to unemployment during recessions, as firms cannot reduce wages to match lower demand, causing layoffs instead. Sticky wages contribute to slower economic adjustments and prolonged periods of disequilibrium in the labor market.

Real-World Examples of Sticky Prices

Wage contracts in labor markets often exemplify sticky prices, as firms and workers negotiate fixed wages that do not adjust immediately to inflation or shifts in demand. Rent agreements for commercial and residential properties typically remain constant over lease terms, reflecting slow price adjustments despite fluctuations in market conditions. Retail gasoline prices also demonstrate stickiness, frequently remaining stable for days or weeks before responding to crude oil price changes.

Sticky Prices During Economic Recessions

Sticky prices during economic recessions manifest when firms resist lowering product prices despite decreased demand, causing sluggish market adjustments and prolonged downturns. For example, in the 2008 financial crisis, retailers often maintained prices to avoid damaging brand perception and profit margins, even as consumer spending contracted sharply. This price rigidity contributes to unemployment persistence and slower economic recovery by dampening the natural market correction process.

Case Study: Sticky Prices in the Housing Market

The housing market exemplifies sticky prices as home prices tend to adjust slowly despite shifts in demand or interest rates, largely due to high transaction costs and long negotiation periods. Research shows that during economic downturns, sellers are often reluctant to lower prices quickly, leading to price rigidity and prolonged market imbalances. Empirical data from the 2008 financial crisis highlights how sticky housing prices contributed to a sluggish recovery in the real estate sector.

Central Bank Policy and Sticky Prices

Central bank policies often influence sticky prices by adjusting interest rates to manage inflation without immediate changes in nominal wages or commodity prices. For example, when the Federal Reserve raises rates, businesses may delay adjusting prices due to menu costs and long-term contracts, illustrating price stickiness. This lag in price adjustment under sticky prices affects the transmission of monetary policy and overall macroeconomic stability.

Sticky Prices in the Goods vs. Services Sectors

Prices in the goods sector tend to be more flexible due to frequent adjustments influenced by global supply chains and competitive markets, while prices in the services sector exhibit greater stickiness because of long-term contracts, menu costs, and slower demand shifts. Studies show that service prices adjust infrequently, averaging changes every 9 to 12 months, compared to goods prices which adjust every 3 to 6 months on average. This price rigidity in services can contribute to prolonged inflation persistence and complicate monetary policy responses.

Implications of Sticky Prices for Inflation and Output

Sticky prices in macroeconomics refer to the slow adjustment of prices despite changes in demand or supply, often observed in sectors like wages and consumer goods. This rigidity can cause inflation to persist longer than expected, as firms hesitate to lower prices, which in turn dampens short-term output fluctuations due to slow price adjustments. Consequently, sticky prices contribute to economic inefficiencies by prolonging inflationary pressures and limiting the immediate response of output to monetary policy changes.

example of sticky price in macroeconomics Infographic

samplerz.com

samplerz.com