Stripping in treasury bonds refers to the process of separating a bond's principal and interest payments into individual zero-coupon securities. Each resulting security, called a "strip," represents either a single interest payment or the principal repayment, which can be sold separately in the market. This technique enables investors to target specific cash flows and manage interest rate risk more precisely within their portfolios. The U.S. Treasury offers Treasury STRIPS (Separate Trading of Registered Interest and Principal Securities) as a formal program for these stripped securities. Data shows that Treasury STRIPS are favored by investors seeking long-term, predictable cash flows without reinvestment risk. Treasury STRIPS enhance market liquidity and allow for detailed yield curve analysis by providing distinct maturities for coupon and principal payments.

Table of Comparison

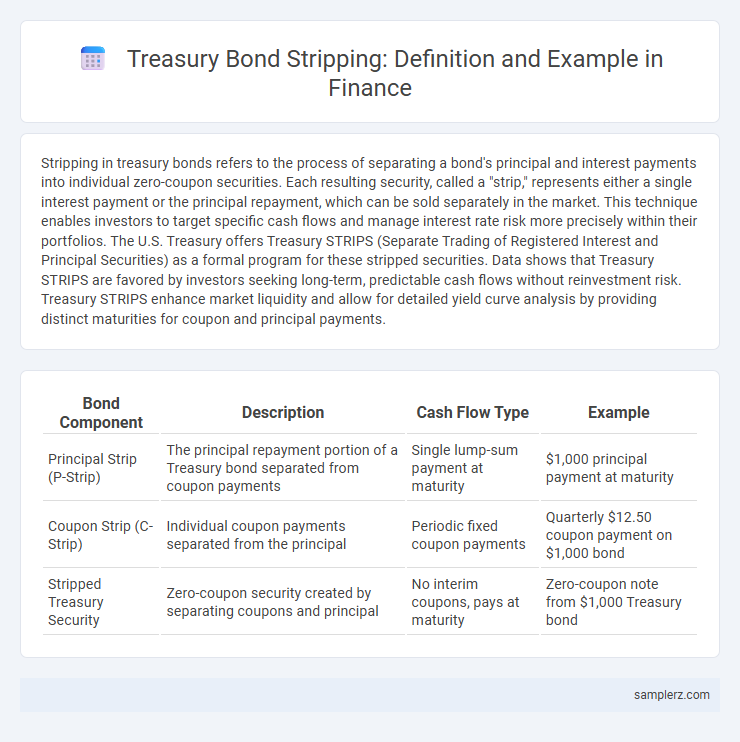

| Bond Component | Description | Cash Flow Type | Example |

|---|---|---|---|

| Principal Strip (P-Strip) | The principal repayment portion of a Treasury bond separated from coupon payments | Single lump-sum payment at maturity | $1,000 principal payment at maturity |

| Coupon Strip (C-Strip) | Individual coupon payments separated from the principal | Periodic fixed coupon payments | Quarterly $12.50 coupon payment on $1,000 bond |

| Stripped Treasury Security | Zero-coupon security created by separating coupons and principal | No interim coupons, pays at maturity | Zero-coupon note from $1,000 Treasury bond |

Understanding Treasury Bond Stripping

Treasury bond stripping involves separating a single Treasury bond into individual interest and principal components, creating zero-coupon securities called STRIPS (Separate Trading of Registered Interest and Principal of Securities). Investors benefit from predictable cash flows and tailored investment horizons by purchasing these stripped securities, which trade at a discount and mature at face value. This process enhances market liquidity and offers tax-efficient strategies for fixed-income portfolios.

The Process of Stripping Treasury Bonds

Stripping treasury bonds involves separating the bond's principal and interest payments into individual zero-coupon securities called STRIPS (Separate Trading of Registered Interest and Principal of Securities). Each interest payment and the final principal repayment become distinct securities that investors can trade separately, allowing targeted investment strategies and risk management. This process enhances liquidity and creates diversified fixed-income instruments tailored to specific maturity or cash flow needs.

Key Players in Treasury Bond Stripping

Key players in Treasury bond stripping include the U.S. Department of the Treasury, primary dealers, and large institutional investors such as pension funds and mutual funds, which facilitate the creation and trading of separate interest and principal components. Primary dealers act as intermediaries, purchasing whole bonds at auctions and then stripping them into interest-only (IO) and principal-only (PO) securities. Institutional investors leverage these stripped securities to manage interest rate risk, enhance portfolio diversification, and optimize cash flow timing.

Examples of Stripped Treasury Securities

Stripped Treasury securities, such as Treasury STRIPS, involve separating a Treasury bond into individual interest and principal components, which can be sold separately. For example, a $1,000 Treasury bond with semiannual coupons may be stripped into multiple zero-coupon securities, each representing a single coupon payment or the final principal repayment. Investors can purchase these zero-coupon strips to receive fixed payments at maturity, enabling targeted cash flow management and interest rate risk hedging.

Benefits of Stripping Treasury Bonds

Stripping Treasury bonds involves separating the bond's principal and interest payments into individual securities, allowing investors to tailor their portfolios with specific cash flow needs. This strategy enhances liquidity and provides tax efficiency by enabling investors to manage income recognition and reinvestment risk more effectively. Institutional investors benefit from stripped bonds' predictable payment schedules, optimizing asset-liability matching and reducing exposure to interest rate fluctuations.

Risks Associated with Stripped Bonds

Stripping treasury bonds involves separating the bond's principal and interest payments into individual zero-coupon securities, exposing investors to heightened interest rate risk and reinvestment risk due to the lack of periodic coupon payments. The absence of regular income increases sensitivity to market fluctuations and inflation, potentially leading to greater price volatility. Credit risk remains low given treasury backing, but liquidity risk may arise as stripped bonds are less commonly traded compared to standard treasury securities.

STRIPS vs. Traditional Treasury Bonds

STRIPS (Separate Trading of Registered Interest and Principal of Securities) transform traditional Treasury bonds by separating the interest and principal payments into individual zero-coupon securities, allowing investors to purchase specific cash flows. Unlike traditional Treasury bonds that pay semiannual coupons and return principal at maturity, STRIPS offer zero-coupon instruments that mature at face value, providing predictable, lump-sum payments without interim income. This structure enhances flexibility for portfolio management and duration targeting, especially for investors focused on long-term liabilities and immunization strategies.

Tax Implications of Stripped Securities

Stripping Treasury bonds creates separate interest and principal components that are taxed differently, with interest strips treated as ordinary income yearly despite no cash receipt. Principal strips, however, are not subject to annual income tax but generate capital gains upon sale or redemption. Investors must carefully consider these tax treatments to optimize after-tax returns and comply with IRS regulations.

Real-World Use Cases of Treasury STRIPS

Treasury STRIPS are utilized by institutional investors to tailor cash flow schedules, allowing precise matching of future liabilities such as pension payments or insurance claims. These zero-coupon securities enable portfolio diversification by isolating principal and interest components, facilitating targeted investment strategies. Moreover, STRIPS offer tax planning advantages and enhance liquidity management in fixed-income portfolios due to their predictable maturity values and interest accruals.

How to Invest in Stripped Treasury Bonds

Investing in stripped Treasury bonds involves purchasing separate interest and principal components of a Treasury security, known as STRIPS (Separate Trading of Registered Interest and Principal of Securities), through a brokerage account that offers access to these zero-coupon bonds. Investors benefit from clear cash flow visibility by holding either the discounted principal or interest payments, which mature at predetermined dates with fixed income guarantees from the U.S. government. To optimize returns and minimize risk, carefully analyze maturity dates, accrued interest, and tax implications before buying stripped Treasury securities.

example of stripping in treasury bond Infographic

samplerz.com

samplerz.com