Ringfencing in finance refers to the practice of isolating a subsidiary's assets and liabilities to protect them from risks associated with the parent company or other affiliates. An example is a bank creating a separate subsidiary to handle high-risk trading activities, ensuring that losses in this unit do not affect the core banking operations. This approach safeguards the parent company's financial stability and protects customer deposits from potential trading losses within the subsidiary. Another example involves utility companies forming ringfenced subsidiaries for regulated activities, such as electricity distribution, to comply with regulatory requirements and separate financial risks. Data on financial performance and liabilities of these subsidiaries are reported independently, enhancing transparency for regulators and investors. Ringfencing minimizes contagion risk, allowing the parent to manage different business risks distinctly and maintain overall corporate health.

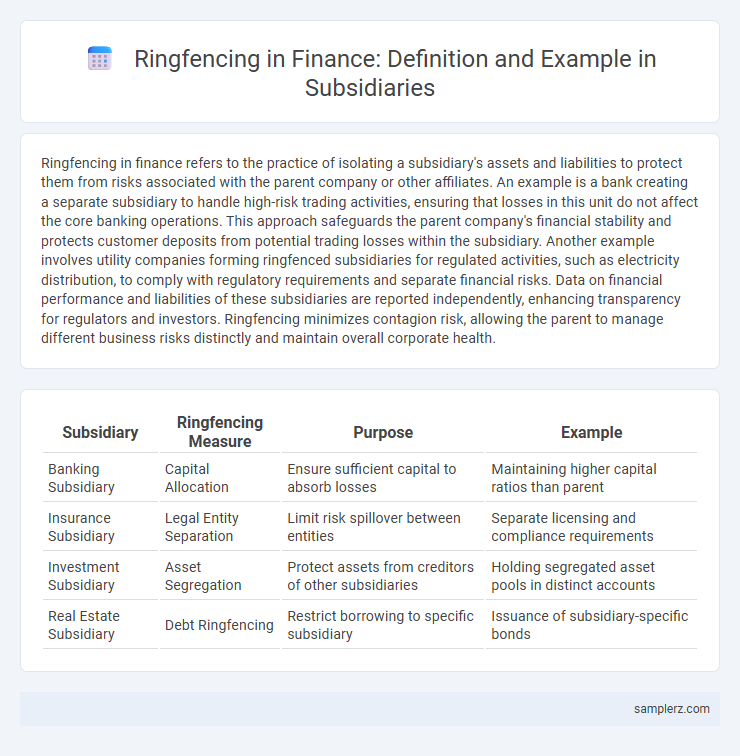

Table of Comparison

| Subsidiary | Ringfencing Measure | Purpose | Example |

|---|---|---|---|

| Banking Subsidiary | Capital Allocation | Ensure sufficient capital to absorb losses | Maintaining higher capital ratios than parent |

| Insurance Subsidiary | Legal Entity Separation | Limit risk spillover between entities | Separate licensing and compliance requirements |

| Investment Subsidiary | Asset Segregation | Protect assets from creditors of other subsidiaries | Holding segregated asset pools in distinct accounts |

| Real Estate Subsidiary | Debt Ringfencing | Restrict borrowing to specific subsidiary | Issuance of subsidiary-specific bonds |

Definition of Ringfencing in Finance

Ringfencing in finance refers to the practice of isolating a subsidiary's assets and liabilities to protect them from risks associated with the parent company or other subsidiaries. This legal and financial separation ensures that the subsidiary remains financially independent, safeguarding its operations and creditors in case of financial distress elsewhere in the corporate group. Typical examples include ringfencing regulated utilities or financial institutions to shield critical services from broader corporate risks.

Key Reasons for Ringfencing a Subsidiary

Ringfencing a subsidiary protects the parent company from financial risks by isolating liabilities and ensuring regulatory compliance, especially in highly regulated industries such as banking and insurance. It safeguards core assets, maintains credit ratings, and prevents contagion in case of subsidiary insolvency or operational failures. This strategic separation facilitates clearer financial reporting and preserves stakeholder confidence during economic uncertainties.

Regulatory Requirements for Subsidiary Ringfencing

Regulatory requirements for subsidiary ringfencing mandate that financial institutions separate specific assets and liabilities to protect the parent company from potential risks associated with the subsidiary's operations. This often involves maintaining distinct capital buffers, liquidity provisions, and risk management frameworks tailored to the subsidiary's activities, as seen in regulations like the EU's Bank Recovery and Resolution Directive (BRRD) and the UK's ring-fencing rules under the Financial Services Act 2012. Compliance ensures enhanced financial stability, limits contagion risk, and safeguards critical banking functions within diversified financial groups.

Real-World Example: UK Banking Subsidiaries

UK banking subsidiaries employ ringfencing by legally separating retail banking operations from riskier investment activities, safeguarding consumer deposits from potential losses in investment arms. The UK's Financial Services (Banking Reform) Act 2013 mandates this structure, requiring major banks like Barclays and HSBC to isolate their core retail services within distinct subsidiaries. This regulatory ringfencing enhances financial stability by limiting contagion risk and protecting everyday banking services during economic downturns.

Case Study: Ringfencing in the Energy Sector

A notable case study of ringfencing in the energy sector involves Enel, the Italian multinational energy company, which established its renewable energy subsidiary with separate financial and operational structures to isolate risks from its conventional fossil fuel operations. This strategic ringfencing enabled Enel to attract targeted green investments while safeguarding the parent company from potential liabilities associated with renewable asset volatility. The ringfenced subsidiary's distinct capital allocation and debt issuance improved transparency and investor confidence, facilitating capital inflows dedicated exclusively to sustainable energy projects.

Impact of Ringfencing on Parent Company Risk

Ringfencing a subsidiary effectively isolates financial and operational risks, preventing potential losses from directly affecting the parent company's balance sheet. This separation enhances the parent company's creditworthiness by limiting exposure to subsidiary liabilities and regulatory penalties. Consequently, ringfencing can stabilize the parent firm's overall risk profile, making it more attractive to investors and creditors.

Ringfenced Subsidiaries versus Non-Ringfenced Entities

Ringfenced subsidiaries are legally and financially isolated from their parent companies to protect critical assets and limit risk exposure, commonly seen in banking and insurance sectors. These subsidiaries have separate capital requirements, governance structures, and operational restrictions compared to non-ringfenced entities, ensuring the safeguarding of essential functions during financial distress. Non-ringfenced entities, in contrast, remain fully integrated within the parent company's risk profile, lacking the protective barriers that limit contagion effects in adverse scenarios.

Compliance Challenges in Maintaining Ringfenced Structures

Maintaining ringfenced structures in subsidiaries presents complex compliance challenges due to varying regulatory requirements across jurisdictions, which can complicate capital and liquidity management. Ensuring strict adherence to ringfencing mandates demands robust governance frameworks and comprehensive internal controls to prevent unauthorized capital transfers that could jeopardize financial stability. Continuous monitoring and reporting are essential to demonstrate compliance to regulators and to mitigate risks associated with operational spillovers between parent companies and ringfenced subsidiaries.

Lessons Learned from Global Ringfencing Practices

Global ringfencing practices demonstrate that establishing clear legal and operational boundaries within subsidiaries enhances financial risk containment and protects parent company assets. Lessons learned emphasize the importance of robust regulatory compliance frameworks and transparent intra-group transactions to prevent capital flight and ensure liquidity management. Effective ringfencing also relies on continuous monitoring and stress testing to adapt to evolving market conditions and regulatory changes.

Future Trends in Subsidiary Ringfencing Policies

Future trends in subsidiary ringfencing policies highlight increased regulatory scrutiny targeting enhanced capital segregation to mitigate systemic risks. Financial institutions are adopting advanced blockchain technologies to improve transparency and enforce compliance within subsidiary frameworks. Emphasis on stringent liquidity requirements and real-time risk monitoring is driving the evolution of ringfencing strategies to ensure operational resilience in volatile markets.

example of ringfencing in subsidiary Infographic

samplerz.com

samplerz.com