A sweeper in cash management is a financial tool used by businesses to enhance liquidity and optimize cash flow. It automatically transfers excess funds from a company's operating accounts into higher-interest accounts or investment vehicles at the end of each business day. This process helps corporations maximize returns on idle cash while ensuring sufficient funds remain available for daily operations. Mid-size and large enterprises utilize sweep accounts to efficiently manage their cash balances across multiple accounts. The sweeper mechanism analyzes daily cash inflows and outflows to maintain a target balance, sweeping surplus funds into interest-bearing accounts or paying down short-term debt. Data from cash flow statements and bank transactions are crucial for configuring sweep thresholds that align with a company's financial strategy.

Table of Comparison

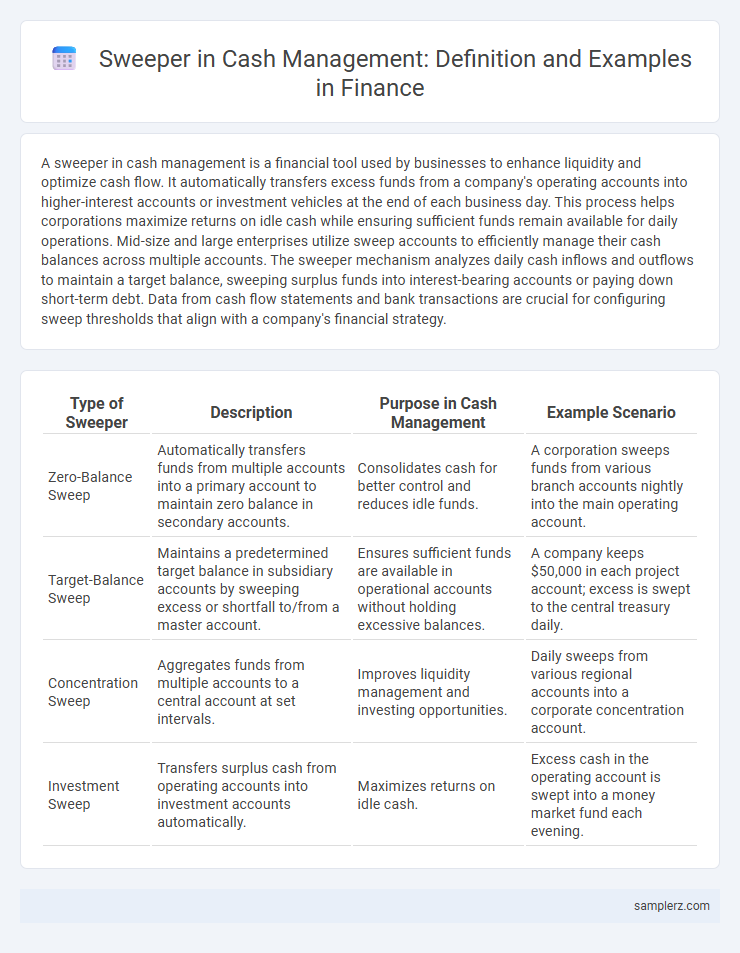

| Type of Sweeper | Description | Purpose in Cash Management | Example Scenario |

|---|---|---|---|

| Zero-Balance Sweep | Automatically transfers funds from multiple accounts into a primary account to maintain zero balance in secondary accounts. | Consolidates cash for better control and reduces idle funds. | A corporation sweeps funds from various branch accounts nightly into the main operating account. |

| Target-Balance Sweep | Maintains a predetermined target balance in subsidiary accounts by sweeping excess or shortfall to/from a master account. | Ensures sufficient funds are available in operational accounts without holding excessive balances. | A company keeps $50,000 in each project account; excess is swept to the central treasury daily. |

| Concentration Sweep | Aggregates funds from multiple accounts to a central account at set intervals. | Improves liquidity management and investing opportunities. | Daily sweeps from various regional accounts into a corporate concentration account. |

| Investment Sweep | Transfers surplus cash from operating accounts into investment accounts automatically. | Maximizes returns on idle cash. | Excess cash in the operating account is swept into a money market fund each evening. |

Understanding Sweeper Accounts in Cash Management

Sweeper accounts automatically transfer excess funds from a business's operating account to an investment or interest-bearing account, optimizing cash flow and maximizing returns. These accounts help companies maintain minimum balance requirements while minimizing idle cash, enhancing liquidity management. Efficient use of sweeper accounts reduces overdraft fees and improves overall financial stability by ensuring funds are effectively allocated.

Types of Sweeper Arrangements in Finance

Sweeper arrangements in cash management include zero balance accounts (ZBAs), where funds are automatically transferred to a master account to maintain a zero balance, and target balance sweep accounts that maintain a predetermined cash level by sweeping excess funds. Overnight sweeps transfer surplus balances into interest-bearing accounts or short-term investments, optimizing liquidity and maximizing return on idle cash. Notional pooling is another type, where balances of multiple accounts are aggregated to reduce borrowing costs and improve overall cash efficiency without physical transfers.

How Sweeper Mechanisms Work in Daily Banking

Sweeper mechanisms in cash management function by automatically transferring excess funds from a company's operating accounts to higher-interest investment accounts at the end of each business day, optimizing liquidity and maximizing returns. Banks monitor account balances continuously, triggering sweeps once predetermined thresholds are met, ensuring funds are not idle. This daily automation enhances cash flow efficiency and minimizes manual intervention in corporate banking operations.

Benefits of Using Sweepers for Corporate Cash Flow

Sweepers in cash management automatically transfer excess funds from subsidiary accounts to a central concentration account, optimizing corporate liquidity and minimizing idle cash. This process reduces borrowing costs by ensuring cash is efficiently utilized across the organization and enhances interest income through centralized investment opportunities. Improved cash visibility and streamlined fund allocation facilitate accurate forecasting and strategic financial planning.

Common Examples of Cash Sweeping in Practice

Common examples of cash sweeping in finance include the automatic transfer of excess funds from multiple subsidiary accounts into a central concentration account to optimize liquidity management. Businesses often implement sweeping to manage daily cash flows, ensuring idle balances are minimized and interest income maximized. Another typical use involves bridging short-term funding gaps by reallocating surplus cash from operational accounts to cover deficit positions within the same corporate group.

Sweeper vs. Zero Balance Account: Key Differences

A sweeper account automatically transfers excess funds from a primary account to a secondary account to maximize interest earnings or reduce idle cash. In contrast, a zero balance account (ZBA) maintains a zero balance by drawing exactly the required amount from a master account to cover disbursements. The key difference lies in fund allocation: sweepers move surplus funds periodically, while ZBAs operate with predetermined funding to ensure no balance remains.

Setting Up a Sweeper System: Step-by-Step Guide

Setting up a sweeper system in cash management involves linking multiple subsidiary accounts to a master account to automatically transfer excess funds at the end of each business day. The process begins by identifying target accounts and establishing transfer thresholds to ensure optimal liquidity without disrupting operational needs. Integrating real-time monitoring tools and coordinating with banking partners solidifies efficient fund consolidation, minimizing overdrafts and maximizing interest income.

Risks and Challenges of Sweeper Accounts

Sweeper accounts streamline cash management by automatically transferring excess funds into investment accounts or paying down debt, but they expose businesses to risks such as insufficient liquidity during unexpected cash flow shortages and errors in transfer timing. Unanticipated market volatility and operational mishaps may lead to overdrafts or missed financial obligations, intensifying exposure to penalties and credit downgrades. Effective risk management involves stringent oversight, accurate cash flow forecasting, and robust controls to mitigate potential challenges associated with sweeper account automation.

Automation Tools for Effective Cash Sweeping

Sweeper automation tools in cash management enable real-time monitoring and automatic transfer of excess funds between accounts, enhancing liquidity optimization and minimizing idle balances. These systems use predefined rules to trigger sweeps, ensuring timely consolidation of funds while reducing manual intervention and operational risks. Integration with enterprise resource planning (ERP) software and banking APIs facilitates seamless execution and comprehensive reporting for improved cash flow visibility.

Best Practices for Optimizing Sweeper Usage in Businesses

Implementing a sweeper in cash management helps businesses automatically transfer excess funds from operating accounts to interest-bearing accounts, maximizing liquidity and reducing idle cash. Best practices include setting customizable threshold levels for transfers, frequently analyzing cash flow patterns to adjust sweep parameters, and integrating sweeper systems with real-time banking platforms for seamless operations. Regular audits and monitoring ensure compliance and optimize fund utilization, ultimately enhancing overall financial efficiency.

example of sweeper in cash management Infographic

samplerz.com

samplerz.com