Netting in settlement refers to the process where multiple financial transactions between two or more parties are consolidated into a single payment obligation. This method reduces the number of individual cash flows, lowering transaction costs and minimizing settlement risk. For instance, in a derivatives market, if Party A owes Party B $1 million and Party B owes Party A $750,000, netting results in Party A making a single payment of $250,000 to Party B. This practice is common in clearinghouses and financial institutions to streamline settlement operations. By offsetting mutual obligations, netting improves liquidity management and enhances operational efficiency. The International Swaps and Derivatives Association (ISDA) frequently incorporates netting clauses in master agreements to legally bind parties to netted settlements.

Table of Comparison

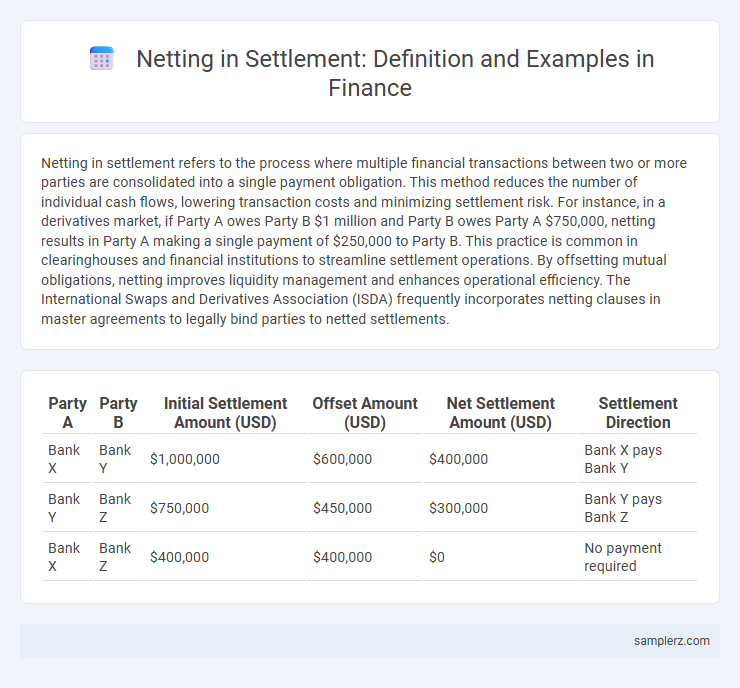

| Party A | Party B | Initial Settlement Amount (USD) | Offset Amount (USD) | Net Settlement Amount (USD) | Settlement Direction |

|---|---|---|---|---|---|

| Bank X | Bank Y | $1,000,000 | $600,000 | $400,000 | Bank X pays Bank Y |

| Bank Y | Bank Z | $750,000 | $450,000 | $300,000 | Bank Y pays Bank Z |

| Bank X | Bank Z | $400,000 | $400,000 | $0 | No payment required |

Introduction to Netting in Financial Settlements

Netting in financial settlements streamlines the process by offsetting mutual obligations between parties, reducing the total number of transactions and lowering counterparty risk. For example, in a multi-party trading environment, if Party A owes Party B $1 million and Party B owes Party A $700,000, netting results in a single payment of $300,000 from Party A to Party B. This practice enhances liquidity management and operational efficiency in clearinghouses, banks, and securities markets.

Key Principles of Netting Mechanisms

Netting mechanisms in settlement processes reduce counterparty risk by offsetting mutual obligations to determine a single net payment, enhancing liquidity efficiency in financial markets. Key principles include legal enforceability, which ensures binding netting arrangements under applicable jurisdiction laws, and multilateral netting, where multiple parties consolidate their transactions into a single net obligation. Risk mitigation and operational efficiency depend on standardized procedures and clear documentation to prevent settlement failures and minimize credit exposure.

Types of Netting Used in Financial Transactions

Types of netting used in financial transactions include bilateral netting, which involves offsetting mutual obligations between two parties to determine a single net payment, and multilateral netting, where multiple parties consolidate their payments and receipts into a single net sum. Settlement netting simplifies the clearing process by combining all transactions between parties on a specific date, reducing credit risk and enhancing liquidity management. Payment netting focuses on offsetting payment obligations to minimize the number of individual transactions, thereby decreasing operational costs and settlement risk.

Bilateral Netting: Definition and Example

Bilateral netting is a settlement process where two counterparties consolidate multiple financial obligations into a single net payment, reducing credit risk and settlement costs. For example, if Party A owes Party B $1 million and Party B owes Party A $700,000, the bilateral netting arrangement results in Party A paying Party B the net amount of $300,000. This technique is widely used in derivatives trading and interbank settlements to streamline cash flows and minimize counterparty exposure.

Multilateral Netting in Clearing Houses

Multilateral netting in clearing houses enhances financial efficiency by consolidating multiple bilateral obligations into a single net payment among all participants, reducing credit risk and liquidity requirements. Clearinghouses such as the Options Clearing Corporation (OCC) and the London Clearing House (LCH) use multilateral netting to streamline settlement processes and minimize systemic risk. This process significantly lowers the total value of transactions settled, optimizing capital usage across interconnected financial institutions.

Netting in Foreign Exchange Settlements

Netting in foreign exchange settlements reduces counterparty risk by offsetting multiple currency transactions into a single payment obligation, streamlining the settlement process. This process minimizes liquidity requirements and operational costs by consolidating payments, often through central counterparties or clearinghouses like CLS Bank. Effective netting improves cash flow management and enhances market efficiency in global FX trading.

Case Study: Netting in Securities Markets

In securities markets, netting reduces settlement risk by offsetting buy and sell transactions among multiple parties, ensuring only the net obligations are exchanged. For example, in a case study involving a clearinghouse, the netting process consolidated thousands of individual trades into a single net payment and delivery per participant, significantly lowering counterparty exposure. This streamlined settlement enhances liquidity and operational efficiency, minimizing the need for upfront capital and reducing systemic risk in financial markets.

Legal and Regulatory Considerations for Netting

Legal and regulatory considerations for netting in settlement ensure enforceability and reduce counterparty risk under frameworks like the ISDA Master Agreement and close-out netting provisions stipulated in financial regulations such as EMIR and Dodd-Frank. Jurisdictional recognition of netting agreements is critical, as insolvency laws must support netting to prevent value dissipation during default scenarios. Compliance with capital adequacy requirements and reporting obligations under Basel III further enhances risk management and regulatory oversight in netting operations.

Benefits and Risks of Netting in Settlements

Netting in settlement reduces the total number of transactions and outstanding positions, thereby lowering counterparty risk and enhancing liquidity management for financial institutions. This process streamlines cash flow, minimizes transaction costs, and improves operational efficiency during settlement cycles. However, netting introduces systemic risk if a large counterparty defaults, potentially leading to cascading failures without sufficient risk mitigation measures.

Future Trends in Netting and Settlement Technologies

Emerging trends in netting and settlement technologies include the integration of blockchain for enhanced transparency and efficiency, reducing counterparty risk in financial transactions. Real-time gross settlement systems are increasingly adopting artificial intelligence to optimize liquidity management and minimize settlement times. These technologies collectively drive faster, more secure netting processes, paving the way for a more resilient financial infrastructure.

example of netting in settlement Infographic

samplerz.com

samplerz.com