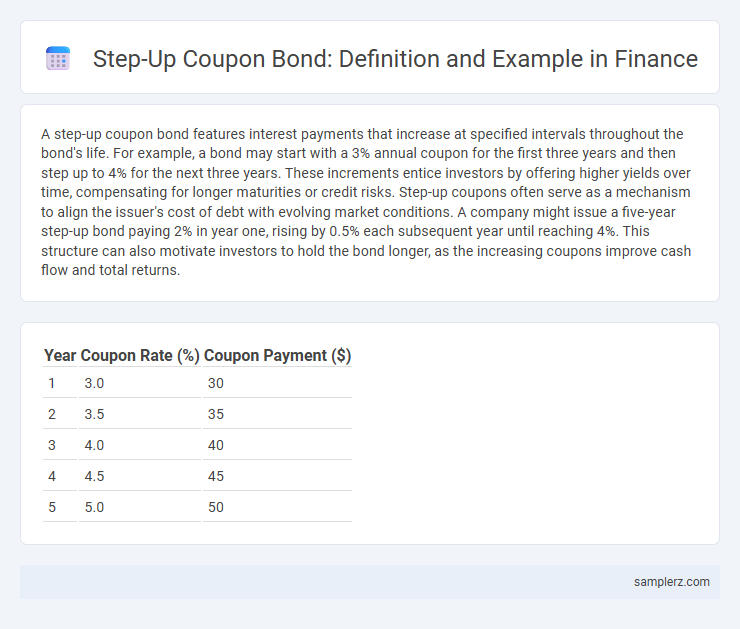

A step-up coupon bond features interest payments that increase at specified intervals throughout the bond's life. For example, a bond may start with a 3% annual coupon for the first three years and then step up to 4% for the next three years. These increments entice investors by offering higher yields over time, compensating for longer maturities or credit risks. Step-up coupons often serve as a mechanism to align the issuer's cost of debt with evolving market conditions. A company might issue a five-year step-up bond paying 2% in year one, rising by 0.5% each subsequent year until reaching 4%. This structure can also motivate investors to hold the bond longer, as the increasing coupons improve cash flow and total returns.

Table of Comparison

| Year | Coupon Rate (%) | Coupon Payment ($) |

|---|---|---|

| 1 | 3.0 | 30 |

| 2 | 3.5 | 35 |

| 3 | 4.0 | 40 |

| 4 | 4.5 | 45 |

| 5 | 5.0 | 50 |

Introduction to Step-Up Coupon Bonds

Step-up coupon bonds feature interest rates that increase at predetermined intervals, providing investors with rising income over the bond's lifetime. An example includes a bond issued with a 3% coupon rate for the first two years, stepping up to 5% for the subsequent three years, aligning payments with anticipated inflation or credit improvements. This structure attracts investors seeking gradual income growth and protection against interest rate risk during the bond term.

How Step-Up Coupons Work in Bond Structures

Step-up coupons in bond structures involve predetermined periodic increases in the bond's interest rate, enhancing investor returns over time. These coupon increments are typically scheduled at specific intervals, such as every few years, reflecting changes in market interest rates or issuer risk profiles. This mechanism provides issuers flexibility in managing debt costs while offering investors compensation for potential interest rate risks.

Real-Life Example of a Step-Up Coupon Bond

A notable example of a step-up coupon bond is the Tesla 5.3% Step-Up Notes due 2025, which initially offered a 5.3% coupon rate that increases by 0.25% annually until maturity. This structure appeals to investors seeking rising income over time, reflecting Tesla's confidence in improving cash flow. Step-up coupons provide a mechanism for issuers like Tesla to attract investors by gradually increasing interest payments as the company's financial outlook strengthens.

Key Features of Step-Up Coupon Bonds

Step-up coupon bonds feature periodic increases in interest payments at predetermined intervals, providing investors with higher yields over time to compensate for potential inflation or credit risk changes. These bonds typically include fixed initial coupon rates followed by step-up rates, enhancing income predictability and inflation protection. The escalating coupon structure benefits issuers by allowing lower initial interest costs and investors seeking rising cash flows during the bond's life.

Advantages of Investing in Step-Up Coupon Bonds

Step-up coupon bonds offer investors increasing interest payments over time, which can provide protection against rising inflation and interest rate environments. This structured growth in coupon rates enhances income stability and can attract investors seeking predictable yet gradually improving returns. Such bonds often reduce reinvestment risk, making them a strategic choice for long-term portfolios aiming to balance income and capital preservation.

Potential Risks Associated with Step-Up Coupon Bonds

Step-up coupon bonds feature increasing interest rates over time, exposing investors to reinvestment risk as higher coupons may coincide with fluctuating market interest rates. The complexity of their structure can lead to liquidity risk, making it challenging to sell the bond before maturity without a potential loss. Credit risk remains critical, as issuers with deteriorating credit profiles may struggle to meet higher coupon payments, increasing the likelihood of default.

Step-Up Coupon Bonds vs. Fixed-Rate Bonds

Step-up coupon bonds feature interest rates that increase at predetermined intervals, providing investors with rising income streams aligned with inflation or credit improvements. These bonds contrast with fixed-rate bonds, which maintain a constant coupon regardless of market or issuer conditions, offering predictable but potentially less lucrative returns. The structured increase in step-up coupons can enhance yield and reduce reinvestment risk compared to static fixed-rate bond payments.

Investor Profile Suited for Step-Up Coupon Bonds

Step-up coupon bonds feature increasing interest payments over time, making them ideal for investors seeking predictable income growth and protection against inflation. These bonds suit retirees or conservative investors who prefer a gradual rise in cash flow without reinvesting interest. Investors with a medium to long-term horizon benefit from the step-up structure as it compensates for interest rate volatility and potential credit risk.

Tax Implications of Step-Up Coupon Payments

Step-up coupon bonds increase their interest payments at predetermined intervals, affecting the investor's taxable income by causing fluctuations in reported interest earnings. Tax implications vary depending on whether the step-up payment is treated as interest income or a return of principal, which influences the timing and amount of taxable income. Investors should consult tax regulations to accurately report these payments and optimize their tax liabilities.

Recent Step-Up Coupon Bond Issuances in the Market

Recent step-up coupon bond issuances have gained traction as issuers seek to attract investors with gradually increasing interest payments over the bond's tenure. For example, a $500 million corporate step-up bond issued in 2023 began with a 3% coupon rate, escalating by 0.5% every two years, incentivizing long-term holding while aligning with rising interest rate environments. Market data show growing demand for such bonds due to their structured yield enhancement and mitigation of reinvestment risk amid economic uncertainty.

example of step-up coupon in bond Infographic

samplerz.com

samplerz.com