A forward rate agreement (FRA) in interest rate is a contract between two parties to exchange interest payments on a specified principal amount at a predetermined future date. The agreement sets the interest rate to be paid or received on the principal for a set period, helping companies hedge against interest rate fluctuations. For instance, a company expecting to borrow $1 million in six months can enter into an FRA to lock in the interest rate today, avoiding uncertainty. The FRA specifies the contract rate, notional principal, and the settlement date. On the settlement date, the difference between the agreed forward rate and the prevailing market rate on a designated reference rate, such as LIBOR or SOFR, is calculated. This settlement amount is then exchanged between the parties to offset interest rate risk, enabling financial planning and risk management.

Table of Comparison

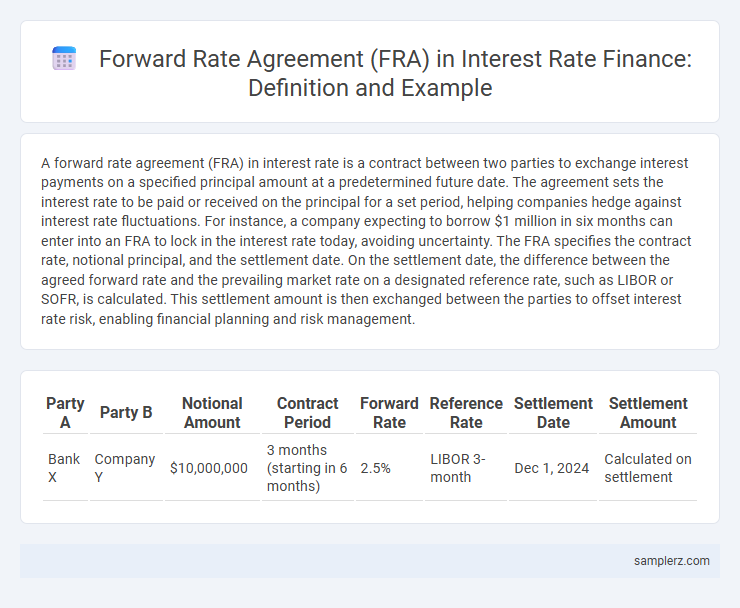

| Party A | Party B | Notional Amount | Contract Period | Forward Rate | Reference Rate | Settlement Date | Settlement Amount |

|---|---|---|---|---|---|---|---|

| Bank X | Company Y | $10,000,000 | 3 months (starting in 6 months) | 2.5% | LIBOR 3-month | Dec 1, 2024 | Calculated on settlement |

Understanding Forward Rate Agreements (FRAs) in Interest Rate Markets

A Forward Rate Agreement (FRA) is a financial contract between two parties to lock in an interest rate on a notional loan amount for a future period, typically between one and six months. For instance, a company anticipating borrowing $1 million in three months might enter into a 3x6 FRA to secure a fixed interest rate today, mitigating the risk of rising rates. This agreement settles the difference between the contracted forward rate and the prevailing market rate at the contract's start date, providing a hedge against interest rate fluctuations.

Key Components of a Forward Rate Agreement

A Forward Rate Agreement (FRA) in interest rate trading involves key components such as the notional principal, the agreed-upon fixed interest rate, and the contract period, which defines the start and end dates for the interest calculation. The settlement date is when the difference between the agreed fixed rate and the prevailing market floating rate is exchanged, settled in cash without principal exchange. These elements enable parties to hedge against interest rate fluctuations by locking in financing costs or investment returns in advance.

How Forward Rate Agreements Work: Step-by-Step Example

A Forward Rate Agreement (FRA) allows two parties to lock in an interest rate for a future period, protecting against interest rate fluctuations. For example, Company A and Bank B agree on a 3-month FRA starting in 6 months at a fixed interest rate of 5%. When the contract matures, if the market rate is higher than 5%, Bank B pays the difference to Company A, and if it's lower, Company A pays Bank B, settling the net difference based on the notional principal.

Calculating Settlement Amount in a Forward Rate Agreement

In a Forward Rate Agreement (FRA), the settlement amount is calculated by determining the difference between the contracted forward interest rate and the actual reference rate at the contract's settlement date. The formula used is: Settlement Amount = Notional Principal x (Forward Rate - Reference Rate) x (Days/360) / (1 + Reference Rate x Days/360). This payment compensates the party paying the fixed rate or receiving the floating rate based on the net interest differential for the agreed period.

Practical Example: FRA Between Two Banks

A Forward Rate Agreement (FRA) between two banks typically involves Bank A agreeing to pay Bank B a fixed interest rate on a notional principal for a specified future period, while Bank B pays Bank A a floating rate based on a reference index like LIBOR. For example, if Bank A expects interest rates to rise, it locks in a fixed rate of 3% for a three-month period starting in six months, while Bank B takes the floating rate risk. At the FRA settlement date, the difference between the agreed fixed rate and the actual floating rate is exchanged, allowing both banks to hedge against interest rate fluctuations efficiently.

Hedging Interest Rate Risk Using FRAs

A company expecting to borrow $10 million in six months can enter a forward rate agreement (FRA) to lock in the current six-month interest rate, mitigating the risk of rising rates. By agreeing on a fixed rate today, the FRA settles the difference between the contracted rate and the market rate at the start of the borrowing period, providing cash flow certainty. This hedging strategy protects against interest rate volatility and stabilizes borrowing costs.

Real-World FRA Application: Corporate Treasury Scenario

A corporate treasury uses a forward rate agreement (FRA) to hedge against rising short-term interest rates on a loan scheduled to start in six months. By locking in an interest rate today, the company eliminates uncertainty about future borrowing costs, ensuring predictable cash flow and budgeting accuracy. This real-world FRA application safeguards the firm's financial stability amid fluctuating market rates.

FRA Valuation: An Illustrative Case

A forward rate agreement (FRA) valuation hinges on comparing the contracted forward interest rate with the prevailing market rate at the settlement date to determine the payoff. For example, if the FRA rate is 3% for a notional principal of $1 million over a 3-month period starting in six months, and the actual market rate at that future date is 2.5%, the difference of 0.5% applied to the notional principal and discounted back to the valuation date defines the FRA's value. This valuation process enables counterparties to hedge interest rate risk or speculate on future rate movements effectively.

Comparing FRAs to Interest Rate Swaps: Real Examples

A Forward Rate Agreement (FRA) involves two parties agreeing on an interest rate to be paid or received on a notional amount at a future date, often used for hedging short-term interest rate exposure. For example, a company anticipating a rate increase in 3 months might enter a 3x6 FRA to lock in today's 3-month interest rate payable in 3 months, contrasting with an Interest Rate Swap (IRS) where cash flows are exchanged over multiple periods, such as a 5-year swap exchanging fixed for floating rates. Comparing FRAs to IRSs reveals that FRAs provide a cost-effective tool for managing single-period interest rate risk, while swaps offer flexibility and duration, ideal for longer-term interest rate exposure management.

Common Mistakes in FRA Transactions and How to Avoid Them

Common mistakes in forward rate agreement (FRA) transactions include miscalculating the notional principal, neglecting the impact of interest rate fluctuations, and failing to accurately determine the settlement date. Traders often overlook the importance of precise contract specifications, which can result in financial losses or disputes. To avoid these errors, rigorous contract review, accurate interest rate modeling, and regular communication between counterparties are essential for successful FRA execution.

example of forward rate agreement in interest rate Infographic

samplerz.com

samplerz.com