Backpricing in commodities occurs when a buyer agrees to pay a price for a commodity after the delivery date, often based on a previously agreed benchmark. For instance, a gold buyer and seller finalize a transaction where the buyer commits to pay the spot price as of the delivery date, despite agreeing on terms beforehand. This practice allows both parties to manage price volatility and align payments with market conditions at the time of delivery. In petroleum trading, backpricing is common when crude oil is delivered under contracts that settle prices based on future benchmark averages, such as Brent crude. The buyer takes physical delivery but pays according to the price established days or weeks later, enabling hedging against price fluctuations. Data from commodity exchanges often reflect backpricing through adjustments in the final payment that correspond to market index movements during the contract's price determination period.

Table of Comparison

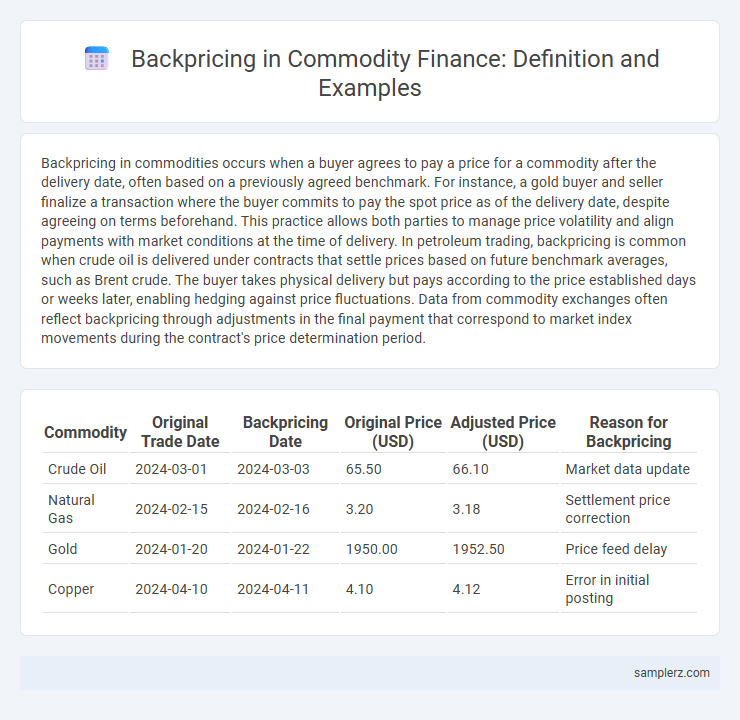

| Commodity | Original Trade Date | Backpricing Date | Original Price (USD) | Adjusted Price (USD) | Reason for Backpricing |

|---|---|---|---|---|---|

| Crude Oil | 2024-03-01 | 2024-03-03 | 65.50 | 66.10 | Market data update |

| Natural Gas | 2024-02-15 | 2024-02-16 | 3.20 | 3.18 | Settlement price correction |

| Gold | 2024-01-20 | 2024-01-22 | 1950.00 | 1952.50 | Price feed delay |

| Copper | 2024-04-10 | 2024-04-11 | 4.10 | 4.12 | Error in initial posting |

Understanding Backpricing in Commodity Markets

Backpricing in commodity markets occurs when trade prices are adjusted retroactively to reflect prevailing market conditions, often due to delays in price discovery or settlement processes. This practice helps align contract values with fluctuations in supply, demand, and geopolitical events impacting commodities like oil or metals. Understanding backpricing enables traders and risk managers to accurately assess position values and manage exposure in volatile markets.

Key Features of Backpricing Transactions

Backpricing transactions in commodity markets enable buyers to lock in a purchase price after receiving the goods, typically used to hedge against price fluctuations. Key features include deferred pricing agreements, flexibility in timing for price determination, and risk transfer mechanisms that protect both buyers and sellers from adverse market movements. These transactions often incorporate settlement terms based on market indices or benchmarks, ensuring transparent and fair valuation.

Real-World Example: Backpricing in Crude Oil Trade

Backpricing in crude oil trade occurs when a buyer negotiates a purchase price based on historical settlement prices rather than current market rates, often during periods of price volatility. For instance, in the 2020 oil price crash, companies locked in contracts using backpricing to capitalize on earlier, higher prices despite spot prices plunging below zero. This strategy helps traders manage risk and secure more favorable financial terms amid fluctuating commodity markets.

Backpricing in Agricultural Commodities: A Case Study

Backpricing in agricultural commodities occurs when a buyer agrees to pay a price set after the delivery of goods, often based on future market prices or indices. In a notable case study involving wheat trading, farmers delivered their grain first and received payment later, with prices adjusted according to the market value at the sale date, exposing them to significant price volatility risk. This practice helps manage cash flow but requires careful risk assessment due to fluctuating commodity prices in markets like CBOT (Chicago Board of Trade).

How Backpricing Impacts Commodity Pricing Strategies

Backpricing in commodity markets occurs when transactions are recorded at prices different from the market price at the time of execution, often influenced by delayed settlement or retrospective contract adjustments. This practice impacts commodity pricing strategies by creating challenges in price discovery, leading to potential misalignment between supply costs and current market conditions. Firms must incorporate backpricing risk into their hedging models and pricing algorithms to maintain accurate valuation and profit margin optimization.

Backpricing vs. Fixed Pricing: A Comparative Example

Backpricing in commodities involves adjusting transaction prices after the initial trade to reflect updated market values, often used when final settlement prices are uncertain, unlike fixed pricing where the price is predetermined and locked in regardless of market fluctuations. For example, in crude oil contracts, backpricing allows buyers and sellers to settle prices based on the average market price at delivery, reducing risk from volatile spot prices, whereas fixed pricing sets a constant rate agreed upon at the contract's start. This comparison highlights backpricing's flexibility in managing price risk, contrasting with the certainty and potential risk exposure inherent in fixed pricing agreements.

Risks Associated with Backpricing: An Illustrative Scenario

Backpricing in commodity trading exposes firms to significant risks such as price volatility and liquidity constraints when settling trades based on historical prices rather than current market rates. For instance, an oil producer agreeing to backprice its supply contract during a period of stable prices may face unexpected losses if crude prices sharply decline before settlement, leading to a mismatch in cash flows. This scenario illustrates how backpricing can amplify market risk, credit risk, and operational risk, ultimately affecting profitability and financial stability.

Step-by-Step Example of a Backpricing Deal

A backpricing deal in commodities involves setting the commodity price at a later date based on market conditions at the time of delivery rather than at the contract signing. For example, a buyer and seller agree in January to transact 1,000 barrels of crude oil with payment locked to the price on March 31; when March 31 arrives, the agreed price is determined by the oil market closing price, allowing the buyer or seller to benefit from favorable market movements. This method mitigates price risk and provides flexibility, commonly used in agribusiness or energy sectors where commodity prices fluctuate significantly.

Backpricing and Hedging: Practical Applications

Backpricing in commodity markets involves adjusting contract prices retrospectively based on prevailing market prices to align with hedging strategies and manage risk exposure effectively. Traders and producers use backpricing to lock in profits or minimize losses by matching physical commodity transactions with futures contracts, ensuring price stability despite market fluctuations. This method enhances precision in hedging by allowing adjustments that reflect real-time market conditions, improving overall portfolio performance and financial forecasting.

Lessons Learned from Real-Life Backpricing Examples

Backpricing in commodity trading highlights the critical importance of accurate market data and timing in trade settlements, as illustrated by cases where delayed price confirmations led to substantial financial discrepancies. Traders experience significant risk exposure when backpricing results in valuations inconsistent with actual market movements, emphasizing the need for robust risk management systems. These real-life examples demonstrate that integrating automated pricing tools and establishing clear cut-off times can mitigate errors and enhance pricing accuracy in commodity markets.

example of backpricing in commodity Infographic

samplerz.com

samplerz.com