A swaption is a financial derivative that grants the holder the right, but not the obligation, to enter into an interest rate swap agreement at a specified future date. This instrument allows investors to hedge against or speculate on changes in interest rates by locking in swap rates in advance. For example, a company anticipating rising interest rates may purchase a payer swaption, giving it the right to pay a fixed rate and receive a floating rate in the future. Swaptions are commonly used by institutional investors and corporations to manage interest rate exposure and optimize debt portfolios. The pricing of swaptions depends on factors such as the underlying swap rate, volatility, time to expiration, and prevailing market conditions. By using swaptions, entities can effectively control risk and enhance financial flexibility in interest rate environments.

Table of Comparison

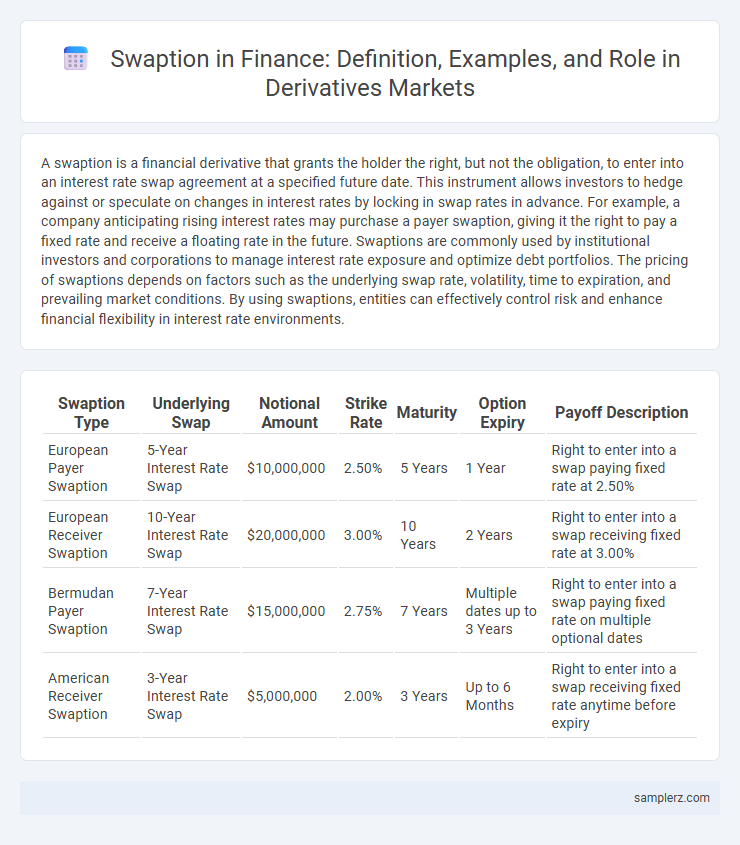

| Swaption Type | Underlying Swap | Notional Amount | Strike Rate | Maturity | Option Expiry | Payoff Description |

|---|---|---|---|---|---|---|

| European Payer Swaption | 5-Year Interest Rate Swap | $10,000,000 | 2.50% | 5 Years | 1 Year | Right to enter into a swap paying fixed rate at 2.50% |

| European Receiver Swaption | 10-Year Interest Rate Swap | $20,000,000 | 3.00% | 10 Years | 2 Years | Right to enter into a swap receiving fixed rate at 3.00% |

| Bermudan Payer Swaption | 7-Year Interest Rate Swap | $15,000,000 | 2.75% | 7 Years | Multiple dates up to 3 Years | Right to enter into a swap paying fixed rate on multiple optional dates |

| American Receiver Swaption | 3-Year Interest Rate Swap | $5,000,000 | 2.00% | 3 Years | Up to 6 Months | Right to enter into a swap receiving fixed rate anytime before expiry |

Introduction to Swaptions in Derivatives

Swaptions, or swap options, grant the holder the right but not the obligation to enter into an interest rate swap at a predetermined fixed rate on a specified future date. These financial derivatives are widely used in interest rate risk management to hedge against fluctuations or to speculate on changes in interest rates. Market participants, including banks and hedge funds, leverage swaptions to optimize exposure to swaps while maintaining flexibility in their trading strategy.

Key Features of Swaption Contracts

Swaption contracts grant the holder the right, but not the obligation, to enter into an interest rate swap at a predetermined date and rate, providing flexibility in managing interest rate exposure. Key features include the option premium paid upfront, the exercise style (European, American, or Bermudan), and the underlying swap details such as notional amount, fixed rate, and tenor. These contracts play a critical role in hedging interest rate risk, enabling customized financial strategies for corporations and institutional investors.

Types of Swaptions: Payer vs Receiver

A payer swaption grants the holder the right to enter into an interest rate swap as the fixed-rate payer, benefiting when interest rates rise. Conversely, a receiver swaption gives the holder the right to become the fixed-rate receiver, profiting from falling interest rates. These two primary types of swaptions serve as strategic tools for managing interest rate risk and optimizing derivative portfolios.

Practical Swaption Example in Interest Rate Management

A practical example of a swaption in interest rate management involves a corporate treasurer purchasing a payer swaption to hedge against rising interest rates on future debt issuance. By paying a premium for the right to enter an interest rate swap as the fixed-rate payer, the company secures cost certainty and protection if market rates increase. This strategic use of swaptions mitigates interest rate exposure, enhancing financial stability and optimizing debt service costs.

Swaption Pricing: An Illustrative Scenario

In swaption pricing, a common example involves valuing a payer swaption that gives the holder the right to enter an interest rate swap as the fixed-rate payer. The Black model is frequently applied, using inputs such as the current forward swap rate, strike rate, time to expiry, volatility of the swap rate, and discount factors derived from the yield curve. Accurate modeling of these parameters enables precise estimation of the swaption's premium, reflecting potential future interest rate movements and embedded optionality.

Real-world Use Case: Corporate Swaption Hedging

A corporate swaption enables companies to hedge interest rate risk by locking in future borrowing costs through an option to enter into an interest rate swap. For instance, a corporation anticipating debt issuance in six months can purchase a payer swaption to secure a fixed rate, protecting against rising interest rates. This derivative tool effectively manages cash flow volatility and optimizes financial planning in volatile markets.

Swaption Strategies in Risk Management

Swaption strategies in risk management provide financial institutions with valuable tools to hedge interest rate exposures and manage portfolio volatility effectively. Utilizing payer or receiver swaptions allows firms to secure favorable terms on future interest rate swaps, optimizing cash flows and mitigating potential losses from adverse market movements. Implementing strategic timing and strike prices in swaption contracts enhances flexibility and precision in adjusting risk profiles aligned with changing market conditions.

Case Study: Swaption in Mergers and Acquisitions

A swaption allows companies involved in mergers and acquisitions to hedge interest rate risk by securing the option to enter into an interest rate swap at a future date, providing flexibility amid fluctuating market conditions. In a notable case study, a corporation acquiring a target firm utilized a payer swaption to lock in fixed borrowing costs, protecting against rising interest rates during the transaction period. This strategic use of swaptions mitigated financing uncertainty and enhanced capital structure stability throughout the M&A process.

Swaption Execution: Step-by-Step Example

A swaption execution begins with the buyer paying a premium to acquire the right, but not the obligation, to enter into an interest rate swap at a future date. Upon exercise, the swaption holder initiates the predetermined interest rate swap, exchanging fixed for floating rate payments based on the agreed notional principal. The valuation involves discounting expected cash flows using the prevailing yield curve and volatility to determine the swaption's fair value.

Summary of Swaption Applications in Finance

Swaptions serve as versatile instruments in finance for managing interest rate risk and enhancing portfolio hedging strategies. Market participants use swaptions to secure the right to enter into swap agreements, enabling precise control over future cash flows and interest rate exposure. This flexibility supports activities such as yield curve positioning, risk mitigation in bond portfolios, and speculative strategies on rate movements.

example of swaption in derivative Infographic

samplerz.com

samplerz.com