Shelf registration in finance refers to a regulatory process allowing a company to register a new issue of securities without selling the entire issue at once. For example, a technology firm may file a shelf registration statement with the Securities and Exchange Commission (SEC) to offer up to $500 million in bonds over a period of three years. This approach gives the company the flexibility to time the market and issue securities when conditions are favorable. In an actual offering, a pharmaceutical company might utilize shelf registration to sell common stock incrementally. After receiving SEC clearance, the company can issue shares in multiple tranches without filing separate registration statements for each sale. Data from recent market activities indicate that shelf registrations streamline capital raising while maintaining compliance with regulatory requirements.

Table of Comparison

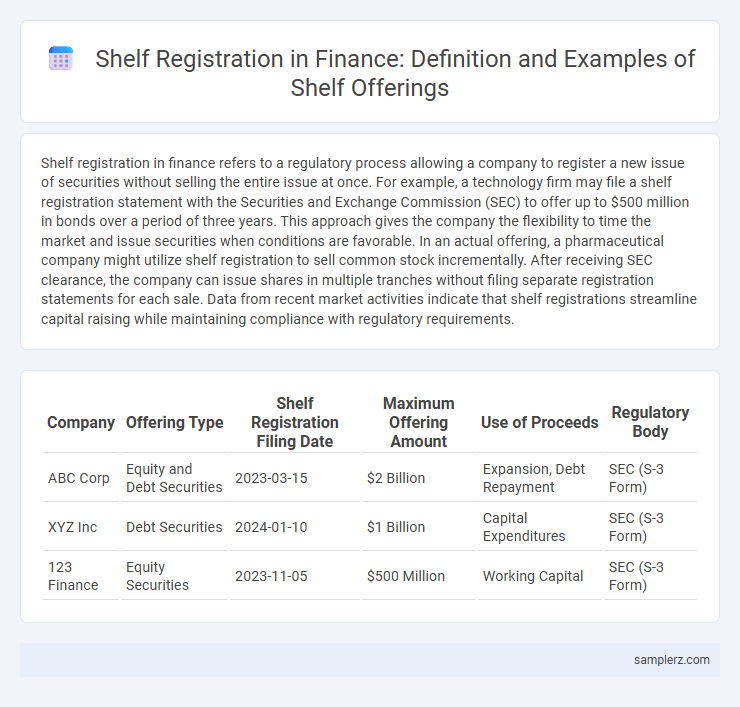

| Company | Offering Type | Shelf Registration Filing Date | Maximum Offering Amount | Use of Proceeds | Regulatory Body |

|---|---|---|---|---|---|

| ABC Corp | Equity and Debt Securities | 2023-03-15 | $2 Billion | Expansion, Debt Repayment | SEC (S-3 Form) |

| XYZ Inc | Debt Securities | 2024-01-10 | $1 Billion | Capital Expenditures | SEC (S-3 Form) |

| 123 Finance | Equity Securities | 2023-11-05 | $500 Million | Working Capital | SEC (S-3 Form) |

Introduction to Shelf Registration in Finance

Shelf registration in finance allows companies to register a new issue of securities without selling the entire issue at once, streamlining the capital-raising process. It enables firms to access capital markets quickly by offering securities over a multi-year period under a single registration statement filed with the SEC. This flexibility reduces regulatory delays and costs, supporting efficient financial planning and fundraising strategies.

Key Features of Shelf Registration Offerings

Shelf registration offerings enable companies to register a new issue of securities without immediately selling the entire issue, allowing flexibility in timing and market conditions. Key features include the ability to offer multiple securities over a period, reduced administrative burden by filing a single registration statement, and the potential to respond quickly to capital needs or favorable market opportunities. This streamlined process enhances efficiency and reduces costs compared to traditional registration, supporting strategic financial planning.

Real-World Examples of Shelf Registration

Real-world examples of shelf registration include Apple Inc.'s $5 billion offering announced in 2020, allowing the tech giant to quickly access capital markets without immediate issuance. Another notable case is Ford Motor Company's $10 billion shelf registration in 2021, enabling flexible debt issuance to support operational needs amid market volatility. These examples illustrate how large corporations leverage shelf registration to enhance financial agility and optimize capital structure management.

Case Study: Shelf Registration by Major Corporations

Major corporations like Apple and General Electric utilize shelf registration to streamline capital raising by pre-registering securities with the SEC, enabling rapid issuance when market conditions are favorable. This method reduces regulatory delays and offers flexibility in timing and sizing offerings, optimizing financial strategy. Shelf registration supports large-scale financing needs by allowing companies to issue various securities, including bonds and stocks, over an extended period without repeated registration.

Shelf Registration vs. Traditional Public Offerings

Shelf registration allows companies to register a new issue of securities without selling the entire issue at once, providing flexibility and faster access to capital markets. Traditional public offerings require the full registration and immediate sale of securities, often leading to longer regulatory delays and market timing challenges. Shelf registration streamlines capital raising by enabling issuers to offer securities in multiple tranches over a specified period, adapting to market conditions more efficiently than traditional offerings.

Regulatory Framework Governing Shelf Registration

The regulatory framework governing shelf registration is primarily established by the U.S. Securities and Exchange Commission (SEC) under Rule 415 of the Securities Act of 1933, which permits issuers to register a new issue of securities without selling the entire issue at once. This framework requires comprehensive disclosure documents that remain effective for up to three years, enabling issuers, including corporations and investment funds, to adjust their offering pace according to market conditions. Compliance with continuous reporting obligations and periodic updates ensures transparency and protects investors while facilitating capital raising with greater flexibility.

Recent Trends in Shelf Registration Offerings

Recent trends in shelf registration offerings highlight increased utilization by technology firms and emerging startups seeking expedited capital access. Regulatory adjustments by the SEC have facilitated more flexible shelf registration procedures, enabling companies to register securities without immediate issuance. Data from 2023 indicates a 15% rise in shelf registrations compared to prior years, reflecting market preference for streamlined securities offerings.

Advantages of Using Shelf Registration for Issuers

Shelf registration offers issuers the advantage of faster access to capital markets by allowing them to register securities in advance and sell them incrementally over a period, typically up to three years. This flexibility reduces the time and cost associated with multiple securities offerings and helps issuers respond quickly to favorable market conditions. Additionally, shelf registration provides issuers with the ability to strategically time their offerings to maximize fundraising efficiency while minimizing market disruption.

Steps Involved in Executing a Shelf Registration

Shelf registration begins with filing a registration statement with the Securities and Exchange Commission (SEC), allowing a company to offer multiple securities over time without re-filing. After SEC review and comment resolution, the registration becomes effective, enabling the company to sell portions of the registered securities during the expiration period, typically up to three years. Continuous disclosure requirements, including updated financial statements and material event reports, must be maintained throughout the shelf registration lifecycle to ensure compliance and investor transparency.

Impact of Shelf Registration on Capital Raising Strategies

Shelf registration allows companies to register a new issue of securities without selling the entire issue at once, facilitating flexible capital raising aligned with market conditions. This strategic tool enhances liquidity management by enabling issuers to time offerings to capitalize on favorable investor demand and market volatility. The availability of shelf registration reduces issuance costs and improves access to capital markets, ultimately optimizing financial planning and enhancing shareholder value.

example of shelf registration in offering Infographic

samplerz.com

samplerz.com