A poison pill is a defense strategy used by companies to prevent hostile takeovers by making the company less attractive to potential acquirers. One common example involves issuing new shares to existing shareholders at a discount, diluting the ownership interest of the acquiring company. This tactic increases the cost and complexity of the takeover, discouraging unwanted bidders from pursuing the acquisition. In a notable case, Netflix adopted a poison pill in 2012 when activist investor Carl Icahn acquired a significant stake in the company. Netflix authorized a shareholder rights plan allowing existing shareholders to purchase additional shares at a discount if any single investor crossed a 10% ownership threshold. This move effectively limited Icahn's ability to increase his stake and take control, protecting Netflix from a hostile takeover.

Table of Comparison

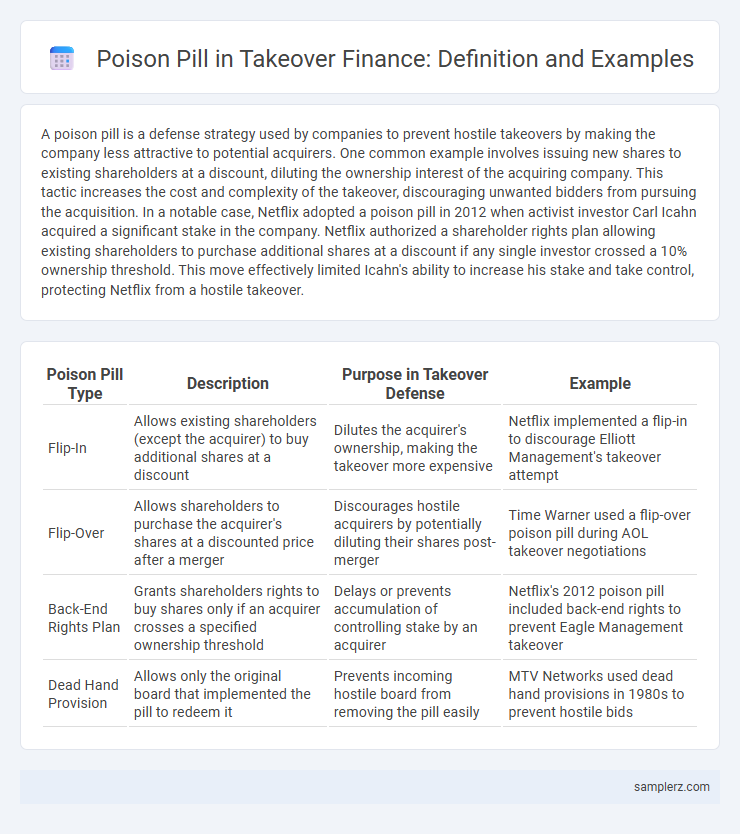

| Poison Pill Type | Description | Purpose in Takeover Defense | Example |

|---|---|---|---|

| Flip-In | Allows existing shareholders (except the acquirer) to buy additional shares at a discount | Dilutes the acquirer's ownership, making the takeover more expensive | Netflix implemented a flip-in to discourage Elliott Management's takeover attempt |

| Flip-Over | Allows shareholders to purchase the acquirer's shares at a discounted price after a merger | Discourages hostile acquirers by potentially diluting their shares post-merger | Time Warner used a flip-over poison pill during AOL takeover negotiations |

| Back-End Rights Plan | Grants shareholders rights to buy shares only if an acquirer crosses a specified ownership threshold | Delays or prevents accumulation of controlling stake by an acquirer | Netflix's 2012 poison pill included back-end rights to prevent Eagle Management takeover |

| Dead Hand Provision | Allows only the original board that implemented the pill to redeem it | Prevents incoming hostile board from removing the pill easily | MTV Networks used dead hand provisions in 1980s to prevent hostile bids |

Understanding Poison Pills in Corporate Takeovers

A poison pill is a defensive strategy used by a target company during a hostile takeover to dilute the value of its shares, making the acquisition more expensive and less attractive. Typically, the company issues new shares or grants existing shareholders the right to purchase additional stock at a discount, triggering significant dilution for the potential acquirer. This tactic effectively deters unwanted takeover attempts by increasing the financial burden and complexity for the bidder.

Types of Poison Pills: Flip-In vs. Flip-Over

Poison pills in finance serve as defensive strategies against hostile takeovers by diluting the value of shares when triggered. The flip-in poison pill allows existing shareholders, excluding the acquirer, to purchase additional shares at a discount, thereby reducing the acquirer's ownership percentage. Conversely, the flip-over poison pill permits shareholders to buy the acquirer's shares after a merger at a discounted rate, discouraging the takeover by diluting the acquirer's stock value.

Notable Poison Pill Examples in Finance History

In 1985, the famous PepsiCo poison pill thwarted a hostile takeover attempt by the Greyhound Corporation by allowing existing shareholders to purchase additional shares at a discount, diluting the acquirer's stake. Another notable example is Netflix's 2012 poison pill that activated when Carl Icahn accumulated more than 10% of shares, preventing an unwanted takeover. These strategic defensive measures have become pivotal in protecting companies from aggressive acquisition bids in finance history.

The Netflix Poison Pill Defense Against Carl Icahn

The Netflix poison pill defense against Carl Icahn involved issuing rights to existing shareholders, allowing them to purchase discounted shares if any single investor acquired more than 10% of the company's stock, effectively diluting Icahn's stake to prevent a hostile takeover. This strategy increased the cost of acquisition, deterring Icahn's attempt to gain controlling interest without board approval. Netflix's use of the poison pill highlights a classic shareholder rights plan designed to maintain management control during aggressive takeover bids.

Yahoo’s Use of Poison Pill Strategy in Microsoft’s Pursuit

Yahoo implemented a poison pill strategy during Microsoft's 2008 takeover attempt by issuing preferred stock rights to existing shareholders, diluting Microsoft's potential stake and making the acquisition prohibitively expensive. This tactic effectively thwarted Microsoft's bid by triggering protective measures that restricted the accumulation of shares beyond a certain threshold. The move preserved Yahoo's independence by increasing the cost and complexity of the hostile takeover.

Airgas and the Long-Term Poison Pill Protection

Airgas implemented a poison pill strategy during its takeover bid to deter hostile acquisitions, specifically by adopting a long-term poison pill plan that limited shareholder rights to purchase additional shares upon a triggering event. This mechanism effectively increased the cost and complexity for any potential acquirer, safeguarding Airgas from unsolicited takeover attempts. The long-term poison pill protection demonstrated a robust defense, preserving shareholder value by maintaining Airgas's independence until a more favorable acquisition proposal emerged.

The Papa John’s Poison Pill: Preventing Hostile Takeover

The Papa John's poison pill involved issuing rights to existing shareholders that allowed them to purchase additional shares at a discount if a single investor acquired more than 10% of the company. This tactic effectively diluted the potential acquirer's stake, increasing the cost of a hostile takeover and protecting the board's control. By implementing this shareholder rights plan, Papa John's aimed to deter aggressive acquisition attempts while safeguarding long-term shareholder value.

Williams Companies: A Modern Poison Pill Case Study

Williams Companies implemented a modern poison pill strategy during its hostile takeover attempt by El Paso Corporation in 2011, issuing rights enabling existing shareholders to purchase additional stock at a discount, diluting the acquirer's stake. This defense mechanism effectively thwarted El Paso's advance by increasing the cost and complexity of the acquisition. The Williams Companies case exemplifies how contemporary poison pill tactics serve as powerful tools in protecting corporate autonomy during aggressive takeover bids.

How Twitter Adopted a Poison Pill Facing Elon Musk’s Bid

Twitter adopted a poison pill strategy in response to Elon Musk's bid by allowing existing shareholders to purchase additional shares at a discount, diluting Musk's potential ownership above 15%. This shareholder rights plan aimed to prevent Musk from gaining control without negotiating directly with the board. The tactic effectively deterred hostile takeovers by increasing the cost and complexity of acquiring a majority stake.

Impacts and Outcomes: Lessons from Poison Pill Implementations

Poison pill strategies, such as the shareholder rights plan introduced by Netflix in 2012, effectively deter hostile takeovers by diluting the value of shares acquired by an unwanted bidder. The implementation often leads to increased negotiation power for the target company, preserving management's control and allowing for better deal terms or rejecting undervalued offers. However, poison pills can also trigger shareholder disputes and impact stock prices, highlighting the importance of carefully balancing defensive measures with shareholder interests.

example of poison pill in takeover Infographic

samplerz.com

samplerz.com