A drawdown in a fund refers to the reduction in the value of an investment from its peak to its trough over a specific period. For example, if a mutual fund reaches a peak value of $1 million and subsequently declines to $800,000, the fund has experienced a 20% drawdown. This metric helps investors measure the risk and volatility associated with the fund's performance. Drawdowns are an essential consideration in risk management and portfolio evaluation. Hedge funds often report maximum drawdowns to illustrate potential losses during downturns. Data on drawdowns assists investors in comparing the resilience of various funds under adverse market conditions, allowing for informed decision-making based on historical performance.

Table of Comparison

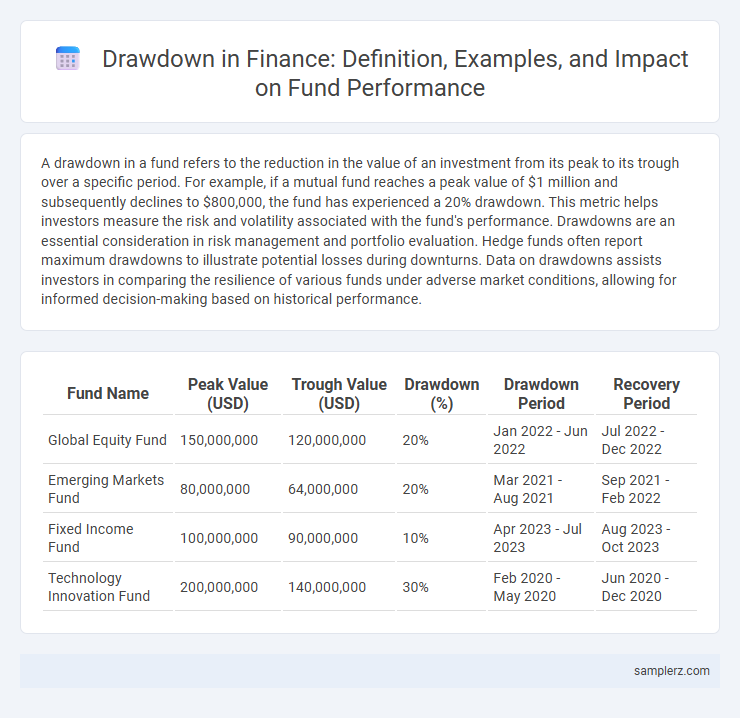

| Fund Name | Peak Value (USD) | Trough Value (USD) | Drawdown (%) | Drawdown Period | Recovery Period |

|---|---|---|---|---|---|

| Global Equity Fund | 150,000,000 | 120,000,000 | 20% | Jan 2022 - Jun 2022 | Jul 2022 - Dec 2022 |

| Emerging Markets Fund | 80,000,000 | 64,000,000 | 20% | Mar 2021 - Aug 2021 | Sep 2021 - Feb 2022 |

| Fixed Income Fund | 100,000,000 | 90,000,000 | 10% | Apr 2023 - Jul 2023 | Aug 2023 - Oct 2023 |

| Technology Innovation Fund | 200,000,000 | 140,000,000 | 30% | Feb 2020 - May 2020 | Jun 2020 - Dec 2020 |

Understanding Drawdown in Investment Funds

Drawdown in investment funds refers to the peak-to-trough decline during a specific period, measuring the reduction from the highest value to the lowest point before a new peak. For example, a mutual fund with a peak net asset value (NAV) of $150 per share dropping to $120 per share represents a 20% drawdown. Understanding drawdown helps investors assess risk, evaluate fund performance, and set expectations for potential losses during market downturns.

Key Causes of Drawdown in Fund Performance

Drawdown in fund performance often results from market volatility, economic downturns, and sector-specific risks that lead to a decline in asset values. Poor portfolio diversification and high exposure to high-risk assets exacerbate the drawdown impact. Additionally, sudden interest rate changes and geopolitical events can significantly disrupt fund returns, causing substantial capital erosion.

Real-Life Examples of Drawdown in Mutual Funds

One real-life example of drawdown in mutual funds occurred during the 2008 financial crisis when the Vanguard Total Stock Market Index Fund experienced a peak-to-trough decline of approximately 37%. Another instance is the 2020 COVID-19 pandemic sell-off, where the Fidelity Contrafund saw a drawdown nearing 25% before recovering. These drawdowns illustrate market volatility impacts on mutual fund values, highlighting the importance of risk management and diversification for investors.

Historical Drawdown Events in Hedge Funds

Historical drawdown events in hedge funds often highlight significant capital declines during market stress, such as the 2008 global financial crisis when many funds experienced drawdowns exceeding 30%. The Long-Term Capital Management (LTCM) collapse in 1998 is a notable example, with drawdowns reaching approximately 90%, triggering widespread financial instability. These events underscore the importance of robust risk management strategies to mitigate deep capital losses in hedge fund portfolios.

Managing Drawdown Risk in Portfolio Strategy

Managing drawdown risk in portfolio strategy involves setting predefined thresholds, such as a 10-15% maximum acceptable decline, to limit potential losses during market downturns. Utilizing stop-loss orders and diversification across uncorrelated assets can effectively reduce drawdown severity and duration. Continuous monitoring of volatility and employing risk management tools like Value at Risk (VaR) and conditional drawdown at risk (CDaR) enhance resilience against substantial portfolio declines.

Lessons from Major Drawdown Cases in Funds

Major drawdown cases in funds, such as the 2008 financial crisis where many equity funds experienced declines exceeding 50%, highlight the critical importance of risk management and diversification. Investors learned that overexposure to a single asset class or sector can exacerbate losses and delay recovery. These events underscore the necessity for robust stress testing and dynamic portfolio adjustments to mitigate drawdown impacts.

Impact of Drawdown on Investor Confidence

A significant drawdown in a fund, such as a 20% decline in asset value over a quarter, can severely erode investor confidence, leading to increased redemption requests and reduced new investments. Historical data shows that prolonged drawdowns often correlate with investor panic, causing liquidity challenges and forcing funds to sell assets at unfavorable prices. Managing drawdowns effectively is critical to maintaining trust and ensuring long-term capital retention within investment portfolios.

Comparative Drawdown Analysis: Equity vs. Bond Funds

Equity funds typically experience deeper drawdowns, often exceeding 20% during market downturns, compared to bond funds which usually see drawdowns below 10%. For example, during the 2008 financial crisis, the S&P 500 dropped approximately 57%, whereas investment-grade bond indexes declined about 10%. This comparative drawdown analysis highlights the higher volatility and risk associated with equities relative to fixed-income securities.

How Fund Managers Respond to Significant Drawdowns

Fund managers respond to significant drawdowns by re-evaluating portfolio allocations, reducing exposure to high-risk assets, and implementing risk management strategies such as stop-loss orders and hedging. They also increase communication with investors to maintain confidence and transparency during turbulent market conditions. Tactical adjustments often involve shifting toward defensive sectors or increasing liquidity to safeguard capital and improve recovery prospects.

Strategies to Recover from Fund Drawdowns

Effective strategies to recover from fund drawdowns include portfolio diversification, reallocating assets to less volatile investments, and implementing stop-loss orders to limit further losses. Employing tactical asset allocation allows fund managers to adjust exposure based on market conditions, while disciplined reinvestment of dividends can accelerate recovery. Risk management tools such as options hedging provide an additional layer of protection, helping to stabilize returns during market downturns.

example of drawdown in fund Infographic

samplerz.com

samplerz.com