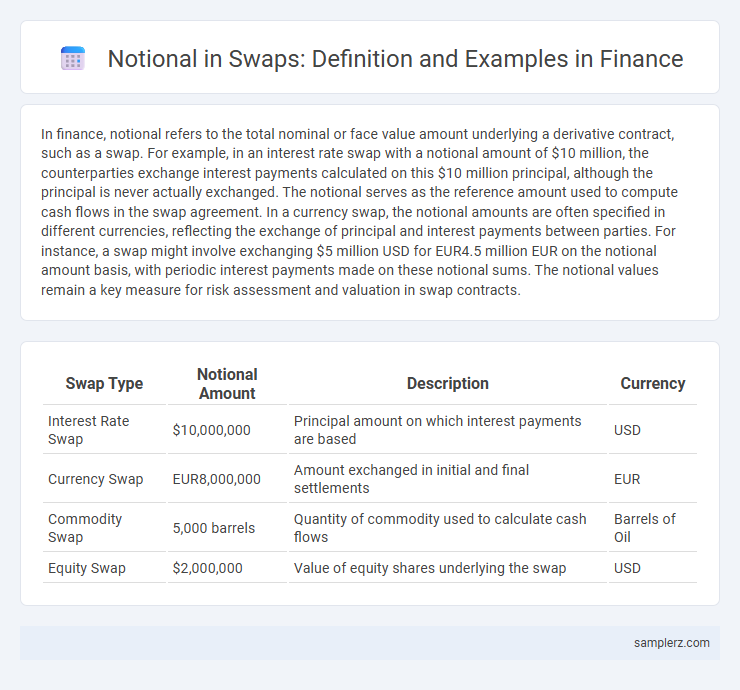

In finance, notional refers to the total nominal or face value amount underlying a derivative contract, such as a swap. For example, in an interest rate swap with a notional amount of $10 million, the counterparties exchange interest payments calculated on this $10 million principal, although the principal is never actually exchanged. The notional serves as the reference amount used to compute cash flows in the swap agreement. In a currency swap, the notional amounts are often specified in different currencies, reflecting the exchange of principal and interest payments between parties. For instance, a swap might involve exchanging $5 million USD for EUR4.5 million EUR on the notional amount basis, with periodic interest payments made on these notional sums. The notional values remain a key measure for risk assessment and valuation in swap contracts.

Table of Comparison

| Swap Type | Notional Amount | Description | Currency |

|---|---|---|---|

| Interest Rate Swap | $10,000,000 | Principal amount on which interest payments are based | USD |

| Currency Swap | EUR8,000,000 | Amount exchanged in initial and final settlements | EUR |

| Commodity Swap | 5,000 barrels | Quantity of commodity used to calculate cash flows | Barrels of Oil |

| Equity Swap | $2,000,000 | Value of equity shares underlying the swap | USD |

Understanding Notional Amount in Swaps

The notional amount in swaps represents the principal value upon which the exchanged cash flows are calculated, but it is never actually exchanged between parties. For example, in an interest rate swap with a $1 million notional amount, one party pays fixed interest while the other pays floating interest, both based on this principal. Understanding the notional amount is crucial for assessing exposure and determining the scale of cash flow exchanges in derivative contracts.

What Is Notional Value?

Notional value in a swap represents the principal amount on which the exchanged interest payments are calculated, though this amount is never exchanged between parties. For example, in an interest rate swap with a notional value of $1 million, the parties exchange payments based on this $1 million figure without actually transferring the principal. Understanding notional value is essential because it determines the scale of the swap's cash flows and risk exposure without reflecting the actual money changing hands.

Notional Principal in Interest Rate Swaps

Notional principal in interest rate swaps refers to the hypothetical underlying amount on which interest payments are calculated, though this principal is never exchanged between parties. For example, in a $10 million interest rate swap, the notional principal is $10 million, used solely to determine the interest payment amounts between the fixed-rate payer and the floating-rate payer. This notional amount provides a reference for cash flows, enabling risk management without exchanging the actual principal sum.

Notional Example in Currency Swaps

In a currency swap, the notional amount represents the principal value on which the exchanged interest payments are based, such as $10 million USD swapped for EUR9 million EUR at an agreed exchange rate. This notional principal is never exchanged physically but serves as the reference for calculating the interest cash flows between parties. For example, two corporations might agree to swap interest payments on these notionals to hedge currency risk or secure favorable borrowing costs in different currencies.

Fixed vs Floating Notional in Swaps

In interest rate swaps, the notional amount represents the principal used to calculate payment exchanges, with fixed notional remaining constant throughout the contract while floating notional can adjust based on underlying benchmarks or market indices. Fixed notional swaps provide predictable cash flows and risk management by using a stable principal for interest calculations, whereas floating notional swaps introduce variability to better align with fluctuating exposure or hedging needs. Understanding the distinction between fixed and floating notional is essential for accurately structuring swaps and managing interest rate risk effectively in financial portfolios.

Why Notional Is Not Exchanged

In interest rate swaps, the notional amount represents the principal on which interest payments are calculated but is never exchanged between parties. This setup reduces counterparty risk and operational complexity, allowing counterparties to hedge or speculate on interest rate movements without transferring the underlying asset. The notional serves solely as a reference figure for determining the cash flows exchanged during the swap's lifecycle.

Calculating Notional in Swap Transactions

Calculating notional in swap transactions involves determining the principal amount on which cash flows are based, despite no actual exchange of this amount occurring. For interest rate swaps, the notional typically represents the loan size or bond value used to calculate interest payments exchanged between parties. Accurate calculation of notional ensures precise valuation, risk assessment, and settlement of the derivative contract.

Notional Risk Exposure in Swaps

Notional risk exposure in swaps refers to the total nominal amount underlying the derivative contract, which determines the scale of potential financial impact without being exchanged between parties. For example, in an interest rate swap with a notional principal of $10 million, the notional amount drives the calculation of interest payments but is not itself exchanged, exposing parties to risk based on interest rate fluctuations. Monitoring notional amounts is crucial for managing counterparty risk and evaluating potential credit exposures in swap agreements.

Impact of Notional on Swap Valuation

In interest rate swaps, the notional amount serves as the principal reference for determining the cash flows exchanged between parties, directly influencing the swap's valuation. Variations in the notional size affect the magnitude of interest payments, thereby impacting the sensitivity of the swap's market value to interest rate fluctuations. Accurate assessment of the notional amount is critical for pricing, risk management, and calculating potential exposures in swap contracts.

Real-World Case: Notional in Swaps

In a real-world case, a corporation entering an interest rate swap might use a $100 million notional amount to hedge against fluctuating interest rates on its debt. The notional principal itself is never exchanged but serves as the basis for calculating periodic interest payments between the parties. This approach allows the company to manage interest rate risk efficiently without altering the underlying loan balance.

example of notional in swap Infographic

samplerz.com

samplerz.com