Payment-in-kind (PIK) loans allow borrowers to pay interest with additional debt rather than cash, enhancing liquidity during tight financial periods. A common example is a leveraged buyout (LBO) where the company issues PIK notes, enabling deferred cash interest payments that accumulate to the principal amount. Data from financial markets indicate PIK loans often feature interest rates 200-400 basis points higher than standard loans, reflecting the increased risk to lenders. In corporate finance, PIK loans serve as strategic tools to finance acquisitions or restructuring without immediate cash outflow. Entities like private equity firms utilize PIK toggles, allowing the borrower to switch between cash and PIK interest payments based on cash availability. Market analysis shows that PIK structures are prevalent in mezzanine debt layers, representing approximately 15-20% of total leveraged lending volume in high-yield markets.

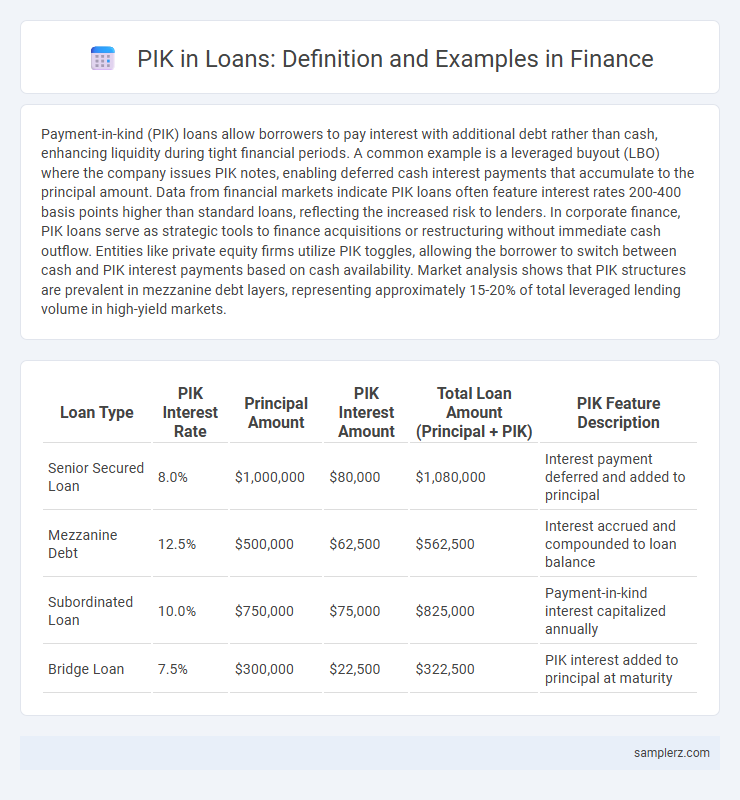

Table of Comparison

| Loan Type | PIK Interest Rate | Principal Amount | PIK Interest Amount | Total Loan Amount (Principal + PIK) | PIK Feature Description |

|---|---|---|---|---|---|

| Senior Secured Loan | 8.0% | $1,000,000 | $80,000 | $1,080,000 | Interest payment deferred and added to principal |

| Mezzanine Debt | 12.5% | $500,000 | $62,500 | $562,500 | Interest accrued and compounded to loan balance |

| Subordinated Loan | 10.0% | $750,000 | $75,000 | $825,000 | Payment-in-kind interest capitalized annually |

| Bridge Loan | 7.5% | $300,000 | $22,500 | $322,500 | PIK interest added to principal at maturity |

Understanding PIK Loans: Definition and Key Features

Payment-in-Kind (PIK) loans allow borrowers to defer cash interest payments by paying interest with additional debt or equity, enhancing cash flow management during financial stress. Common in leveraged buyouts and corporate restructurings, PIK loans feature higher interest rates and increased risk due to the compounding debt structure. Lenders demand premium yields compensating for the lack of periodic cash interest, emphasizing careful assessment of borrower creditworthiness and future cash generation.

How Payment-in-Kind (PIK) Loans Work in Practice

Payment-in-Kind (PIK) loans allow borrowers to pay interest by increasing the loan principal instead of making cash payments, effectively deferring cash outflows. This mechanism is common in high-yield debt and leveraged buyouts, where borrowers prioritize liquidity preservation during growth or restructuring phases. PIK loans typically feature higher interest rates to compensate lenders for the increased risk of deferred payment and capitalized interest.

Common Scenarios for PIK Loan Utilization

Payment-in-Kind (PIK) loans are frequently utilized in leveraged buyouts where cash flow constraints make cash interest payments challenging. Companies undergoing restructuring often employ PIK loans to defer interest payments, preserving liquidity during turnaround periods. Growth-stage firms may use PIK instruments to finance expansion without immediate cash outflows, leveraging the deferred interest to support operational needs.

Advantages of Using PIK Loans in Financing

PIK loans allow borrowers to defer interest payments by adding the interest to the principal balance, conserving cash flow during critical growth or turnaround phases. These loans are ideal in situations where immediate liquidity is limited but future profitability is expected, reducing pressure on operational cash resources. Investors benefit from potentially higher returns due to interest compounding, while companies retain capital for strategic investments without diluting equity.

Risks and Drawbacks of PIK Loans for Borrowers

PIK loans, or Payment-in-Kind loans, increase debt burden by allowing interest to be added to the principal balance instead of being paid in cash, leading to higher overall repayment amounts. Borrowers face risks including escalating leverage, reduced cash flow flexibility, and potential solvency issues if business performance weakens. The compounding interest can significantly worsen financial distress, making PIK loans less attractive for companies with unstable revenues.

Real-World Example: Structuring a PIK Loan Agreement

A Payment-in-Kind (PIK) loan example involves a private equity firm structuring a financing deal where interest payments are made in additional debt rather than cash. In a real-world scenario, a company seeking growth capital agrees to a PIK toggle structure, allowing interest to be paid in cash or, if cash flow is tight, in kind through accrued interest capitalized into the loan principal. This approach preserves liquidity for the borrower while increasing the lender's future return through the compounded principal balance.

Case Study: PIK Loan in a Leveraged Buyout Transaction

A PIK (Payment-in-Kind) loan was utilized in a leveraged buyout (LBO) where the borrower deferred cash interest payments by issuing additional debt instead, boosting liquidity during the acquisition. This structure allowed the private equity firm to preserve cash flow while leveraging the target company with a higher debt load. The increased debt amortization and compounded PIK interest improved the sponsor's equity returns upon exit.

Interest Calculation and Repayment Methods in PIK Loans

Payment-in-kind (PIK) loans calculate interest by adding unpaid interest to the principal balance, causing the loan amount to grow over time rather than requiring periodic cash interest payments. Repayment methods typically involve a lump sum at maturity or conversion of accrued interest into additional debt, allowing borrowers to preserve cash flow during the loan term. This mechanism makes PIK loans suitable for companies with limited immediate liquidity but strong future cash flow prospects.

Investor Perspective: Why Choose PIK Loans?

Investors prefer PIK loans due to their ability to defer interest payments, enhancing cash flow during early investment phases. The accrued interest compounds, potentially increasing the overall yield when the loan matures, offering higher returns compared to traditional loans. This structure aligns with investors seeking long-term capital appreciation while managing short-term liquidity constraints.

Regulatory Considerations and Compliance for PIK Loans

Payment-in-Kind (PIK) loans often face stringent regulatory considerations to ensure transparency and prevent excessive risk-taking by borrowers and lenders. Compliance requirements include adherence to capital adequacy standards set by financial regulators such as Basel III, as PIK interest accruals can impact a borrower's leverage and debt service coverage ratios. Lenders must also comply with disclosure mandates under securities laws and conduct thorough credit risk assessments to mitigate potential enforcement actions and maintain regulatory approval.

example of PIK in loan Infographic

samplerz.com

samplerz.com