Overcollateralization in asset-backed securities (ABS) occurs when the value of the underlying assets exceeds the value of the issued securities. For example, a mortgage-backed security might be issued with $100 million in bonds backed by $120 million worth of mortgages. This $20 million cushion provides extra protection to investors by ensuring that even if some loans default, the overall collateral covers the bond payments. This risk mitigation technique increases investor confidence by reducing the probability of losses. Data from ABS transactions show overcollateralization ratios often range between 5% and 30%, depending on market conditions and asset quality. Investors rely on this excess collateral as a critical factor in credit rating assessments, influencing the pricing and demand of the securities.

Table of Comparison

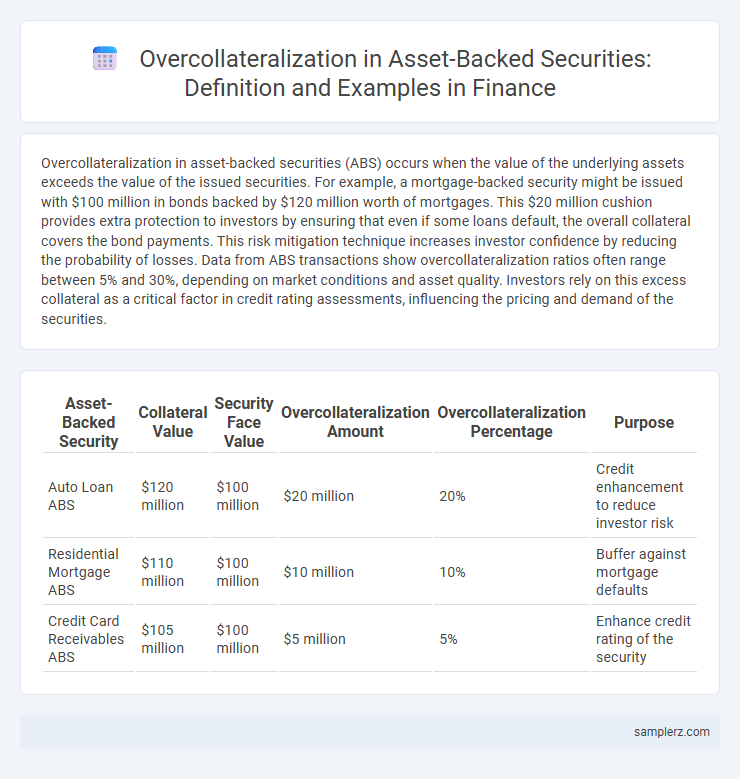

| Asset-Backed Security | Collateral Value | Security Face Value | Overcollateralization Amount | Overcollateralization Percentage | Purpose |

|---|---|---|---|---|---|

| Auto Loan ABS | $120 million | $100 million | $20 million | 20% | Credit enhancement to reduce investor risk |

| Residential Mortgage ABS | $110 million | $100 million | $10 million | 10% | Buffer against mortgage defaults |

| Credit Card Receivables ABS | $105 million | $100 million | $5 million | 5% | Enhance credit rating of the security |

Introduction to Overcollateralization in Asset-Backed Securities

Overcollateralization in asset-backed securities (ABS) occurs when the value of collateral assets exceeds the amount of issued securities, creating a credit buffer that enhances investor protection. This excess collateral serves as a financial cushion against defaults, improving the ABS's credit rating and reducing risk for bondholders. Common in mortgage-backed securities and auto loan ABS, overcollateralization is a key mechanism to maintain market confidence and ensure timely payments.

Understanding Asset-Backed Securities (ABS)

Overcollateralization in asset-backed securities (ABS) occurs when the value of the collateral exceeds the amount of the issued securities, providing a credit enhancement that reduces investor risk. For example, a mortgage-backed ABS pool might hold $120 million in loans, but only $100 million in bonds are issued, creating a 20% buffer against defaults. This structural feature enhances the ABS's credit rating by ensuring that cash flows from excess collateral cover potential losses.

The Role of Collateral in ABS Structures

Overcollateralization in asset-backed securities (ABS) involves pledging collateral that exceeds the value of the issued securities to enhance credit quality and reduce default risk. For instance, an ABS backed by auto loans may include loans totaling $120 million to support $100 million in issued securities, providing a 20% collateral cushion. This excess collateral absorbs potential losses, strengthening investor confidence and improving the ABS credit rating.

What is Overcollateralization?

Overcollateralization in asset-backed securities occurs when the value of the underlying collateral exceeds the amount of securities issued, providing a cushion that protects investors from losses. This financial structure enhances credit quality by reducing default risk, as the excess collateral serves as a buffer against borrower delinquency or asset devaluation. A typical example is a mortgage-backed security backed by $120 million in mortgage loans but issued with only $100 million in notes, creating a 20% overcollateralization margin.

Example 1: Mortgage-Backed Securities (MBS) with Overcollateralization

Mortgage-Backed Securities (MBS) often employ overcollateralization by pooling mortgage loans whose combined principal balance exceeds the issued securities' face value, enhancing credit quality. For example, if an MBS issues $90 million in securities secured by $100 million in mortgage loans, the $10 million excess loan value serves as a cushion against defaults. This structure reduces investor risk by absorbing potential losses before impacting payments, thereby improving the asset-backed security's credit rating.

Example 2: Auto Loan ABS and Overcollateralization

Example 2 of overcollateralization in asset-backed securities involves auto loan ABS, where the collateral pool value exceeds the issued bond principal by a significant margin, typically 10-20%. This excess collateral mitigates credit risk by providing a buffer against loan defaults within the auto loan portfolio. Investors benefit from improved credit ratings and reduced loss severity due to this strategic overcollateralization.

Example 3: Credit Card Receivables and Overcollateralization

In asset-backed securities backed by credit card receivables, overcollateralization occurs when the value of the underlying credit card debt exceeds the principal amount of the issued securities, providing extra protection to investors. For example, if a $100 million ABS is issued but the credit card receivables pool totals $120 million, the $20 million difference acts as a cushion against defaults or losses. This structure enhances creditworthiness and helps achieve higher ratings by mitigating risks associated with debtor delinquencies.

Benefits of Overcollateralization for Investors

Overcollateralization in asset-backed securities involves issuing debt backed by assets valued higher than the debt itself, providing investors with an added layer of protection against credit risk. This cushion reduces the likelihood of losses since the excess collateral absorbs potential defaults, enhancing the security's credit rating and marketability. Investors benefit from improved risk-adjusted returns and increased confidence in the stability of cash flows.

Risks and Limitations of Overcollateralization

Overcollateralization in asset-backed securities (ABS) provides a cushion against credit risk by pledging collateral exceeding the debt value, but it introduces risks such as reduced liquidity and increased capital requirements for issuers. Excess collateral may fail to protect investors during systemic market downturns or correlated defaults, limiting its effectiveness as a risk mitigant. Regulatory constraints and asset quality degradation also pose significant limitations, impacting the overall performance and valuation of overcollateralized ABS structures.

Real-World Case Studies of Overcollateralized ABS

The 2007 Citigroup Home Equity Loan Asset-Backed Securities serve as a prominent example of overcollateralization, where excess collateral was used to enhance credit quality and reduce default risk. Similarly, the 2013 Toyota ABS transaction featured overcollateralization to provide additional protection to investors against borrower prepayment and credit losses. These real-world case studies illustrate how overcollateralization in asset-backed securities can improve investor confidence and facilitate favorable credit ratings.

example of overcollateralization in asset-backed security Infographic

samplerz.com

samplerz.com