Sunsetting in fund management refers to the planned termination or winding down of an investment fund after a predetermined period or upon achieving specific financial targets. For example, a private equity fund might have a life span of 10 years, after which it sunsets, meaning the fund manager must liquidate assets and return capital to investors. This process ensures that the fund does not operate indefinitely, providing a clear exit strategy and timeline for stakeholders. In venture capital, a fund sunset clause is often included in the limited partnership agreement to define the duration of the fund's active investment period. Once the sunset date is reached, no new investments are made, and the focus shifts to managing existing portfolio companies and returning profits. Data from the Investment Company Institute indicates that sunsetting allows fund managers to focus on value realization and supports structured portfolio turnover, enhancing overall fund performance metrics.

Table of Comparison

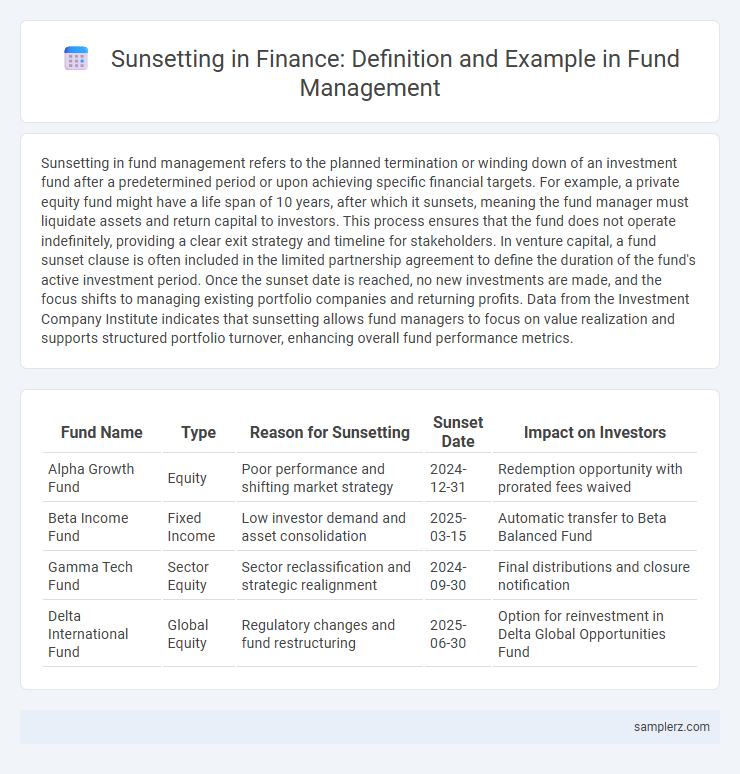

| Fund Name | Type | Reason for Sunsetting | Sunset Date | Impact on Investors |

|---|---|---|---|---|

| Alpha Growth Fund | Equity | Poor performance and shifting market strategy | 2024-12-31 | Redemption opportunity with prorated fees waived |

| Beta Income Fund | Fixed Income | Low investor demand and asset consolidation | 2025-03-15 | Automatic transfer to Beta Balanced Fund |

| Gamma Tech Fund | Sector Equity | Sector reclassification and strategic realignment | 2024-09-30 | Final distributions and closure notification |

| Delta International Fund | Global Equity | Regulatory changes and fund restructuring | 2025-06-30 | Option for reinvestment in Delta Global Opportunities Fund |

Understanding Sunsetting in Finance: An Overview

Sunsetting in finance refers to the predetermined termination or closure of an investment fund after a specific period or upon achieving certain returns, commonly seen in private equity and venture capital funds. This process ensures disciplined exit strategies and capital return to investors, mitigating prolonged fund management risks. Understanding sunsetting mechanisms allows investors to anticipate fund lifecycle events and optimize portfolio allocation decisions accordingly.

Key Reasons for Sunsetting Investment Funds

Sunsetting investment funds often occurs due to consistent underperformance compared to benchmark indices, leading to diminished investor confidence and capital outflows. Regulatory changes and shifts in market conditions can render certain fund strategies obsolete or less viable, prompting asset managers to close or merge these funds. Another key reason includes strategic portfolio realignment where asset managers consolidate funds to optimize operational efficiency and focus on high-performing products.

Indicators That a Fund May Be Sunsetting

Declining assets under management (AUM) and consistent underperformance relative to benchmarks are key indicators that a fund may be sunsetting. Low redemption rates coupled with a shrinking investor base often signal strategic winding down. Regulatory changes or shifts in market demand can also prompt fund managers to initiate sunsetting processes.

Real-World Examples of Fund Sunsetting

The Carlyle Group's South East Asia Partners fund underwent sunsetting after reaching its 10-year lifespan, successfully returning capital to investors while winding down portfolio companies. Blackstone's Real Estate Partners Europe fund exemplifies sunsetting through strategic asset dispositions aligned with a predetermined exit timeline, maximizing returns before fund closure. KKR Infrastructure Fund adopted sunsetting by gradually divesting assets as the fund matured, promoting efficient capital recycling and adhering to limited partnership agreements.

The Sunsetting Process: Step-by-Step Breakdown

The sunsetting process in a fund involves a systematic winding down of investment activities as the fund approaches its predetermined end date, ensuring capital distribution to investors. Initially, the fund ceases new investments and focuses on liquidating existing assets to maximize returns while minimizing market impact. Finally, remaining liquid assets are distributed to limited partners, and all administrative and regulatory obligations are completed to formally close the fund.

Impact of Fund Sunsetting on Investors

Fund sunsetting, the predetermined closure of an investment fund, directly impacts investors by limiting the timeframe for capital appreciation and requiring the liquidation of assets, which may lead to potential realized gains or losses. This process often prompts investors to reallocate capital into new opportunities, potentially altering their portfolio diversification and risk profile. Understanding fund sunsetting helps investors anticipate shifts in cash flow and investment strategy adjustments, optimizing long-term financial planning.

Legal and Regulatory Aspects of Sunsetting Funds

Sunsetting a fund involves legally winding down its operations according to regulatory requirements set by authorities such as the SEC, which mandate notifying investors, fulfilling outstanding obligations, and ensuring full compliance with disclosure rules. Fund managers must file formal termination documents and conduct audits to confirm no residual liabilities remain, adhering strictly to guidelines under the Investment Company Act of 1940. Failure to comply with these legal and regulatory obligations can result in penalties, investor lawsuits, and regulatory sanctions, emphasizing the critical importance of a meticulously managed sunsetting process.

Communication Strategies During Fund Sunsetting

Effective communication strategies during fund sunsetting include transparent updates on timelines, clear explanations of redemption procedures, and proactive outreach to investors via multiple channels such as emails, webinars, and personalized calls. Providing detailed FAQs and dedicated support lines helps mitigate confusion and maintain investor trust throughout the wind-down process. Consistent messaging aligned with regulatory guidelines ensures compliance and preserves the fund manager's reputation.

Lessons Learned from Sunsetting Historical Funds

Sunsetting historical funds reveals critical lessons in managing lifecycle risk and maximizing shareholder value. Analyzing performance declines and investor redemptions helps identify optimal timing for closure, reducing drag on portfolios and enhancing capital efficiency. Transparent communication during sunsetting fosters trust and minimizes reputational impact, crucial for maintaining investor confidence in future fund launches.

Preparing for Sunsetting: Best Practices for Fund Managers

Fund managers should establish a clear timeline and communication plan to ensure a smooth sunsetting process, minimizing investor uncertainty and operational disruptions. Conducting comprehensive portfolio reviews and gradually reallocating assets helps optimize fund value and meet redemption demands efficiently. Implementing transparent reporting practices and engaging with stakeholders maintain trust and support compliance throughout the fund's closure.

example of sunsetting in fund Infographic

samplerz.com

samplerz.com