A quant in trading utilizes mathematical models and algorithms to identify profitable investment opportunities. These professionals analyze vast datasets, including price movements, trading volumes, and economic indicators, to develop strategies that minimize risk and maximize returns. Common tools used by quants include statistical analysis, machine learning, and stochastic calculus. Quantitative traders often deploy algorithmic trading systems that execute trades at high speeds based on real-time market data. They focus on entities such as equities, derivatives, currencies, and commodities to capture inefficiencies in financial markets. The effectiveness of quant strategies is measured through backtesting on historical data and ongoing performance metrics.

Table of Comparison

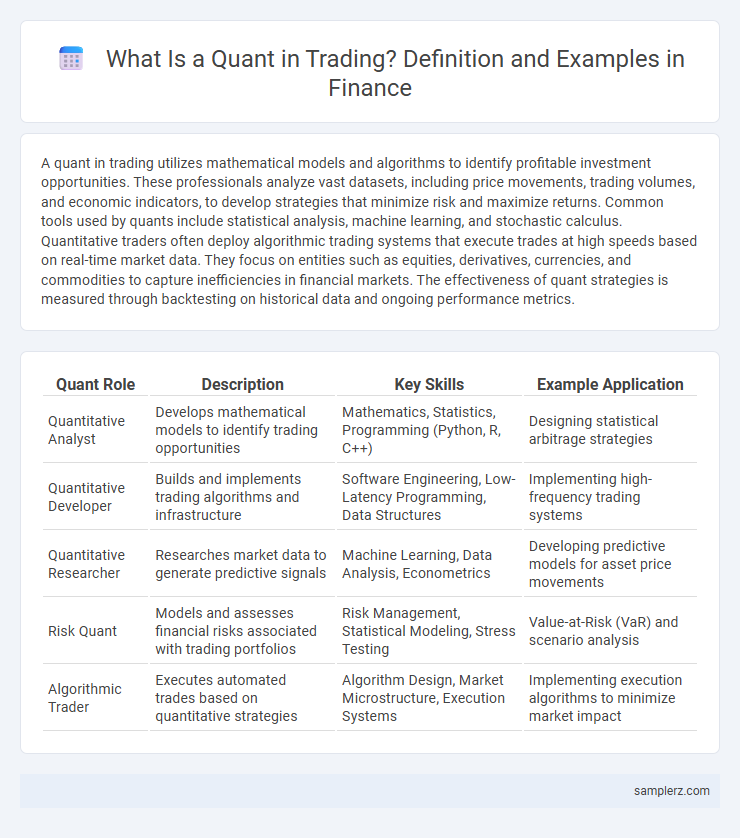

| Quant Role | Description | Key Skills | Example Application |

|---|---|---|---|

| Quantitative Analyst | Develops mathematical models to identify trading opportunities | Mathematics, Statistics, Programming (Python, R, C++) | Designing statistical arbitrage strategies |

| Quantitative Developer | Builds and implements trading algorithms and infrastructure | Software Engineering, Low-Latency Programming, Data Structures | Implementing high-frequency trading systems |

| Quantitative Researcher | Researches market data to generate predictive signals | Machine Learning, Data Analysis, Econometrics | Developing predictive models for asset price movements |

| Risk Quant | Models and assesses financial risks associated with trading portfolios | Risk Management, Statistical Modeling, Stress Testing | Value-at-Risk (VaR) and scenario analysis |

| Algorithmic Trader | Executes automated trades based on quantitative strategies | Algorithm Design, Market Microstructure, Execution Systems | Implementing execution algorithms to minimize market impact |

Introduction to Quantitative Trading in Finance

Quantitative trading in finance leverages mathematical models and algorithmic strategies to identify trading opportunities and optimize portfolio performance. Key examples include statistical arbitrage, trend-following systems, and high-frequency trading, which utilize vast datasets and quantitative analysis to generate consistent returns. These techniques rely on advanced programming skills, statistical knowledge, and real-time market data to execute trades with minimal human intervention.

Key Roles of Quants in Trading Firms

Quants in trading firms develop sophisticated mathematical models to identify profitable trading strategies and optimize portfolio risk. They analyze large datasets using statistical techniques and machine learning algorithms to forecast market movements and enhance decision-making. Their expertise in quantitative analysis drives algorithmic trading, risk management, and pricing of complex financial instruments.

Common Quantitative Trading Strategies

Common quantitative trading strategies include statistical arbitrage, momentum trading, and mean reversion. Statistical arbitrage exploits price inefficiencies using complex algorithms to identify mispriced securities across correlated assets. Momentum trading capitalizes on trends by purchasing assets showing upward price momentum, while mean reversion assumes prices will revert to their historical averages, enabling traders to buy undervalued and sell overvalued securities.

Example: Statistical Arbitrage in Action

Statistical arbitrage in trading utilizes quantitative models to identify and exploit temporary price inefficiencies between correlated securities. By analyzing historical price data and applying mean-reversion strategies, quants develop algorithms that continuously monitor pairs of stocks or assets, executing trades when statistical deviations occur. This approach minimizes risk through diversified, high-frequency trades while leveraging complex mathematical frameworks for optimal portfolio performance.

Example: High-Frequency Trading Algorithms

High-frequency trading algorithms use advanced quantitative models to execute thousands of trades per second, capitalizing on minute price discrepancies in financial markets. These algorithms rely on complex mathematical techniques, such as statistical arbitrage and machine learning, to identify profitable trading opportunities. By reducing latency through co-location with exchanges, high-frequency trading firms achieve rapid order execution and competitive market advantages.

Machine Learning Applications in Quant Trading

Machine learning algorithms such as random forests and neural networks play a pivotal role in quantitative trading by identifying complex patterns in large financial datasets to predict asset price movements. Techniques like reinforcement learning optimize portfolio allocation by continuously adapting to market dynamics, enhancing risk-adjusted returns. High-frequency trading firms employ deep learning models to analyze order book dynamics and execute trades with minimal latency, capitalizing on microstructure patterns.

Example: Options Pricing Models Used by Quants

Quants in trading commonly utilize options pricing models such as the Black-Scholes-Merton model and the Binomial Options Pricing model to estimate the fair value of options contracts. These models incorporate factors like underlying asset price, volatility, time to expiration, risk-free interest rate, and dividend yield to generate precise option prices. Advanced variations, including stochastic volatility models like Heston, further enhance accuracy by capturing dynamic market behavior and implied volatility surfaces.

Risk Management Techniques Employed by Quants

Quants in trading utilize advanced risk management techniques such as Value at Risk (VaR), stress testing, and scenario analysis to quantify and mitigate potential losses. They deploy machine learning algorithms to analyze vast datasets, identifying hidden correlations and extreme market events to adjust positions dynamically. Portfolio optimization models, including the use of covariance matrices and tail-risk hedging strategies, are integral to minimizing exposure and maximizing risk-adjusted returns.

Example: Portfolio Optimization Using Quant Methods

Portfolio optimization in quant trading employs mathematical models such as mean-variance optimization and the Black-Litterman model to maximize returns and minimize risk. Quantitative analysts use historical price data, covariance matrices, and expected returns to construct efficient frontiers and balance asset allocation. Advanced techniques like machine learning algorithms and factor models enhance predictive accuracy and dynamically adjust portfolios in real time.

Future Trends and Innovations in Quantitative Trading

Advanced machine learning algorithms and alternative data sources are propelling future trends in quantitative trading, enabling more accurate predictive models for price movements. The integration of high-frequency trading with artificial intelligence enhances decision-making speed and execution efficiency in futures markets. Quantum computing holds potential to revolutionize risk assessment and portfolio optimization by performing complex calculations beyond classical system capabilities.

example of quant in trading Infographic

samplerz.com

samplerz.com