Tranching in mortgage-backed securities (MBS) involves dividing the pooled mortgage loans into different segments or tranches, each with varying risk levels and returns. Senior tranches typically receive priority for interest and principal payments, making them lower risk but offering lower yields. Subordinate tranches absorb initial losses and provide higher returns, attracting investors with a higher risk tolerance. Data collected on MBS tranches include credit ratings, payment priority, and expected cash flow schedules. For example, an MBS might be split into AAA-rated senior tranches and BB-rated mezzanine tranches based on the credit quality of the underlying mortgage pool. This segmentation allows investors to select tranches aligned with their risk preferences and investment strategies.

Table of Comparison

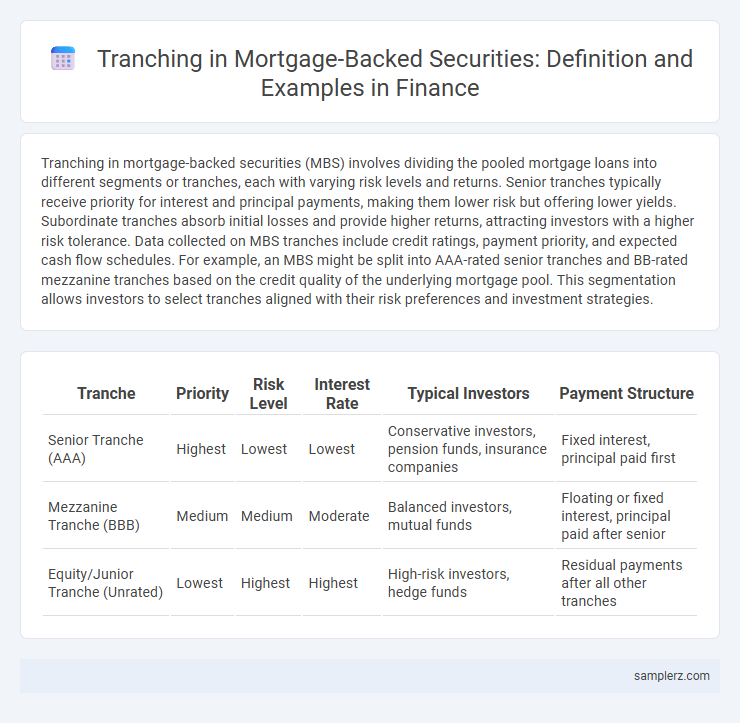

| Tranche | Priority | Risk Level | Interest Rate | Typical Investors | Payment Structure |

|---|---|---|---|---|---|

| Senior Tranche (AAA) | Highest | Lowest | Lowest | Conservative investors, pension funds, insurance companies | Fixed interest, principal paid first |

| Mezzanine Tranche (BBB) | Medium | Medium | Moderate | Balanced investors, mutual funds | Floating or fixed interest, principal paid after senior |

| Equity/Junior Tranche (Unrated) | Lowest | Highest | Highest | High-risk investors, hedge funds | Residual payments after all other tranches |

Understanding Tranching in Mortgage-Backed Securities

Mortgage-backed securities (MBS) are structured into tranches that categorize debt by risk level and priority of payment, enhancing investor appeal through tailored risk and return profiles. Senior tranches receive priority for principal and interest payments, offering lower risk and yields, while mezzanine and equity tranches absorb initial losses but compensate with higher returns. This layered approach in tranching facilitates capital market efficiency by attracting diverse investors, optimizing funding costs for mortgage originators.

Key Components of MBS Tranches

Mortgage-backed security tranches are divided based on risk, maturity, and payment priority, with senior tranches receiving principal and interest payments first, followed by mezzanine and junior tranches. Key components include credit enhancement levels, which protect senior tranches from defaults, and varying coupon rates reflecting differing risk profiles. Understanding these factors helps investors evaluate potential returns and exposure within the structured finance framework.

Step-by-Step Example of Tranching in MBS

A mortgage-backed security (MBS) is divided into tranches based on risk and maturity, starting with the senior tranche that receives priority in principal and interest payments, followed by mezzanine and equity tranches that absorb losses sequentially. In a step-by-step example, a pool of $100 million in mortgages is split into a $60 million senior tranche rated AAA, a $30 million mezzanine tranche rated BBB, and a $10 million equity tranche with no rating, reflecting increasing levels of risk. Investors select tranches matching their risk tolerance and return expectations, with cash flows distributed accordingly to reduce default impact on senior tranche holders.

Types of Tranches in a Typical MBS Structure

In a typical mortgage-backed security (MBS) structure, tranches are segmented into senior, mezzanine, and equity classes, each bearing different risk and return profiles. Senior tranches have the highest credit ratings and priority in receiving principal and interest payments, minimizing risk exposure. Mezzanine tranches absorb moderate risk with higher yields, while equity tranches carry the most risk, offering residual claims and serving as the first loss bearer.

Cash Flow Distribution Among Mortgage Tranches

Mortgage-backed securities (MBS) use tranching to distribute cash flows among different classes of bonds, prioritizing payments based on seniority and credit risk. Senior tranches receive principal and interest payments first, reducing default risk exposure, while mezzanine and junior tranches absorb losses and receive payments later. This structured cash flow allocation enhances investor segmentation, allowing customized risk-return profiles within a single MBS issuance.

Senior, Mezzanine, and Junior Tranche Examples

In mortgage-backed securities, senior tranches hold the highest credit quality, receiving priority for interest payments with lower yields due to reduced risk exposure. Mezzanine tranches carry moderate risk and returns, absorbing losses only after the senior tranches are affected but before junior tranches incur losses. Junior tranches, also known as equity tranches, bear the highest risk with the lowest priority for payments, offering higher potential yields as compensation for their subordinate claim on cash flows.

Credit Risk Allocation Through Tranching

Mortgage-backed securities (MBS) exemplify credit risk allocation through tranching by dividing pooled mortgage loans into senior, mezzanine, and equity tranches, each bearing different levels of risk and return. Senior tranches receive priority on principal and interest payments, minimizing default risk, while mezzanine and equity tranches absorb initial losses, compensating investors with higher yields for greater credit exposure. This structured credit risk distribution enhances investment flexibility and attracts diverse investor risk appetites in the mortgage market.

Real-World Case Study: Tranching in MBS

In the 2007 collapse of the U.S. housing market, tranching in mortgage-backed securities (MBS) played a crucial role, as senior, mezzanine, and equity tranches were created to distribute risk among investors. Senior tranches received priority for payments and maintained higher credit ratings, while mezzanine and equity tranches absorbed initial losses, exemplified by the widespread default rates in subprime mortgage pools. This real-world case study highlights how tranche structuring influenced investor exposure and contributed to systemic financial instability during the crisis.

Impact of Tranching on Investor Returns

Tranching in mortgage-backed securities (MBS) divides the pool of mortgages into segments with varying risk and return profiles, directly influencing investor returns by offering tailored cash flows and risk exposure. Senior tranches typically provide lower yields with higher credit quality and priority in payments, while junior tranches offer higher yields that compensate for increased default risk. This structure enables investors to align their risk tolerance with investment choices, optimizing portfolio performance based on individual return objectives and market conditions.

Regulatory Considerations for MBS Tranching

Mortgage-backed security tranching requires strict adherence to regulatory frameworks such as the Dodd-Frank Act, which enforces transparency and risk retention rules to protect investors. Regulatory bodies like the SEC mandate comprehensive disclosure of tranche-specific credit ratings and cash flow structures to ensure market stability. Compliance with Basel III capital requirements also affects how banks hold MBS tranches on their balance sheets, influencing their risk-weighted asset calculations and overall capital adequacy.

example of tranching in mortgage-backed security Infographic

samplerz.com

samplerz.com