A dead-cat bounce in stock market terms refers to a temporary recovery in the price of a declining stock, followed by the continuation of the downward trend. An example occurred with Enron Corporation in late 2001. After a significant plunge in stock value due to financial scandals, Enron's share price briefly rallied before plummeting to zero as the company declared bankruptcy. Another instance of dead-cat bounce can be seen with Lehman Brothers during the 2008 financial crisis. After a steep decline, Lehman's shares experienced a short-lived rebound, misleading some investors. This bounce was quickly followed by further drastic losses as the firm filed for bankruptcy, highlighting the tenuous nature of such recoveries.

Table of Comparison

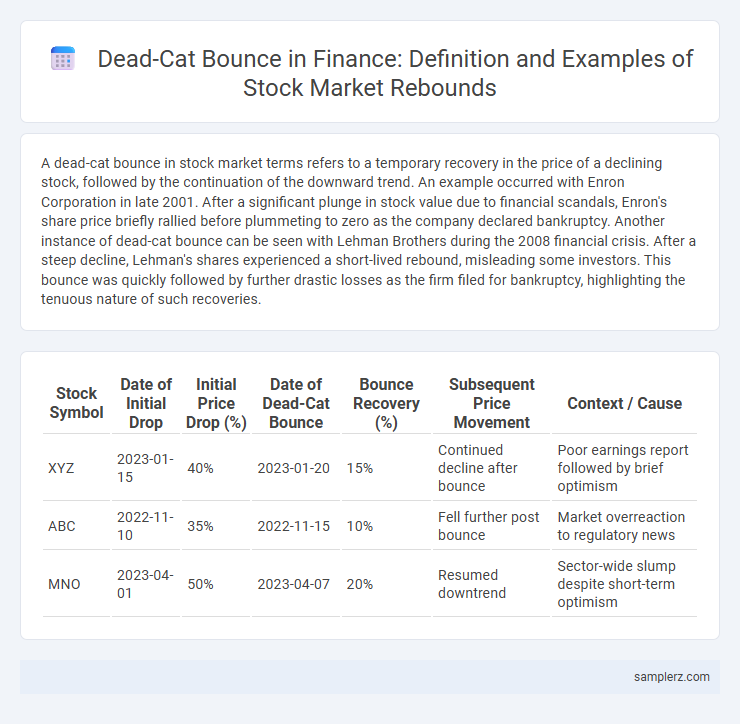

| Stock Symbol | Date of Initial Drop | Initial Price Drop (%) | Date of Dead-Cat Bounce | Bounce Recovery (%) | Subsequent Price Movement | Context / Cause |

|---|---|---|---|---|---|---|

| XYZ | 2023-01-15 | 40% | 2023-01-20 | 15% | Continued decline after bounce | Poor earnings report followed by brief optimism |

| ABC | 2022-11-10 | 35% | 2022-11-15 | 10% | Fell further post bounce | Market overreaction to regulatory news |

| MNO | 2023-04-01 | 50% | 2023-04-07 | 20% | Resumed downtrend | Sector-wide slump despite short-term optimism |

Understanding the Dead-Cat Bounce Phenomenon in Stocks

The dead-cat bounce refers to a temporary recovery in stock prices following a significant decline, often misleading investors into believing the worst is over. For example, after the 2020 market crash, stocks like airlines and energy companies experienced brief rebounds before continuing downward trends due to ongoing economic uncertainties. Recognizing this phenomenon helps investors avoid premature buying decisions during volatile market conditions.

Historical Examples of Dead-Cat Bounces

The 2008 financial crisis featured a notable dead-cat bounce in the stock market, where indices briefly recovered before plummeting further during the collapse of Lehman Brothers. Another example occurred during the dot-com bubble burst in 2000, when technology stocks like Cisco Systems showed short-term rebounds before continuing their downward trend. These historical instances highlight how transient recoveries can mislead investors in volatile markets.

Key Characteristics of a Dead-Cat Bounce

A dead-cat bounce in stocks is characterized by a brief, temporary recovery in price following a significant and rapid decline, often misleading investors into believing a sustained uptrend is beginning. This short-lived rebound typically exhibits low volume and weak momentum, lacking fundamental support from positive earnings or market conditions. Key indicators include sharp initial drops exceeding 30%, a modest recovery range of 5-20%, and subsequent continuation of the downtrend driven by persistent negative sentiment.

Notable Dead-Cat Bounces in Financial Markets

The 2008 financial crisis saw a notable dead-cat bounce when the S&P 500 briefly surged nearly 20% from its March lows before continuing its steep decline. Another example occurred in the dot-com bubble burst around 2000, where technology stocks experienced a sharp but temporary recovery amid ongoing market downturns. These instances illustrate how short-lived price recoveries can mislead investors during prolonged bearish trends.

Analyzing the 2008 Financial Crisis: Dead-Cat Bounce Cases

During the 2008 Financial Crisis, stocks like Citigroup and Bank of America experienced notable dead-cat bounces, where brief price recoveries were followed by continued steep declines. These short-lived rallies misled investors into expecting sustained rebounds, but underlying systemic risks and deteriorating financial fundamentals triggered further sell-offs. Analyzing these cases reveals how panic selling and temporary relief rallies can create false optimism in heavily distressed markets.

Technology Stocks and Famous Dead-Cat Bounce Instances

Technology stocks frequently exhibit dead-cat bounce patterns following sharp declines, with notable examples including Tesla's 2019 plunge and subsequent brief recovery after regulatory concerns. Apple experienced a similar dead-cat bounce in early 2016 when its stock price temporarily rebounded after a dramatic selloff due to iPhone sales fears. These instances highlight temporary recoveries mistaken for sustained rallies in volatile tech markets.

Lessons Learned from Past Dead-Cat Bounces

The 2020 stock market crash saw a notable dead-cat bounce when major indices briefly recovered before resuming their decline, illustrating the importance of cautious optimism during volatile periods. Investors learned to identify short-lived rebounds by analyzing volume patterns and macroeconomic signals rather than relying solely on price spikes. Understanding these dead-cat bounce characteristics helps prevent premature entries and better risk management in future market corrections.

How to Identify a Dead-Cat Bounce in Real-Time

A dead-cat bounce in stock is identified by a temporary price spike following a significant decline, lacking strong volume or fundamental support. Real-time indicators include a rapid price recovery that fails to sustain momentum, with technical patterns such as low Relative Strength Index (RSI) and declining moving averages signaling weakness. Monitoring trading volume trends and confirming with key support and resistance levels helps distinguish a dead-cat bounce from a genuine recovery.

Investor Mistakes During a Dead-Cat Bounce

Investors often mistake a dead-cat bounce for a genuine market recovery, leading to premature buying and increased exposure to further losses. This misjudgment is fueled by short-term price spikes that obscure underlying negative fundamentals in stocks like those during the 2020 energy sector crash. Failing to conduct thorough due diligence during these temporary rebounds can result in significant financial setbacks and misaligned portfolio strategies.

The Impact of News and Earnings on Dead-Cat Bounces

Dead-cat bounces often occur after a sharp decline in a stock's price, triggered by negative news or disappointing earnings reports, followed by a brief and misleading recovery. For example, when a major tech company reported lower-than-expected quarterly earnings, the stock plunged but then experienced a short-lived rebound as investors hoped for a turnaround. This temporary rally can mislead traders before the stock resumes its downtrend, influenced heavily by ongoing negative sentiment and lack of substantial positive catalysts.

example of dead-cat bounce in stock Infographic

samplerz.com

samplerz.com