Overhang in the capital market refers to the excess supply of securities that are expected to be sold but have not yet entered the market. A common example is large blocks of shares held by insiders or institutional investors that might be offloaded once lock-up periods expire. These potential sales can place downward pressure on stock prices due to anticipated increases in supply. Another instance of overhang occurs when companies announce secondary offerings or convertible bond issuances, signaling future dilution. Investors may react conservatively knowing that the eventual increase in available shares can affect market valuations. Monitoring overhang levels helps market participants gauge supply-demand dynamics and anticipate price movements.

Table of Comparison

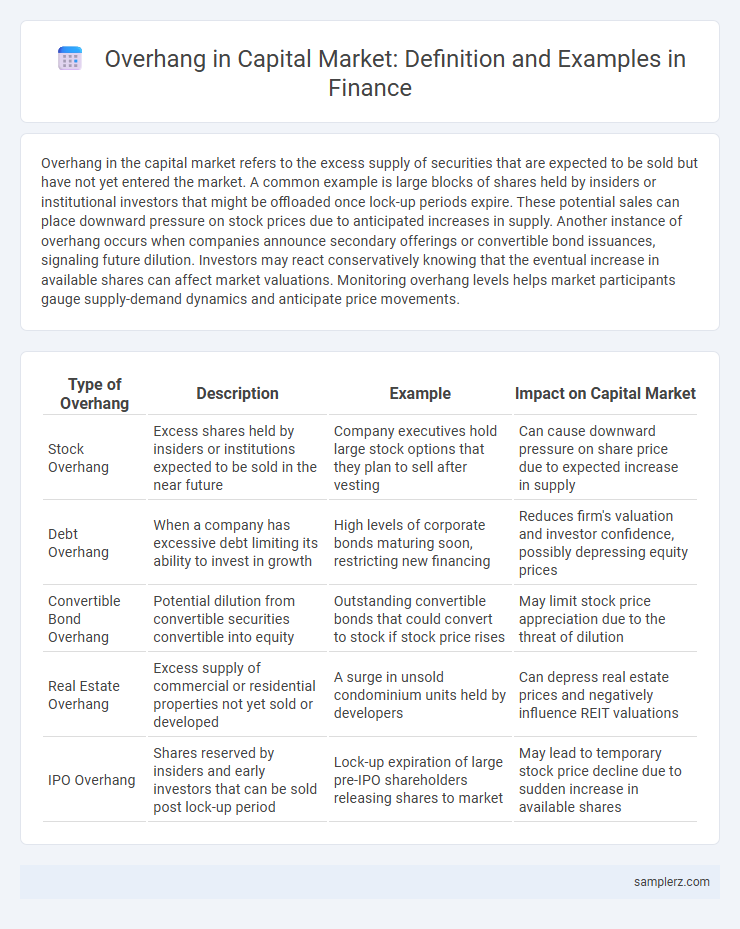

| Type of Overhang | Description | Example | Impact on Capital Market |

|---|---|---|---|

| Stock Overhang | Excess shares held by insiders or institutions expected to be sold in the near future | Company executives hold large stock options that they plan to sell after vesting | Can cause downward pressure on share price due to expected increase in supply |

| Debt Overhang | When a company has excessive debt limiting its ability to invest in growth | High levels of corporate bonds maturing soon, restricting new financing | Reduces firm's valuation and investor confidence, possibly depressing equity prices |

| Convertible Bond Overhang | Potential dilution from convertible securities convertible into equity | Outstanding convertible bonds that could convert to stock if stock price rises | May limit stock price appreciation due to the threat of dilution |

| Real Estate Overhang | Excess supply of commercial or residential properties not yet sold or developed | A surge in unsold condominium units held by developers | Can depress real estate prices and negatively influence REIT valuations |

| IPO Overhang | Shares reserved by insiders and early investors that can be sold post lock-up period | Lock-up expiration of large pre-IPO shareholders releasing shares to market | May lead to temporary stock price decline due to sudden increase in available shares |

Understanding Overhang: A Key Concept in Capital Markets

Overhang in capital markets refers to the large amount of securities, such as shares or bonds, that investors are expected to sell but have not yet entered the market, creating potential selling pressure. This phenomenon can impact stock prices by signaling possible dilution or supply glut, influencing investor sentiment and market liquidity. Understanding overhang helps in assessing market risks and timing investment decisions by anticipating possible price movements due to future selling activity.

Common Examples of Overhang in Financial Markets

Overhang in financial markets often appears when a significant volume of shares is held by insiders, such as founders or early investors, ready to be sold once restrictions lift, causing potential downward pressure on stock prices. Another common example involves large blocks of convertible securities, like bonds or preferred shares, that can be converted into common stock, increasing supply and potentially diluting existing shareholders. Stock overhang may also arise from employee stock options nearing expiration, prompting mass exercising and increased share liquidity that impacts market valuation.

How Debt Overhang Impacts Corporate Financing

Debt overhang occurs when a company has excessive outstanding debt, discouraging new investors due to fears of diminished returns or potential default. This situation constrains corporate financing by elevating borrowing costs and limiting access to additional capital, which impedes growth opportunities. Firms facing debt overhang often struggle to raise funds for profitable projects, undermining overall financial stability and market confidence.

Equity Overhang: Effects on Shareholder Value

Equity overhang occurs when a company has issued convertible securities or stock options that can dilute existing shareholders upon conversion, leading to potential declines in share price. This overhang creates uncertainty and often suppresses shareholder value, as investors anticipate future dilution and hesitate to bid up the stock. Effective management of equity overhang is crucial to maintaining investor confidence and optimizing capital structure in equity markets.

IPO Overhang: What Happens When Shares Flood the Market

IPO overhang occurs when a significant number of shares held by insiders, early investors, or underwriters become eligible for public trading shortly after the initial public offering. This sudden influx of sellable shares can depress stock prices due to increased supply and investor uncertainty about the company's prospects. Large IPO overhang may lead to reduced investor demand, heightened volatility, and challenges in achieving stable market valuations.

Investor Behavior Amidst Overhang Situations

Investor behavior amidst overhang situations often reveals heightened caution, as the prospect of a substantial volume of unsold securities can signal potential market dilution and price pressure. This anticipation leads to reduced buying activity and increased volatility, with investors strategically timing their entry to avoid unfavorable price adjustments. Empirical studies demonstrate that overhang scenarios typically trigger a shift toward more defensive portfolio allocations, reflecting an appetite for risk mitigation.

Identifying Signs of Overhang in Capital Structures

Signs of overhang in capital structures include a significant volume of outstanding convertible securities or warrants that can dilute existing shareholders upon conversion. A disproportionate amount of preferred stock redeemable at a fixed price may indicate potential pressure on the equity base if holders exercise their rights. Monitoring large blocks of planned equity issuances or upcoming debt maturities also helps identify capital overhang risks impacting market valuation.

Case Studies: Major Overhang Events in Global Markets

The 1997 Asian financial crisis exemplifies overhang in capital markets, where excessive foreign debt led to massive sell-offs and liquidity shortages across multiple Asian economies. Another major event occurred during the 2008 global financial crisis, when distressed asset overhang from subprime mortgage-backed securities created prolonged market instability and credit freezes. The European sovereign debt crisis also demonstrated overhang effects, as uncertainty over countries like Greece's debt sustainability resulted in investor reluctance and persistent market volatility.

Strategies for Managing Overhang in Corporate Finance

Overhang in corporate finance often refers to the excess supply of shares available for sale, which can depress stock prices and hinder capital raising efforts. Strategies for managing overhang include implementing share buyback programs to reduce the outstanding shares, negotiating lock-up agreements to delay the sale of large blocks of stock, and issuing convertible securities that can be converted to equity under specific conditions. Effective management of overhang improves investor confidence and stabilizes market valuation by controlling supply dynamics and signaling management's commitment to shareholder value.

The Long-Term Consequences of Overhang on Market Stability

Overhang in capital markets, such as large volumes of unexercised stock options or locked-in shares, can suppress liquidity and delay price discovery. Prolonged overhang creates uncertainty, amplifying volatility and undermining investor confidence, which ultimately threatens long-term market stability. Historical data from technology IPOs in the early 2000s illustrate how extended overhang periods contributed to sustained market disruptions and slower recovery rates.

example of Overhang in capital market Infographic

samplerz.com

samplerz.com