A haircut in a repurchase agreement (repo) refers to the percentage difference between the market value of the collateral and the loan amount. For example, if an investor lends $95 million using securities worth $100 million as collateral, the haircut is 5%. This margin protects the lender from a decline in the collateral's market value during the loan period. In the finance industry, haircuts vary based on the risk and liquidity of the collateral. Government bonds typically have lower haircuts, often around 2-5%, due to their high stability. Conversely, corporate bonds or equities might experience haircuts of 10% or more to account for greater price volatility.

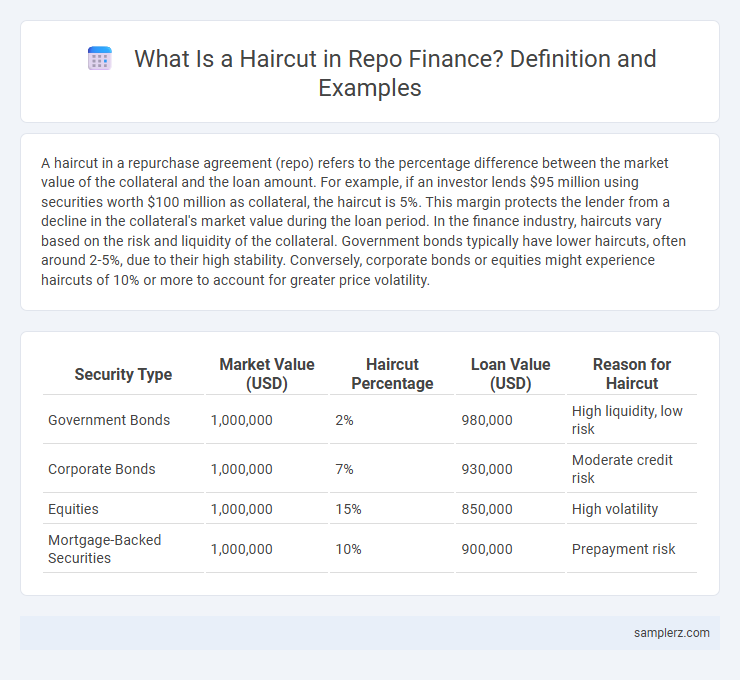

Table of Comparison

| Security Type | Market Value (USD) | Haircut Percentage | Loan Value (USD) | Reason for Haircut |

|---|---|---|---|---|

| Government Bonds | 1,000,000 | 2% | 980,000 | High liquidity, low risk |

| Corporate Bonds | 1,000,000 | 7% | 930,000 | Moderate credit risk |

| Equities | 1,000,000 | 15% | 850,000 | High volatility |

| Mortgage-Backed Securities | 1,000,000 | 10% | 900,000 | Prepayment risk |

Understanding Haircuts in Repo Transactions

In repo transactions, a haircut represents the percentage difference between the market value of the collateral and the loan amount, serving as a risk buffer for lenders. For example, if a bond with a market value of $1 million is used as collateral with a 5% haircut, the borrower can receive only $950,000 in cash. This mechanism protects lenders against market volatility and potential declines in collateral value during the repo period.

Common Haircut Percentages in Repo Agreements

Common haircut percentages in repo agreements typically range from 1% to 5%, depending on the credit quality and liquidity of the collateral. High-quality government securities often have haircuts around 1% to 2%, while lower-quality or less liquid assets may incur haircuts up to 5% or higher. These haircuts protect lenders against potential declines in collateral value during the term of the repurchase agreement.

Example: Applying a 2% Haircut on Government Bonds

Applying a 2% haircut on government bonds in a repo transaction means the lender values the bonds at 98% of their market price, reducing counterparty risk by requiring more collateral than the loan amount. For instance, if the bond's market value is $1 million, the lender will accept only $980,000 as collateral, ensuring a buffer against price volatility. This haircut protects the lender from potential losses if the borrower defaults and bond prices decline.

Calculating Collateral Value After a Haircut

Calculating collateral value after a haircut in a repo transaction involves adjusting the market value of the securities by a predetermined percentage to mitigate credit risk. For example, if Treasury bonds valued at $1,000,000 have a 5% haircut, the collateral value becomes $950,000, reflecting the lender's protection against market volatility. This adjusted value determines the maximum loan amount and ensures adequate coverage in case of borrower default.

Impact of Asset Type on Repo Haircuts

In repo transactions, the haircut applied varies significantly based on the asset type, with government securities typically receiving lower haircuts around 1-2% due to their liquidity and credit quality. Corporate bonds and equities often face higher haircuts, ranging from 5% to 15%, reflecting increased risk and price volatility. These differences ensure lenders are protected against market fluctuations and credit risk inherent in less stable asset classes.

Real-World Scenario: Haircut on Corporate Bonds in Repo

In a real-world repo transaction, a corporate bond with a market value of $1 million may be assigned a 10% haircut, meaning the lender will advance only $900,000 to the borrower. This haircut accounts for the bond's credit risk, liquidity, and market volatility, protecting the lender against potential declines in bond value during the repo period. Such haircuts are crucial for mitigating counterparty risk and ensuring the collateral adequately covers the loan in corporate bond repos.

Central Bank Guidelines for Repo Haircuts

Central Bank Guidelines for Repo Haircuts typically mandate a minimum percentage reduction in the collateral's market value to mitigate credit risk during repurchase agreements, often ranging from 2% to 10% depending on asset quality and market volatility. These haircuts ensure liquidity and protect the central bank from potential losses by adjusting for price fluctuations of securities such as government bonds or high-grade corporate debt used in repos. Compliance with such guidelines is crucial for maintaining stability in money market operations and upholding the integrity of monetary policy implementation.

Risk Factors Influencing Repo Haircut Levels

Repo haircut levels are influenced by risk factors such as collateral quality, market volatility, and borrower creditworthiness. Higher volatility or lower credit ratings typically result in increased haircuts to mitigate lender risk. Additionally, liquidity risk and regulatory requirements also play crucial roles in determining appropriate haircut percentages in repurchase agreements.

Case Study: Haircut Application During Market Volatility

During the 2008 financial crisis, a major repo transaction involving mortgage-backed securities saw the haircut increase from the typical 2% to over 20% due to heightened credit risk and asset price volatility. This significant haircut adjustment protected the lender by requiring the borrower to provide substantially more collateral, reflecting increased market uncertainty. The case exemplifies how haircuts serve as a dynamic risk management tool in repo markets during periods of financial stress.

Summary Table: Haircut Examples by Collateral Type

In finance, a haircut in repo transactions represents the percentage reduction applied to the market value of collateral to protect lenders against credit and market risk. For example, government bonds typically have a lower haircut of around 2-5%, corporate bonds range from 5-10%, and equities can have higher haircuts between 15-25%, reflecting increased volatility. This summary table of haircut examples by collateral type helps traders and risk managers assess the appropriate margin to mitigate exposure in repurchase agreements.

example of haircut in repo Infographic

samplerz.com

samplerz.com