In finance, a strip refers to a fixed-income instrument created by separating the interest and principal payments of a bond into individual securities. Each component, known as a zero-coupon bond, is sold separately and pays no interest until maturity. Investors use strips to manage interest rate risk and tailor their investment strategies to specific cash flow needs. Strips are commonly issued by government entities such as the U.S. Treasury, allowing investors to purchase individual interest payments or the principal amount of Treasury bonds. The data associated with strips includes maturity dates, face values, and yield rates for each separated payment. This structure enhances liquidity and provides greater flexibility in portfolio management.

Table of Comparison

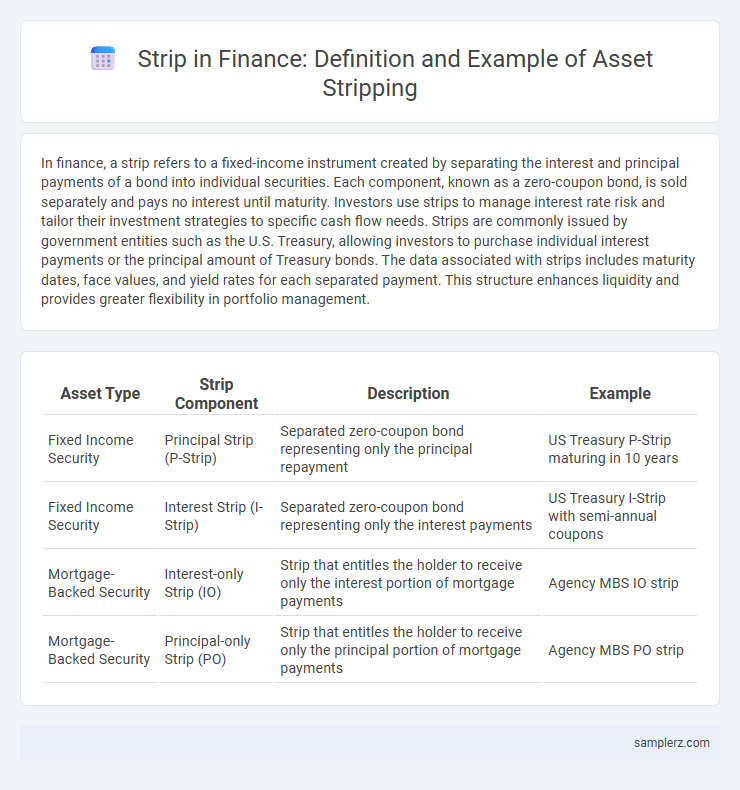

| Asset Type | Strip Component | Description | Example |

|---|---|---|---|

| Fixed Income Security | Principal Strip (P-Strip) | Separated zero-coupon bond representing only the principal repayment | US Treasury P-Strip maturing in 10 years |

| Fixed Income Security | Interest Strip (I-Strip) | Separated zero-coupon bond representing only the interest payments | US Treasury I-Strip with semi-annual coupons |

| Mortgage-Backed Security | Interest-only Strip (IO) | Strip that entitles the holder to receive only the interest portion of mortgage payments | Agency MBS IO strip |

| Mortgage-Backed Security | Principal-only Strip (PO) | Strip that entitles the holder to receive only the principal portion of mortgage payments | Agency MBS PO strip |

Introduction to Strip in Asset Finance

A strip in asset finance refers to the process of separating the interest and principal components of a fixed-income security, such as a bond, into distinct zero-coupon securities. Investors purchase these individual strips to tailor their cash flow profiles according to specific investment strategies and risk appetites. Strip securities provide greater flexibility in managing duration risk and optimizing portfolio performance in fixed-income portfolios.

Definition and Concept of Asset Stripping

Asset stripping involves acquiring a company primarily to sell its valuable assets individually for profit rather than operating the business as a whole. This finance strategy targets tangible or intangible assets such as real estate, intellectual property, or equipment, often leading to the dismemberment of the original company structure. The practice can maximize short-term financial gains while potentially reducing the long-term value or viability of the acquired firm.

How Strip Works in Fixed-Income Securities

A strip in fixed-income securities involves separating a bond's interest payments (coupons) and principal repayment into individual zero-coupon securities, each sold independently. Investors buy these stripped securities at a discount and receive a single lump-sum payment at maturity, reflecting the time value of money without interim cash flows. Strips allow for targeted investment strategies, managing interest rate risk and matching specific future cash flow needs.

Example: Stripping U.S. Treasury Bonds

Stripping U.S. Treasury bonds involves separating the principal and interest payments into individual zero-coupon securities, called Treasury STRIPS, which trade at a discount and mature at face value. This process allows investors to target specific cash flow timings and manage interest rate risk more precisely. Treasury STRIPS are highly liquid and backed by the U.S. government, making them a popular choice for conservative, income-focused portfolios.

Case Study: Mortgage-Backed Securities Strips

Mortgage-backed securities (MBS) strips are created by separating the cash flows of principal and interest components from a pool of mortgage loans, resulting in two distinct securities: interest-only (IO) strips and principal-only (PO) strips. IO strips derive value solely from the interest payments, which fluctuate based on prepayment speeds, while PO strips represent claims on the principal repayments and are highly sensitive to interest rate changes and prepayment risk. Case studies show that investors use these strips to hedge specific risks or to speculate on interest rate movements, exploiting the unique risk-return profiles of IO and PO strips within MBS markets.

Practical Applications of Strip in Asset Management

Strip bonds are used in asset management to isolate interest and principal payments, allowing precise matching of cash flows with liabilities. Portfolio managers employ strip securities to optimize duration and immunize portfolios against interest rate fluctuations. This technique enhances yield curve positioning and risk management strategies in fixed-income portfolios.

Risks and Benefits of Asset Stripping

Asset stripping in finance involves buying a company's assets to sell them individually, often maximizing immediate returns while risking long-term value erosion and reputational damage. The primary benefits include unlocking hidden asset value and generating quick cash flow, whereas risks encompass potential legal challenges, loss of operational synergy, and negative impact on employee morale. Careful due diligence and strategic planning are crucial to balance the financial gains against regulatory compliance and stakeholder interests.

Strip vs Traditional Bond Investing

Strip bonds represent fixed-income securities where principal and interest payments are separated into individual zero-coupon securities, allowing investors to target specific cash flows. Unlike traditional bond investing, where coupon payments are received periodically, strips provide a predictable lump-sum payment at maturity without reinvestment risk. This separation enhances portfolio customization, duration management, and tax planning opportunities for fixed-income investors.

Regulatory Perspective on Asset Stripping

Asset stripping involves selling off a company's valuable assets to repay debts or improve liquidity, often raising regulatory concerns about creditor protection and market fairness. Financial regulators enforce strict disclosure requirements and impose fiduciary duties on corporate managers to prevent abusive asset stripping that could harm shareholders and creditors. Regulatory frameworks like the Sarbanes-Oxley Act and Basel III guidelines aim to ensure transparency and maintain financial stability during asset restructuring processes.

Key Takeaways on Strips in Asset Finance

Strips in asset finance represent separated interest and principal components of fixed-income securities, providing investors targeted cash flow profiles and risk exposure. Key takeaways include the ability to customize maturity dates, enhance portfolio diversification, and improve liquidity by trading individual interest or principal strips separately. These structured products help manage interest rate risk and align investment strategies with specific financial goals.

example of strip in asset Infographic

samplerz.com

samplerz.com