In private equity, a vintage refers to the year in which a fund makes its initial investments. This term helps categorize funds based on the economic and market conditions during their starting period. Investors often analyze vintage years to compare performance across different timeframes and assess risk levels associated with market cycles. For example, a private equity fund with a 2018 vintage made its primary investments that year, amid post-financial crisis market recoveries and growing technology sector opportunities. By tracking vintages, analysts can measure a fund's returns relative to its peers and benchmark indices from the same period. Vintage analysis is crucial for understanding how external factors like interest rates and economic growth impacted fund performance.

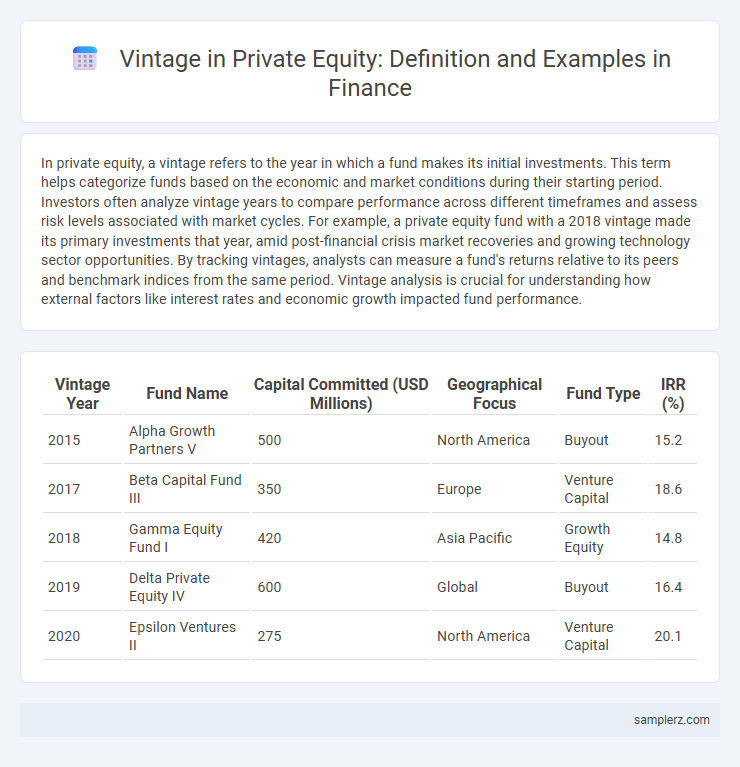

Table of Comparison

| Vintage Year | Fund Name | Capital Committed (USD Millions) | Geographical Focus | Fund Type | IRR (%) |

|---|---|---|---|---|---|

| 2015 | Alpha Growth Partners V | 500 | North America | Buyout | 15.2 |

| 2017 | Beta Capital Fund III | 350 | Europe | Venture Capital | 18.6 |

| 2018 | Gamma Equity Fund I | 420 | Asia Pacific | Growth Equity | 14.8 |

| 2019 | Delta Private Equity IV | 600 | Global | Buyout | 16.4 |

| 2020 | Epsilon Ventures II | 275 | North America | Venture Capital | 20.1 |

Understanding the Concept of Vintage in Private Equity

Vintage in private equity refers to the year in which a fund makes its first investment or closes its initial fundraising, serving as a key metric for performance benchmarking and risk assessment. Analyzing vintage years allows investors to compare funds launched during similar market conditions, helping to identify trends and economic cycles impacting returns. For example, funds with a 2008 vintage experienced distinct challenges due to the global financial crisis, influencing their investment pace and exit timing.

Importance of Vintage Year in Fund Performance

The vintage year in private equity denotes the year a fund makes its first investment, serving as a critical benchmark for evaluating its performance against market cycles. Funds with earlier vintage years may demonstrate resilience through multiple economic downturns, while those with recent vintages help investors gauge exposure to current market conditions. Understanding vintage year effects enhances portfolio diversification and informs risk-adjusted return assessments in private equity investing.

Examples of Successful Vintage Years in Private Equity

Successful vintage years in private equity, such as 2005, 2009, and 2012, have demonstrated exceptional returns with post-crisis market recoveries and technological innovation fueling growth. The 2005 vintage capitalized on the pre-financial crisis boom, generating IRRs exceeding 20%, while 2009 vintages benefited from undervalued assets and market dislocations, producing strong multiples. The 2012 vintage leveraged digital transformation trends, delivering above-average exits and expanding portfolios across technology and healthcare sectors.

How Vintage Year Affects Portfolio Returns

Vintage year in private equity refers to the specific year when a fund makes its initial investment, significantly impacting portfolio returns due to varying economic cycles and market conditions. Funds with earlier vintage years may benefit from downturns that allow for undervalued acquisitions, while those with later vintages might capitalize on emerging growth trends and sector innovations. Analyzing internal rate of return (IRR) across different vintage years highlights the importance of timing in maximizing capital appreciation and distribution multiples.

Case Studies: Notable Vintage Private Equity Funds

Notable vintage private equity funds such as Blackstone Capital Partners IV (2007) and KKR Asia Fund III (2013) demonstrate significant performance variability by vintage year, directly impacting internal rate of return (IRR) and total value to paid-in (TVPI) multiples. Vintage year analysis reveals how macroeconomic conditions and market cycles influence fund outcomes, exemplified by the robust recovery and growth of 2009 vintage funds post-financial crisis. Case studies on Carlyle Partners IV (2005) highlight strategic sector allocations and exit timing that optimized returns, showcasing the critical role of vintage in private equity fund performance evaluation.

Factors Influencing Private Equity Vintage Outcomes

Vintage in private equity refers to the year when a fund makes its first investment, significantly impacting performance outcomes. Key factors influencing private equity vintage results include macroeconomic conditions, interest rate trends, and market liquidity at the time of investment. These elements affect deal flow, valuation, and exit opportunities, ultimately shaping the fund's internal rate of return (IRR) and multiple on invested capital (MOIC).

Comparing Vintage Years: Performance Trends and Insights

Private equity vintage years serve as a critical benchmark to assess fund performance across different market cycles, revealing trends in IRR and MOIC. Analyzing data from 2010 to 2020 shows that funds vintage during economic downturns, such as 2011, often generate superior risk-adjusted returns due to opportunistic investments in undervalued assets. Comparative performance insights highlight the importance of vintage year selection in portfolio diversification and strategic allocation decisions.

Risks and Opportunities by Vintage Year in Private Equity

Vintage year in private equity significantly influences risk and opportunity profiles as each year reflects distinct market conditions impacting fund performance. Early vintage years, such as 2007-2008, often carry higher risk due to economic downturns but present opportunities for distressed asset acquisition and strong recovery potential. Conversely, vintages from bull markets like 2013-2014 typically experience lower risk but may face challenges in valuation inflation and exit timing.

Vintage Diversification Strategies for Investors

Vintage diversification strategies in private equity involve selecting funds from different investment years to mitigate market cycle risks and smooth returns. By spreading capital across multiple vintage years, investors reduce exposure to economic downturns specific to a single period, enhancing portfolio stability. Data shows that portfolios diversified across vintages often achieve more consistent IRRs and lower volatility compared to those concentrated in one vintage.

Lessons Learned from Past Private Equity Vintages

Analyzing vintage years in private equity reveals critical lessons in market timing, sector focus, and exit strategies, with the 2007-2008 vintage highlighting the impact of financial crises on fund performance. Vintage analysis underscores the importance of economic cycles, where funds raised during downturns often benefit from lower valuations but face longer holding periods. These insights drive strategic adjustments in capital deployment and portfolio management to enhance risk-adjusted returns in future vintages.

example of vintage in private equity Infographic

samplerz.com

samplerz.com