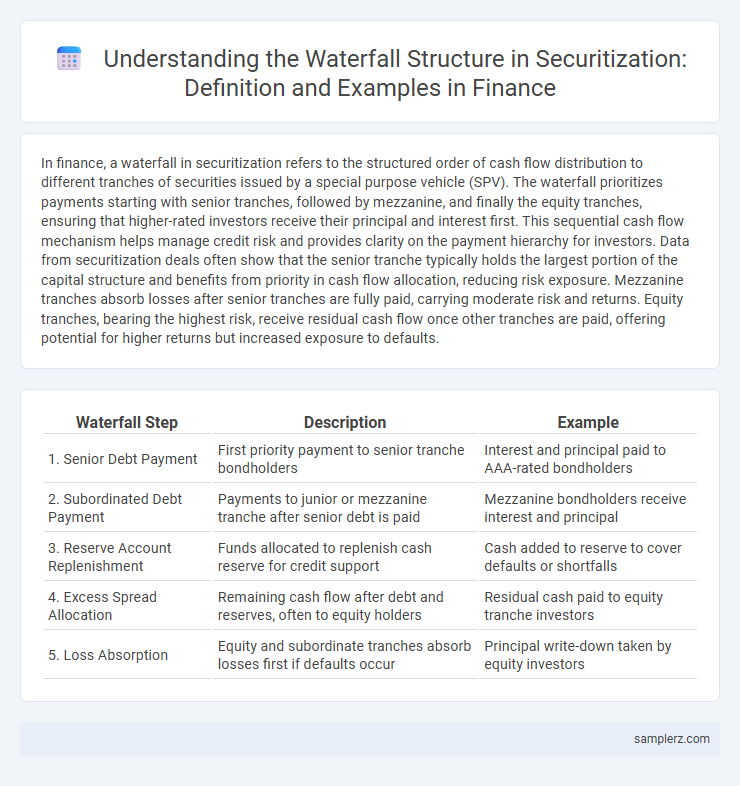

In finance, a waterfall in securitization refers to the structured order of cash flow distribution to different tranches of securities issued by a special purpose vehicle (SPV). The waterfall prioritizes payments starting with senior tranches, followed by mezzanine, and finally the equity tranches, ensuring that higher-rated investors receive their principal and interest first. This sequential cash flow mechanism helps manage credit risk and provides clarity on the payment hierarchy for investors. Data from securitization deals often show that the senior tranche typically holds the largest portion of the capital structure and benefits from priority in cash flow allocation, reducing risk exposure. Mezzanine tranches absorb losses after senior tranches are fully paid, carrying moderate risk and returns. Equity tranches, bearing the highest risk, receive residual cash flow once other tranches are paid, offering potential for higher returns but increased exposure to defaults.

Table of Comparison

| Waterfall Step | Description | Example |

|---|---|---|

| 1. Senior Debt Payment | First priority payment to senior tranche bondholders | Interest and principal paid to AAA-rated bondholders |

| 2. Subordinated Debt Payment | Payments to junior or mezzanine tranche after senior debt is paid | Mezzanine bondholders receive interest and principal |

| 3. Reserve Account Replenishment | Funds allocated to replenish cash reserve for credit support | Cash added to reserve to cover defaults or shortfalls |

| 4. Excess Spread Allocation | Remaining cash flow after debt and reserves, often to equity holders | Residual cash paid to equity tranche investors |

| 5. Loss Absorption | Equity and subordinate tranches absorb losses first if defaults occur | Principal write-down taken by equity investors |

Introduction to Waterfall Structures in Securitization

Waterfall structures in securitization outline the priority of cash flow distribution from the underlying asset pool to various tranche investors, ensuring systematic risk allocation. Senior tranches receive principal and interest payments first, followed by mezzanine and equity tranches, reflecting their credit risk hierarchy. This hierarchical payment system enhances investor confidence by clearly defining loss absorption order and expected returns.

Key Components of a Securitization Waterfall

The key components of a securitization waterfall include principal and interest payments distribution, priority of payments, and the allocation of losses. Cash flow from the underlying asset pool is first applied to senior tranches, then subordinated tranches, following a strict order that protects senior investors. Reserve accounts, fees, and expenses are also accounted for before residual interest payments are made to equity holders.

Cash Flow Distribution in Securitization Waterfalls

In securitization waterfalls, cash flow distribution prioritizes the payment of senior tranche investors before allocating funds to subordinate tranches and equity holders. Interest and principal collections from underlying assets funnel through defined tiers, ensuring risk mitigation by protecting senior noteholders against defaults. This structured priority of payments efficiently manages credit risk and aligns investor returns with tranche seniority.

Priority of Payments: Senior vs. Junior Tranches

In securitization, the waterfall structure dictates the Priority of Payments, where Senior Tranches receive principal and interest payments before Junior Tranches. Senior Tranches typically have lower risk and yield, benefiting from priority repayment, while Junior Tranches absorb initial losses and carry higher risk and yield profiles. This hierarchical payment system ensures that cash flows are distributed according to risk exposure, protecting senior investors in the capital stack.

Step-by-Step Waterfall Example in MBS Transactions

In a typical MBS transaction, the waterfall begins with gross interest and principal collections deposited into a trust account. First, senior tranche bondholders receive scheduled interest payments, followed by principal repayments according to tranche priority. Residual cash flows are then allocated to subordinated tranches and equity investors, absorbing losses only after senior tranche obligations are satisfied.

Role of Credit Enhancements in Waterfall Structures

Credit enhancements such as overcollateralization, reserve accounts, and subordinated tranches play a crucial role in waterfall structures by absorbing initial losses and protecting senior debt holders in securitization. These mechanisms prioritize cash flow distribution by ensuring that principal and interest payments are first allocated to higher-rated tranches before any losses impact them, thereby maintaining credit quality. The strategic placement of credit enhancements within the waterfall minimizes default risk and enhances the overall credit rating of the securitized asset pool.

Waterfall Triggers: Events Impacting Payment Flow

Waterfall triggers in securitization are critical events such as missed interest payments, breaching overcollateralization tests, or declines in asset performance that alter the priority of payment flows to different tranches. These triggers can shift payments from junior to senior tranches or suspend payments to equity investors, ensuring protection for higher-rated securities. Effective management of waterfall triggers enhances risk mitigation and maintains investor confidence in structured finance transactions.

Real-World Example: ABS Waterfall Distribution

In securitization, an ABS waterfall distribution allocates cash flows sequentially to different tranches based on priority, starting with senior debt holders, followed by mezzanine investors, and finally equity holders. For example, a $500 million mortgage-backed ABS might first distribute interest and principal payments to $300 million senior bonds, then to $150 million mezzanine notes, and any residual cash flows go to a $50 million equity tranche. This prioritization reduces risk for senior tranches, enhancing credit ratings and investor confidence in the structured finance deal.

Impact of Defaults on Securitization Waterfalls

Defaults in securitization waterfalls trigger priority shifts where losses are absorbed first by junior tranches, protecting senior tranches from immediate impact. This cascading effect influences cash flow distribution, often halting payments to lower-rated securities while preserving investor confidence in higher-rated tranches. The structural design of the waterfall thus mitigates credit risk by reallocating default-related losses according to tranche seniority and exposure levels.

Best Practices for Structuring Securitization Waterfalls

Structuring securitization waterfalls requires precise allocation of cash flows among multiple tranches, prioritizing senior debt repayment before subordinate classes to optimize risk distribution and investor confidence. Best practices include designing clear trigger mechanisms for cash flow diversion, implementing robust enforcement of payment priorities, and incorporating dynamic modeling to anticipate varying market conditions. Maintaining transparency in waterfall documentation ensures regulatory compliance and facilitates efficient investor communication.

example of waterfall in securitization Infographic

samplerz.com

samplerz.com