Mortgage warehousing refers to a financial process where mortgage lenders temporarily hold or store mortgage loans before selling them to investors. This mechanism allows lenders to manage cash flow efficiently by using warehouse lines of credit to fund loans until they are bundled and sold. The warehouse facility acts as a short-term financing solution that facilitates the transition of mortgage assets from originators to the secondary market. In mortgage warehousing, the warehouse lender evaluates loans based on credit quality, loan-to-value ratios, and documentation standards to mitigate risk. Data management plays a critical role, as accurate tracking of loan details and disbursements ensures compliance and smooth loan transfers. Warehousing enables lenders to increase loan origination volumes without needing to hold large amounts of capital long-term, optimizing operational and financial performance.

Table of Comparison

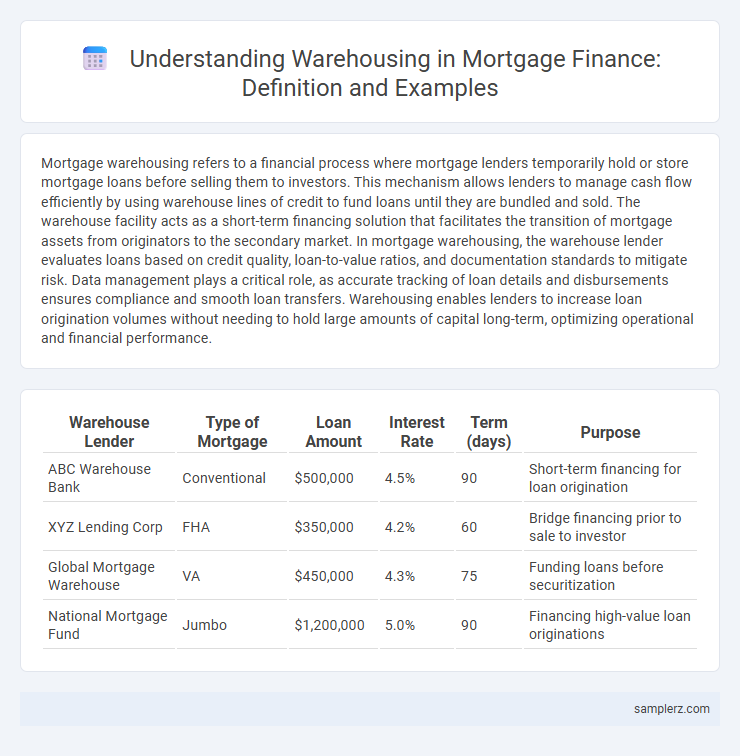

| Warehouse Lender | Type of Mortgage | Loan Amount | Interest Rate | Term (days) | Purpose |

|---|---|---|---|---|---|

| ABC Warehouse Bank | Conventional | $500,000 | 4.5% | 90 | Short-term financing for loan origination |

| XYZ Lending Corp | FHA | $350,000 | 4.2% | 60 | Bridge financing prior to sale to investor |

| Global Mortgage Warehouse | VA | $450,000 | 4.3% | 75 | Funding loans before securitization |

| National Mortgage Fund | Jumbo | $1,200,000 | 5.0% | 90 | Financing high-value loan originations |

Introduction to Warehousing in Mortgage Finance

Warehousing in mortgage finance involves short-term funding that enables lenders to fund loans until they are sold to investors or securitized. This process improves liquidity by allowing mortgage originators to extend more loans without holding long-term capital. Key entities in this system include warehouse lenders, mortgage bankers, and secondary market investors, all contributing to the efficient flow of mortgage capital.

Key Concepts of Mortgage Warehousing

Mortgage warehousing involves short-term financing that allows lenders to fund loans before selling them to investors. Key concepts include holding mortgage loans temporarily, managing interest rate risk during the holding period, and ensuring liquidity for continuous loan origination. Effective warehousing enhances cash flow, supports lender solvency, and facilitates smoother secondary market transactions.

How Mortgage Warehousing Works

Mortgage warehousing involves a short-term financing process where lenders use a warehouse line of credit to fund mortgage loans before selling them to investors. The lender temporarily holds these funded mortgages in a "warehouse" account, allowing rapid loan closure while awaiting final sale or securitization. This mechanism enhances liquidity, enabling continuous mortgage origination without immediate capital constraints.

Benefits of Warehousing in Mortgage Lending

Warehousing in mortgage lending accelerates loan processing by providing lenders with temporary funding, enabling quicker closings and improved borrower satisfaction. This practice enhances liquidity management, allowing lenders to efficiently handle larger loan volumes without immediate capital constraints. Moreover, warehousing reduces interest rate risk by bridging the gap between loan origination and sale to investors, optimizing profitability in volatile markets.

Example of Mortgage Warehousing Process

Mortgage warehousing involves a lender temporarily funding multiple mortgage loans using a credit facility before selling them to investors. For example, a mortgage originator closes several home loans and funds them through a short-term warehouse line of credit, allowing immediate loan disbursement. Once pooled, these loans are sold to a secondary market investor, repaying the warehouse line and providing liquidity for new mortgage originations.

Role of Warehouse Lenders in Mortgage Transactions

Warehouse lenders provide short-term funding to mortgage lenders, enabling them to fund multiple loans before selling them to investors or the secondary market. By offering revolving credit lines, warehouse lenders help mortgage originators manage cash flow efficiently and maintain loan production volume. This crucial financing mechanism supports the continuous flow of mortgage transactions from origination to securitization.

Risks Associated with Mortgage Warehousing

Mortgage warehousing involves short-term financing where lenders fund mortgage loans before selling them to investors, exposing them to risks such as interest rate fluctuations that can reduce loan profitability. Credit risk arises if borrowers default before the loan is sold, potentially leading to significant financial losses for the warehouse lender. Liquidity risk also plays a critical role, as delays in selling loans to investors may strain the lender's capital and impact cash flow management.

Real-World Case Study: Mortgage Warehousing Example

A real-world example of mortgage warehousing involves a regional bank that originates residential mortgage loans and temporarily holds them in a warehouse line of credit before selling to government-sponsored enterprises like Fannie Mae. The bank uses the warehousing facility to manage liquidity and reduce interest rate risk during the loan origination process. This strategy enhances cash flow efficiency and supports steady loan pipeline management in a fluctuating mortgage market.

Regulatory Considerations in Mortgage Warehousing

Mortgage warehousing involves short-term financing to fund mortgage loans before their sale to investors, subject to strict regulatory oversight. Key regulatory considerations include compliance with the Truth in Lending Act (TILA), adherence to state usury laws, and maintaining appropriate capital reserves under the Basel III framework. Financial institutions must also ensure transparency in loan disclosures and implement robust risk management practices to mitigate potential liquidity and credit risks within mortgage warehousing operations.

Future Trends in Mortgage Warehousing

Future trends in mortgage warehousing emphasize increased automation and integration of artificial intelligence to enhance loan processing efficiency and risk assessment. Blockchain technology is gaining traction to improve transparency and security in warehousing transactions. Additionally, sustainable finance practices are shaping warehousing strategies, aligning mortgage portfolios with environmental, social, and governance (ESG) criteria.

example of warehousing in mortgage Infographic

samplerz.com

samplerz.com