A strip in bonds refers to a financial instrument created by separating the interest and principal payments of a bond into individual components. Each component, called a zero-coupon security, can be traded independently in the market. This allows investors to target specific cash flows, either focusing on periodic interest or the lump sum principal repayment at maturity. Treasury STRIPS (Separate Trading of Registered Interest and Principal Securities) are a common example of strips in bonds. The U.S. Treasury Department offers these stripped securities by separating Treasury notes and bonds into their interest and principal parts. Investors use these securities to match long-term liabilities, manage interest rate risks, and enhance portfolio flexibility through customized income streams.

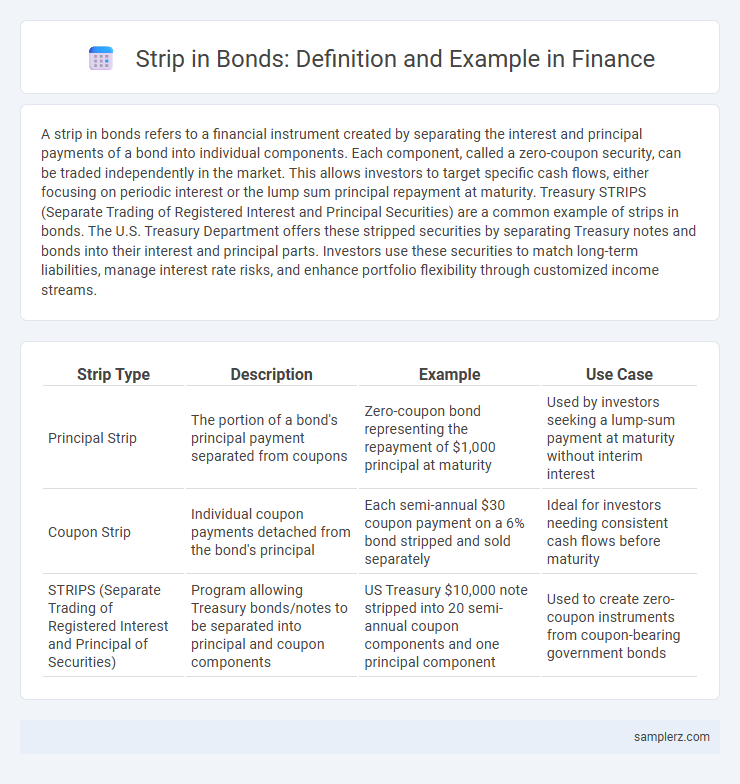

Table of Comparison

| Strip Type | Description | Example | Use Case |

|---|---|---|---|

| Principal Strip | The portion of a bond's principal payment separated from coupons | Zero-coupon bond representing the repayment of $1,000 principal at maturity | Used by investors seeking a lump-sum payment at maturity without interim interest |

| Coupon Strip | Individual coupon payments detached from the bond's principal | Each semi-annual $30 coupon payment on a 6% bond stripped and sold separately | Ideal for investors needing consistent cash flows before maturity |

| STRIPS (Separate Trading of Registered Interest and Principal of Securities) | Program allowing Treasury bonds/notes to be separated into principal and coupon components | US Treasury $10,000 note stripped into 20 semi-annual coupon components and one principal component | Used to create zero-coupon instruments from coupon-bearing government bonds |

Understanding STRIPS in Bond Investments

STRIPS, or Separate Trading of Registered Interest and Principal Securities, divide a bond into individual interest and principal components that trade independently in the market. Investors can purchase these zero-coupon securities to receive fixed payments at maturity, providing opportunities for tailored income streams and interest rate risk management. Understanding STRIPS enhances portfolio diversification by allowing precise targeting of cash flows and duration.

What Are STRIPS? A Financial Overview

STRIPS, or Separate Trading of Registered Interest and Principal Securities, are Treasury securities that have been split into individual interest and principal components, allowing investors to buy and sell each part separately. These zero-coupon bonds are sold at a discount and redeemable at face value upon maturity, making them attractive for long-term investment and interest rate risk management. STRIPS provide predictable, fixed returns without periodic interest payments, appealing to investors seeking security and cash flow planning.

Key Features of STRIPS in Bonds

STRIPS (Separate Trading of Registered Interest and Principal Securities) divide a bond into individual interest and principal components, each traded separately as zero-coupon securities. Key features include zero-coupon structure, fixed maturity dates, and absence of periodic interest payments, which allow investors to target specific cash flow needs and hedge interest rate risk. STRIPS offer high liquidity and are backed by the full faith and credit of the U.S. Treasury, making them low-risk investment options.

Types of STRIPS: Principal vs. Coupon

In bond markets, STRIPS (Separate Trading of Registered Interest and Principal Securities) are divided into two types: principal STRIPS and coupon STRIPS. Principal STRIPS represent the bond's face value payable at maturity, while coupon STRIPS consist of the individual interest payments detached from the bond. Investors can purchase either type to target specific cash flows or invest in zero-coupon instruments with differing maturities.

Advantages of Investing in STRIPS

STRIPS (Separate Trading of Registered Interest and Principal of Securities) offer investors the advantage of predictable, zero-coupon returns by separating interest and principal payments into individual securities. This structure allows for precise cash flow planning, making STRIPS ideal for matching long-term liabilities or retirement goals. Moreover, their high liquidity and backing by U.S. Treasury securities minimize credit risk, providing a secure investment option in volatile markets.

Risks Associated with STRIPS in Fixed Income

STRIPS bonds, created by separating coupon and principal payments, carry significant interest rate risk due to their long durations and zero-coupon nature. Credit risk is minimal since STRIPS are backed by U.S. Treasury securities, but liquidity risk can be higher compared to traditional bonds because STRIPS are less frequently traded. Investors should also consider reinvestment risk is virtually eliminated, while market price volatility can be extreme in response to changing interest rates.

Tax Implications of STRIPS Investments

Investing in Treasury STRIPS generates imputed interest income annually, which is taxable at federal and possibly state levels despite no cash interest payments received. Holders must report phantom income each tax year, increasing their taxable income without corresponding cash flow. Failure to account for these tax implications can lead to unexpected tax liabilities during the bond's maturity.

Comparing STRIPS to Traditional Bonds

STRIPS, or Separate Trading of Registered Interest and Principal Securities, allow investors to hold and trade the individual interest and principal components of a Treasury bond separately, enhancing liquidity and customization compared to traditional bonds. Unlike traditional bonds that pay periodic interest, STRIPS are sold at a deep discount and mature at face value, making them zero-coupon securities ideal for precise cash flow planning. The zero-coupon nature of STRIPS also eliminates reinvestment risk, which is present in traditional bonds due to periodic coupon payments.

Real-World Examples of STRIPS in Practice

U.S. Treasury STRIPS, established in 1985, exemplify the practical use of Separate Trading of Registered Interest and Principal Securities, allowing investors to hold the principal and interest components of Treasury bonds as individual zero-coupon securities. Municipal bonds are also frequently stripped, providing tax-exempt income streams tailored to investor preferences. These real-world STRIPS enhance portfolio diversification by enabling precise duration management and targeted cash flow investment strategies in fixed income markets.

How to Invest in STRIPS: Step-by-Step Guide

To invest in Treasury STRIPS, start by opening a brokerage account that offers access to U.S. Treasury securities. Select the desired maturity dates of the STRIPS, which are zero-coupon bonds created by separating interest and principal payments from Treasury notes or bonds. Purchase STRIPS through the broker, holding them to maturity for a fixed return based on the discounted purchase price without periodic interest payments.

example of strip in bond Infographic

samplerz.com

samplerz.com