A waterfall in structured finance refers to the priority sequence in which cash flows or payments are distributed among different stakeholders or tranches of a securitized asset. For example, in a mortgage-backed security (MBS), the waterfall dictates that interest payments are first allocated to senior tranches, then to mezzanine tranches, and finally to equity tranches. Each tranche receives cash flows based on its risk and priority level, ensuring that higher-rated investors receive payments before lower-rated ones. A typical example of a waterfall structure occurs in collateralized loan obligations (CLOs), where loan repayments are distributed through a defined hierarchy. Senior debt holders receive principal and interest first, followed by subordinated debt, and then equity investors absorb any residual cash flows. This waterfall mechanism protects senior investors from losses and aligns the risk-return profile for all parties involved in the structured finance transaction.

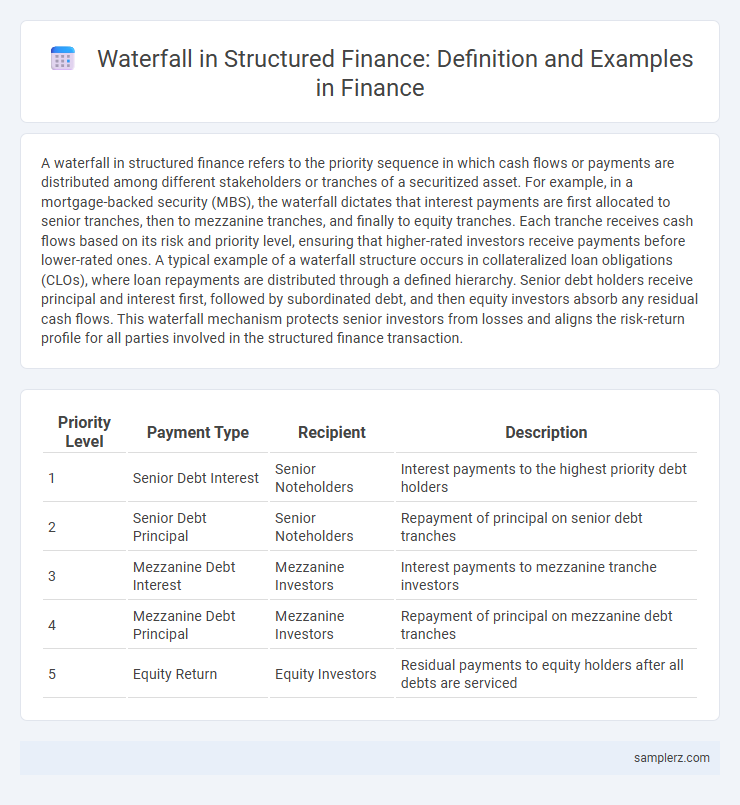

Table of Comparison

| Priority Level | Payment Type | Recipient | Description |

|---|---|---|---|

| 1 | Senior Debt Interest | Senior Noteholders | Interest payments to the highest priority debt holders |

| 2 | Senior Debt Principal | Senior Noteholders | Repayment of principal on senior debt tranches |

| 3 | Mezzanine Debt Interest | Mezzanine Investors | Interest payments to mezzanine tranche investors |

| 4 | Mezzanine Debt Principal | Mezzanine Investors | Repayment of principal on mezzanine debt tranches |

| 5 | Equity Return | Equity Investors | Residual payments to equity holders after all debts are serviced |

Introduction to Waterfall Structures in Structured Finance

Waterfall structures in structured finance dictate the sequential allocation of cash flows among various tranches of securities, prioritizing senior debt repayments before subordinated tranches receive funds. This hierarchy mitigates risk by ensuring that senior tranche investors have the highest claim on incoming payments, while mezzanine and equity tranches absorb initial losses. Commonly utilized in mortgage-backed securities (MBS) and collateralized loan obligations (CLOs), waterfalls enhance creditworthiness and investment transparency through clear payment prioritization.

Key Components of a Structured Finance Waterfall

A structured finance waterfall illustrates the prioritized payment sequence among stakeholders, detailing how cash flows from the underlying assets are distributed. Key components include the senior tranche, which receives principal and interest payments first, followed by the mezzanine and equity tranches that absorb residual risks and returns. This hierarchy ensures credit enhancement by protecting senior investors through subordinated layers, loss absorption, and reserve accounts embedded in the waterfall structure.

Typical Waterfall Priority of Payments

The typical waterfall priority of payments in structured finance begins with servicing senior debt obligations, including interest and principal repayments, followed by payment of operational expenses and trustee fees. Subordinated debts and mezzanine tranches receive payments only after all senior liabilities are fully satisfied, while residual cash flows are distributed to equity holders. This hierarchy ensures risk mitigation by prioritizing creditors and maintaining the structure's credit enhancement mechanisms.

Senior vs. Subordinated Tranches: Waterfall Impact

In structured finance, the waterfall structure dictates the priority of payments, where Senior Tranches receive distributions before Subordinated Tranches, ensuring lower risk and higher credit ratings for senior debt holders. Cash flows from the underlying assets are first allocated to interest and principal payments on the Senior Tranches, with residual payments cascading down to Subordinated Tranches, which absorb losses first in the event of default. This hierarchical payment system impacts the overall risk-return profile of the securitized deal, directly influencing investor demand and pricing.

Waterfall Example in Mortgage-Backed Securities (MBS)

In Mortgage-Backed Securities (MBS), the waterfall structure dictates the sequential allocation of principal and interest payments from mortgage pools to various tranches. Senior tranches receive payments first, followed by mezzanine and equity tranches, reflecting differing risk levels and priorities. This hierarchy ensures that higher-rated tranches have priority claim on cash flows, enhancing investor confidence and credit ratings.

Waterfall Example in Collateralized Loan Obligations (CLO)

In Collateralized Loan Obligations (CLOs), the waterfall structure dictates the priority of cash flow distribution from the underlying loan portfolio, starting with senior debt payments before subordinated tranches and equity investors receive funds. Interest and principal collections are allocated first to senior noteholders to reduce risk, followed by mezzanine tranches, ensuring that subordinated debt absorbs losses before affecting higher-rated securities. This waterfall mechanism enhances credit quality for senior tranches and provides a systematic approach to risk allocation within structured finance transactions.

Triggers and Waterfall Modification Events

Triggers in structured finance waterfalls initiate a reallocation of cash flows when predefined financial benchmarks, such as interest coverage ratios or default probabilities, fall below specified thresholds. Waterfall modification events occur when trigger conditions prompt adjustments in payment priorities, often prioritizing senior debt repayments or activating reserve accounts to protect investor interests. These mechanisms ensure dynamic risk management and preserve capital structure integrity throughout the life of a securitization or structured finance transaction.

Practical Calculation of Waterfall Distributions

In structured finance, waterfall distributions allocate cash flow sequentially, prioritizing senior debt repayments before subordinated tranches. Practical calculation involves determining available cash, deducting senior tranche obligations, then distributing residual amounts to mezzanine and equity holders according to predefined percentages. This process ensures transparency and adherence to the capital structure's hierarchy, optimizing risk-adjusted returns for investors.

Risks and Benefits of Waterfall Structures

Waterfall structures in structured finance allocate cash flows hierarchically to prioritize senior debt repayment before subordinated tranches, effectively managing credit risk and enhancing investor confidence. This risk allocation mitigates default exposure for senior investors but increases potential loss severity for lower-tier stakeholders, reflecting a trade-off between risk and return. The waterfall mechanism benefits overall capital efficiency by optimizing cash flow distribution and aligning incentives across diverse investor classes.

Regulatory Considerations in Structured Finance Waterfalls

Regulatory considerations in structured finance waterfalls include compliance with SEC Rule 144A and Regulation AB, ensuring transparent disclosure and investor protections throughout cash flow distributions. Stress testing under Basel III capital requirements influences the structuring of payment priorities to mitigate systemic risks. Adherence to FATCA and Dodd-Frank Act provisions also impacts waterfall design by imposing reporting and transparency obligations on asset-backed securities issuers.

example of waterfall in structured finance Infographic

samplerz.com

samplerz.com