A swaption is a financial derivative that grants the holder the right, but not the obligation, to enter into an interest rate swap agreement at a predetermined date and rate. In an interest rate swap, two parties exchange cash flows based on different interest rate benchmarks, commonly swapping fixed rates for floating rates. The swaption provides flexibility for investors to hedge interest rate risk or speculate on future movements in rates within the fixed income market. An example of a swaption in interest rates is a payer swaption, which gives the holder the right to pay a fixed interest rate and receive a floating rate. Suppose an investor purchases a payer swaption with a strike rate of 3% and a maturity of one year; if interest rates rise above 3%, the investor can exercise the swaption to lock in the lower fixed rate and benefit from the higher floating rate payments. This instrument is widely used by corporations and financial institutions to manage exposure to fluctuating interest rates in bond issuances or loan portfolios.

Table of Comparison

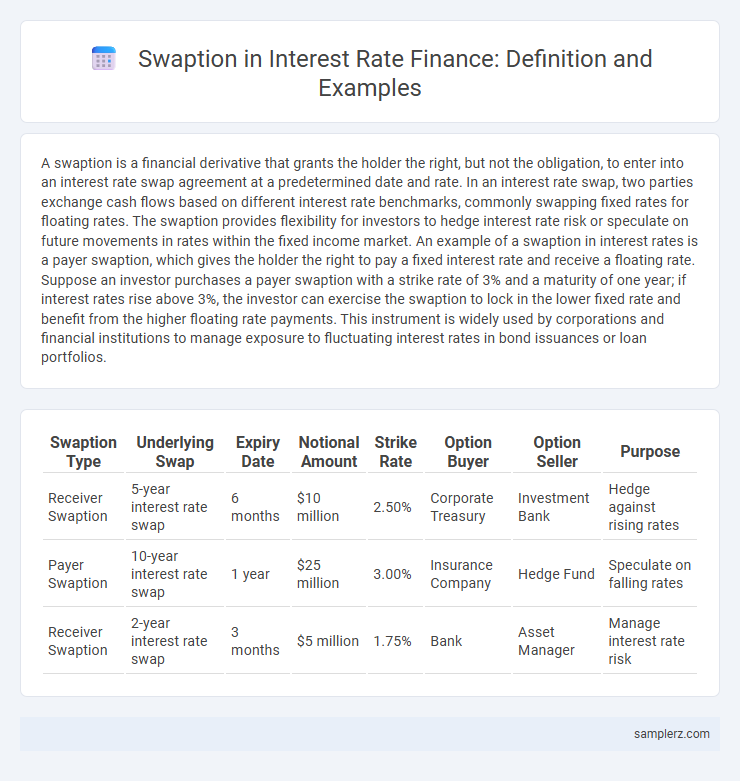

| Swaption Type | Underlying Swap | Expiry Date | Notional Amount | Strike Rate | Option Buyer | Option Seller | Purpose |

|---|---|---|---|---|---|---|---|

| Receiver Swaption | 5-year interest rate swap | 6 months | $10 million | 2.50% | Corporate Treasury | Investment Bank | Hedge against rising rates |

| Payer Swaption | 10-year interest rate swap | 1 year | $25 million | 3.00% | Insurance Company | Hedge Fund | Speculate on falling rates |

| Receiver Swaption | 2-year interest rate swap | 3 months | $5 million | 1.75% | Bank | Asset Manager | Manage interest rate risk |

Introduction to Swaptions in Interest Rate Markets

Swaptions in interest rate markets allow investors to acquire the right, but not the obligation, to enter into a swap agreement at a predetermined fixed rate. These derivatives are crucial for managing interest rate risk, enabling institutions to hedge against fluctuating rates or speculate on future movements. Market participants utilize swaptions for customized risk exposure and strategic positioning in environments of interest rate uncertainty.

Key Features of Interest Rate Swaptions

Interest rate swaptions grant the holder the right, but not the obligation, to enter into an interest rate swap agreement at a predetermined fixed or floating rate on a specified future date. Key features include the option premium, the strike rate, and the expiration date, which collectively determine the swaption's value and risk exposure. These instruments provide flexibility in hedging interest rate risk or speculating on future rate movements without immediate obligation.

How Interest Rate Swaptions Work

Interest rate swaptions grant the holder the right, but not the obligation, to enter into an interest rate swap agreement at a predetermined fixed rate on a specified future date. These derivatives allow investors to hedge against or speculate on movements in interest rates by locking in borrowing or lending costs in advance. The value of a swaption depends on factors such as the volatility of interest rates, time to expiration, and the difference between the fixed swap rate and current market rates.

Real-World Example: Using a Swaption for Hedging

A corporation with a variable-rate loan anticipates rising interest rates and purchases a payer swaption, granting the right to enter an interest rate swap to pay fixed and receive floating rates. This swaption effectively caps borrowing costs, providing financial protection against unfavorable rate increases while allowing benefit if rates decline. This hedging strategy stabilizes cash flows and reduces interest expense volatility, essential for managing interest rate risk in corporate finance.

Cash-Settled vs. Physically-Settled Swaptions

Cash-settled swaptions in interest rate markets provide a net cash payment based on the difference between the swap's market rate and the strike rate, eliminating the need for the physical exchange of principal. Physically-settled swaptions require the actual entering into an interest rate swap contract upon exercise, involving the exchange of fixed and floating rate payments over the swap's life. The choice between cash-settled and physically-settled swaptions impacts liquidity, counterparty risk, and operational complexity in interest rate derivative strategies.

Pricing a Swaption: Essential Concepts

Pricing a swaption involves calculating the option's premium based on the volatility of interest rates, the underlying swap's fixed and floating rates, and the time to expiration. Key models like Black's model or the Hull-White model are commonly used to determine the fair value by estimating the expected payoff under the risk-neutral measure. Accurate swaption pricing requires inputs such as forward swap rates, discount factors from the yield curve, and implied volatility surfaces to capture market expectations.

Buy-Side Example: Corporate Interest Rate Risk Management

A corporate treasurer purchases a payer swaption to hedge against rising interest rates on upcoming debt issuance, securing the right to enter into a swap paying fixed rates and receiving floating rates. This strategy limits exposure to variable rate fluctuations while maintaining flexibility if interest rates decline. The swaption premium acts as insurance, providing cost-effective risk management in volatile interest rate environments.

Sell-Side Example: Dealer Swaption Applications

In sell-side dealer swaption applications, dealers often use swaptions to hedge interest rate risk by offering options to enter into interest rate swaps with clients at predetermined terms. For example, a dealer may sell a payer swaption, granting the client the right to pay fixed and receive floating rates, thus transferring potential upside risk to the client while securing premium income. This strategy enables dealers to manage duration exposure and balance their interest rate portfolios effectively under varying market conditions.

Case Study: Swaption Strategies in Volatile Markets

A swaption allows investors to hedge or speculate on interest rate movements by granting the right to enter into an interest rate swap at predetermined terms, crucial in volatile markets. In a case study during the 2022 bond market turbulence, institutions utilized payer swaptions to protect against rising rates and receiver swaptions to capitalize on potential rate declines. This strategy optimized portfolio resilience by managing exposure to fluctuating LIBOR benchmarks and central bank policy shifts effectively.

Conclusion: Benefits and Risks of Interest Rate Swaptions

Interest rate swaptions offer flexibility by granting the right to enter a rate swap, enabling effective hedging against fluctuating interest rates and optimizing portfolio risk management. They provide opportunities for speculators to benefit from anticipated interest rate movements without obligating immediate swap transactions. However, swaptions carry risks including premium costs, market volatility, and potential liquidity challenges, requiring careful valuation and strategic utilization to balance benefits against financial exposure.

example of swaption in interest rate Infographic

samplerz.com

samplerz.com