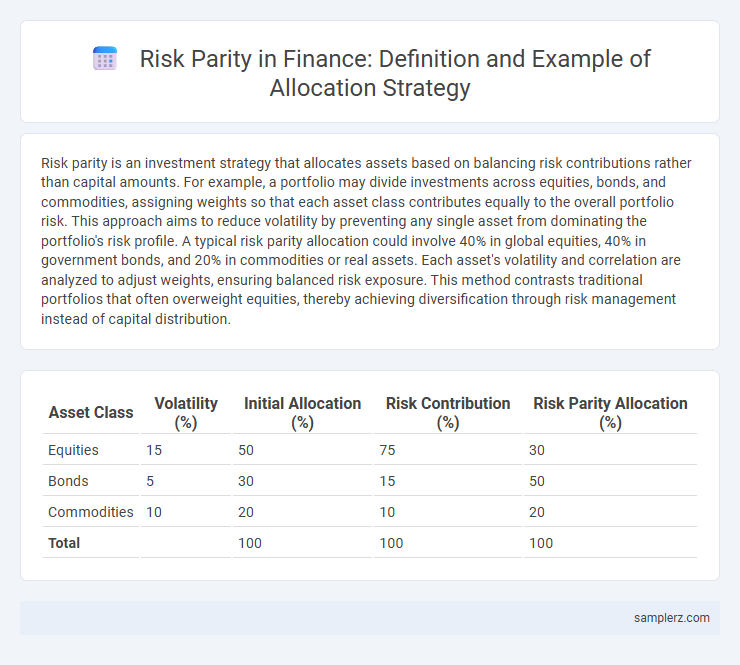

Risk parity is an investment strategy that allocates assets based on balancing risk contributions rather than capital amounts. For example, a portfolio may divide investments across equities, bonds, and commodities, assigning weights so that each asset class contributes equally to the overall portfolio risk. This approach aims to reduce volatility by preventing any single asset from dominating the portfolio's risk profile. A typical risk parity allocation could involve 40% in global equities, 40% in government bonds, and 20% in commodities or real assets. Each asset's volatility and correlation are analyzed to adjust weights, ensuring balanced risk exposure. This method contrasts traditional portfolios that often overweight equities, thereby achieving diversification through risk management instead of capital distribution.

Table of Comparison

| Asset Class | Volatility (%) | Initial Allocation (%) | Risk Contribution (%) | Risk Parity Allocation (%) |

|---|---|---|---|---|

| Equities | 15 | 50 | 75 | 30 |

| Bonds | 5 | 30 | 15 | 50 |

| Commodities | 10 | 20 | 10 | 20 |

| Total | 100 | 100 | 100 |

Introduction to Risk Parity in Portfolio Allocation

Risk parity in portfolio allocation emphasizes balancing risk contributions from various asset classes rather than allocating capital based on market value alone. This method typically involves leveraging lower-risk assets like bonds to equalize their risk weight with higher-risk assets such as equities. By distributing risk evenly, risk parity aims to enhance diversification and improve risk-adjusted returns over traditional allocation strategies.

Core Principles of Risk Parity Strategies

Risk parity strategies emphasize balancing portfolio risk contributions by allocating capital inversely to asset volatility, ensuring no single asset class dominates overall risk exposure. This approach leverages diversification by integrating asset classes with low correlations, such as equities, bonds, and commodities, to stabilize returns and reduce drawdowns. Core principles include systematic volatility targeting, dynamic rebalancing, and prioritizing risk diversification over capital allocation for optimized portfolio resilience.

Traditional Allocation vs. Risk Parity: A Comparative Overview

Traditional allocation typically divides investments equally among asset classes, such as 60% stocks and 40% bonds, prioritizing nominal weight rather than risk contribution. Risk parity adjusts weights based on the risk level of each asset, aiming for balanced volatility exposure by often increasing bond allocation and reducing equity risk. This approach enhances diversification and can lead to improved risk-adjusted returns compared to conventional methods.

Calculating Risk Contributions in Asset Classes

Risk parity in allocation calculates risk contributions by assigning portfolio weights so that each asset class contributes equally to the overall portfolio risk, measured by volatility or standard deviation. This approach involves estimating the covariance matrix of asset returns and solving for weights where the marginal risk contribution of each asset equals the others. For example, if equities have higher volatility than bonds, the model allocates less capital to equities to balance risk contributions uniformly across the portfolio.

Sample Risk Parity Portfolio: Asset Class Breakdown

The Sample Risk Parity Portfolio allocates capital by balancing risk contributions across diverse asset classes such as equities, bonds, commodities, and real estate, rather than equal dollar amounts. Equities typically contribute 30-40% of total portfolio risk, bonds 30-35%, commodities 15-20%, and real estate 10-15%, ensuring risk diversification and stable returns. This method mitigates concentration risk and improves risk-adjusted performance compared to traditional allocation strategies.

Step-by-Step Example: Building a Risk Parity Allocation

Risk parity allocation begins by calculating the volatility of each asset class, such as equities, bonds, and commodities, to determine their individual risk contributions. Next, inverse volatility weights are assigned to balance risks equally, often using the formula weight = 1/volatility for each asset. Finally, these weights are adjusted iteratively to ensure the portfolio's overall risk is distributed evenly, achieving a more stable and diversified investment allocation.

Tools and Metrics for Risk Parity Implementation

Risk parity implementation relies on tools such as volatility forecasting models, covariance matrices, and factor-based risk models to balance portfolio risk contributions from different asset classes. Metrics like the Sharpe ratio, risk contribution percentages, and portfolio diversification ratios help evaluate and maintain equal risk allocation across assets. Advanced platforms integrate these tools with real-time data analytics to dynamically rebalance portfolios based on changing market volatility and correlations.

Real-World Case Study: Risk Parity in Practice

Risk parity allocation in practice is exemplified by Bridgewater Associates, which employs this strategy to balance risk equally across asset classes such as equities, bonds, and commodities. By leveraging low-volatility assets like Treasury bonds alongside higher-volatility equities, the portfolio achieves diversified risk exposure and improved risk-adjusted returns. Empirical data shows that Bridgewater's All Weather Fund has demonstrated resilience during market downturns by minimizing drawdowns and maintaining steady growth.

Advantages and Challenges of Risk Parity Allocation

Risk parity allocation balances portfolio risk by equally weighting assets based on volatility, enhancing diversification and reducing concentration in high-risk investments. Its advantages include improved risk-adjusted returns and resilience during market downturns by avoiding overexposure to equities or bonds. Challenges involve sensitivity to estimation errors in volatility, potential underperformance in trending markets, and higher reliance on leverage to achieve target returns.

Key Takeaways and Best Practices for Risk Parity Investors

Risk parity allocation balances portfolio risk by assigning weights based on volatility and correlation rather than capital, often leading to more stable returns across market cycles. Key takeaways include diversifying across asset classes like equities, bonds, and commodities to mitigate drawdowns and enhance risk-adjusted performance. Best practices for risk parity investors emphasize continuous rebalancing, leveraging low-volatility assets, and integrating stress testing to manage tail risks effectively.

example of risk parity in allocation Infographic

samplerz.com

samplerz.com