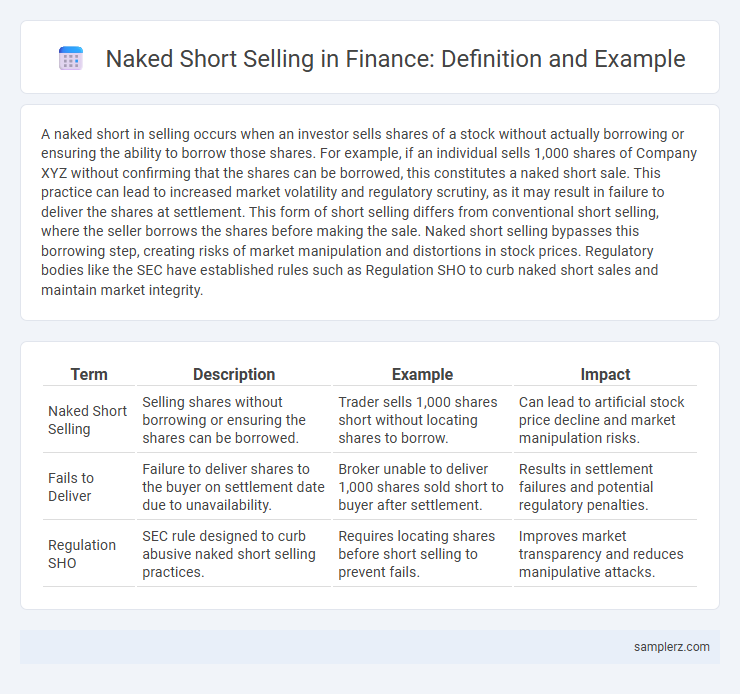

A naked short in selling occurs when an investor sells shares of a stock without actually borrowing or ensuring the ability to borrow those shares. For example, if an individual sells 1,000 shares of Company XYZ without confirming that the shares can be borrowed, this constitutes a naked short sale. This practice can lead to increased market volatility and regulatory scrutiny, as it may result in failure to deliver the shares at settlement. This form of short selling differs from conventional short selling, where the seller borrows the shares before making the sale. Naked short selling bypasses this borrowing step, creating risks of market manipulation and distortions in stock prices. Regulatory bodies like the SEC have established rules such as Regulation SHO to curb naked short sales and maintain market integrity.

Table of Comparison

| Term | Description | Example | Impact |

|---|---|---|---|

| Naked Short Selling | Selling shares without borrowing or ensuring the shares can be borrowed. | Trader sells 1,000 shares short without locating shares to borrow. | Can lead to artificial stock price decline and market manipulation risks. |

| Fails to Deliver | Failure to deliver shares to the buyer on settlement date due to unavailability. | Broker unable to deliver 1,000 shares sold short to buyer after settlement. | Results in settlement failures and potential regulatory penalties. |

| Regulation SHO | SEC rule designed to curb abusive naked short selling practices. | Requires locating shares before short selling to prevent fails. | Improves market transparency and reduces manipulative attacks. |

Understanding Naked Short Selling: A Brief Overview

Naked short selling occurs when traders sell shares without first borrowing the stock or ensuring it can be borrowed, creating an artificial increase in supply that can drive down prices. This practice is different from conventional short selling, where the seller borrows shares before selling them. Regulatory bodies like the SEC monitor and restrict naked short selling to prevent market manipulation and maintain fair trading conditions.

Key Differences between Naked Short Selling and Covered Short Selling

Naked short selling involves selling shares without borrowing them or ensuring their availability, leading to potential settlement failures and market distortions. Covered short selling requires the seller to borrow or arrange for the shares before executing the sale, reducing the risk of delivery failures and maintaining market integrity. Regulatory frameworks like the SEC's Regulation SHO impose strict rules on naked short selling to prevent abuse and protect investors.

How Naked Short Selling Works in Financial Markets

Naked short selling occurs when traders sell shares without borrowing them or ensuring their availability, creating a settlement risk in financial markets. This practice can lead to artificial downward pressure on stock prices, increasing market volatility and undermining investor confidence. Regulatory bodies monitor and restrict naked short selling to maintain market integrity and prevent manipulation.

Notable Historical Examples of Naked Short Selling

Notable historical examples of naked short selling include the 2008 financial crisis, where firms like Lehman Brothers faced severe stock price manipulation partly due to excessive naked short selling pressures. Another significant case involved Overstock.com in the early 2000s, which accused hedge funds of naked shorting to drive down its stock price, leading to regulatory scrutiny and reforms by the SEC. These incidents highlight the risks and market distortions caused by unregulated naked short selling activities.

The Impact of Naked Short Selling on Stock Prices

Naked short selling occurs when traders sell shares without borrowing them or ensuring they can be borrowed, leading to artificial excess supply in the market. This practice can cause significant downward pressure on stock prices, often resulting in increased volatility and distorted market valuations. Regulatory bodies like the SEC monitor naked short selling closely due to its potential to undermine investor confidence and market integrity.

Regulatory Actions against Naked Short Selling

Regulatory actions against naked short selling aim to prevent market manipulation by enforcing strict locate and close-out requirements under regulations like SEC Rule 203(b)(3) of Regulation SHO. These rules mandate brokers to verify the availability of shares before executing short sales, reducing instances of fails to deliver that can distort market prices. Enforcement measures include fines, trading suspensions, and increased reporting obligations to ensure market integrity and protect investors from abusive short-selling practices.

Risks and Consequences of Naked Short Selling

Naked short selling occurs when traders sell shares without borrowing or ensuring their availability, creating risks such as market manipulation, excessive volatility, and potential breaches of securities regulations. This practice can lead to significant financial penalties, legal consequences, and damage to market integrity when shares fail to be delivered on settlement date. Regulatory bodies like the SEC impose strict rules to curb naked short selling and protect investors from its destabilizing effects.

Famous Cases Involving Naked Short Selling Scandals

Famous cases involving naked short selling scandals include the 2008 controversy surrounding Lehman Brothers, where excessive naked short sales exacerbated the firm's collapse. Another notable example is the 2005 case involving Overstock.com, which accused hedge funds of using naked short selling to manipulate its stock price, leading to regulatory scrutiny. These instances highlight the significant impact of naked short selling on market stability and investor confidence.

How to Identify Naked Short Selling Activities

Naked short selling activities can be identified by monitoring unusually high short interest ratios alongside persistent failures to deliver (FTDs) on settlement dates. Regulatory filings such as SEC's Regulation SHO threshold list reveal securities with significant settlement issues indicative of naked short selling. Anomalies in stock price movements, especially sharp declines without corresponding fundamental news, often signal potential naked short sale manipulations.

Preventive Measures and Compliance in Short Selling

Naked short selling involves selling shares without borrowing or ensuring the availability of the stock, leading to potential market manipulation and liquidity risks. Regulatory measures such as Regulation SHO enforce mandatory locate and close-out requirements to prevent naked shorts and ensure timely delivery of securities. Compliance protocols including real-time monitoring, trade surveillance systems, and strict broker-dealer reporting obligations enhance market transparency and mitigate abusive short selling practices.

example of naked short in selling Infographic

samplerz.com

samplerz.com