A black swan event in finance refers to an unpredictable occurrence that has a massive impact on markets and economies. The 2008 global financial crisis serves as a prime example, triggered by the collapse of Lehman Brothers and the bursting of the housing bubble. This event caused widespread panic, massive losses in asset values, and led to a severe recession worldwide. Another notable black swan event is the 2020 COVID-19 pandemic, which instantly disrupted global supply chains and financial markets. Stock markets around the world experienced unprecedented volatility, with the S&P 500 dropping over 30% in just a few weeks. This health crisis translated into economic uncertainty, illustrating how unforeseen events can rapidly destabilize the financial ecosystem.

Table of Comparison

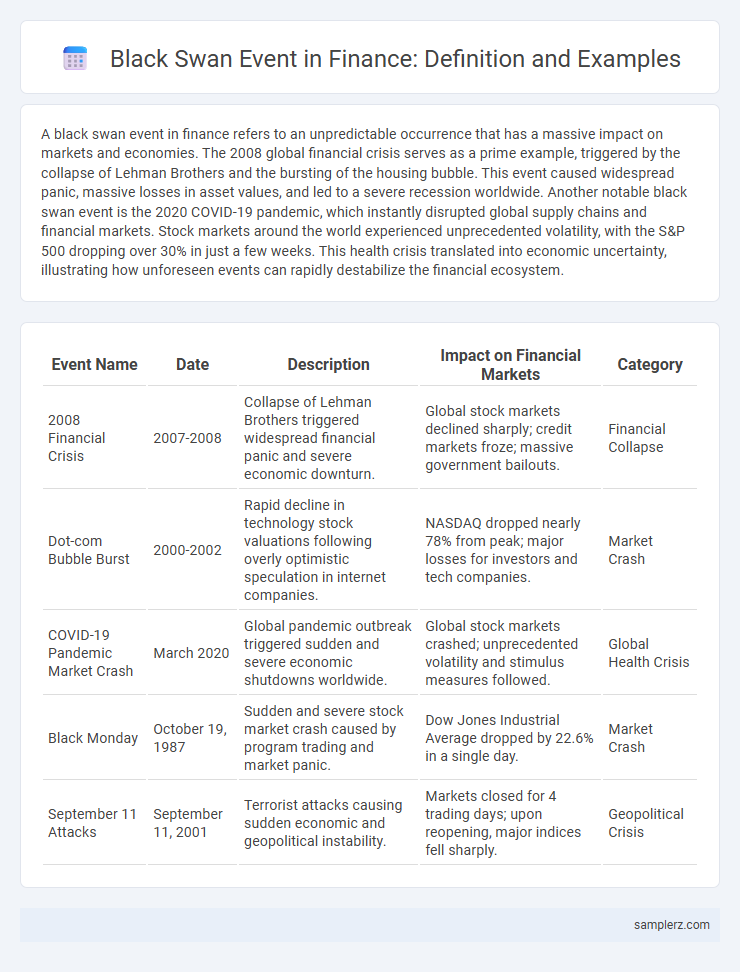

| Event Name | Date | Description | Impact on Financial Markets | Category |

|---|---|---|---|---|

| 2008 Financial Crisis | 2007-2008 | Collapse of Lehman Brothers triggered widespread financial panic and severe economic downturn. | Global stock markets declined sharply; credit markets froze; massive government bailouts. | Financial Collapse |

| Dot-com Bubble Burst | 2000-2002 | Rapid decline in technology stock valuations following overly optimistic speculation in internet companies. | NASDAQ dropped nearly 78% from peak; major losses for investors and tech companies. | Market Crash |

| COVID-19 Pandemic Market Crash | March 2020 | Global pandemic outbreak triggered sudden and severe economic shutdowns worldwide. | Global stock markets crashed; unprecedented volatility and stimulus measures followed. | Global Health Crisis |

| Black Monday | October 19, 1987 | Sudden and severe stock market crash caused by program trading and market panic. | Dow Jones Industrial Average dropped by 22.6% in a single day. | Market Crash |

| September 11 Attacks | September 11, 2001 | Terrorist attacks causing sudden economic and geopolitical instability. | Markets closed for 4 trading days; upon reopening, major indices fell sharply. | Geopolitical Crisis |

Defining Black Swan Events in Finance

Black Swan events in finance represent rare and unpredictable occurrences with severe consequences, such as the 2008 global financial crisis caused by the collapse of Lehman Brothers. These events defy conventional risk models and often lead to massive market disruptions, highlighting the limitations of traditional financial forecasting. Understanding Black Swan events is crucial for developing more robust risk management and contingency planning strategies.

Characteristics of Financial Black Swans

Financial Black Swans exhibit extreme unpredictability, massive impact, and retrospective inevitability, often reshaping markets overnight. The 2008 Global Financial Crisis exemplifies these traits, where the collapse of major financial institutions triggered widespread economic turmoil and new regulatory frameworks. These events reveal vulnerabilities in risk models, emphasizing the importance of stress-testing and adaptive strategies in financial management.

2008 Global Financial Crisis: A Prime Example

The 2008 Global Financial Crisis stands as a prime example of a black swan event, triggered by the collapse of the U.S. housing market and the subsequent failure of major financial institutions like Lehman Brothers. This unprecedented crisis caused widespread market volatility, plummeting asset prices, and a severe global recession. The event highlighted the dangers of excessive leverage, risky mortgage-backed securities, and the lack of adequate regulatory oversight in the financial sector.

The Dot-Com Bubble Burst of 2000

The Dot-Com Bubble Burst of 2000 serves as a prime example of a black swan event in finance, characterized by the sudden collapse of internet-based companies after a period of speculative overvaluation. This market crash resulted in the NASDAQ Composite Index plummeting nearly 78% from its peak, causing massive losses for investors and leading to widespread bankruptcies of tech firms. The unpredictable nature and profound impact of this event highlighted the vulnerability of financial markets to irrational exuberance and speculative bubbles.

COVID-19 Pandemic and Market Shocks

The COVID-19 pandemic exemplified a black swan event by triggering unprecedented global market shocks, including a rapid 30% plunge in the S&P 500 within weeks during early 2020. Financial markets experienced extreme volatility as lockdowns disrupted supply chains, corporate earnings collapsed, and investor sentiment turned sharply negative. This unforeseen crisis led to massive government stimulus interventions and reshaped risk management strategies across all financial sectors.

Asian Financial Crisis of 1997

The Asian Financial Crisis of 1997 stands as a quintessential black swan event, triggered by the sudden collapse of the Thai baht after the government was forced to float it due to lack of foreign currency to support its fixed exchange rate. This unexpected crisis rapidly spread to neighboring economies such as Indonesia, South Korea, and Malaysia, causing severe currency devaluations, stock market crashes, and deep recessions. The event highlighted systemic vulnerabilities in emerging market financial systems, including excessive short-term foreign debt and weak financial sector supervision.

Collapse of Long-Term Capital Management (LTCM)

The collapse of Long-Term Capital Management (LTCM) in 1998 exemplifies a black swan event in finance, where unprecedented market volatility and the Russian debt default triggered massive losses exceeding $4.6 billion. LTCM's highly leveraged positions in fixed income arbitrage strategies collapsed rapidly, causing a liquidity crisis across global financial markets. The Federal Reserve intervened to organize a bailout by major banks, highlighting systemic risk from hedge fund failures.

Swiss Franc Unpegging in 2015

The Swiss Franc unpegging in 2015 exemplifies a black swan event in finance, as the Swiss National Bank unexpectedly abandoned its three-year euro peg, causing the Franc to surge over 30% in minutes. This sudden currency revaluation led to massive losses for forex traders and international investors, disrupting global markets and highlighting the unpredictable nature of central bank interventions. The event underscored the risks of fixed exchange rate regimes and the importance of robust risk management strategies in volatile currency markets.

Flash Crash of 2010

The Flash Crash of 2010 exemplifies a black swan event in financial markets, where the Dow Jones Industrial Average plunged nearly 1,000 points within minutes before swiftly rebounding. Triggered by a combination of high-frequency trading algorithms and liquidity gaps, this event exposed vulnerabilities in market structures that were previously underestimated. The incident led to regulatory reforms aimed at improving market stability, such as circuit breakers and enhanced surveillance mechanisms.

Lessons Learned from Financial Black Swan Events

The 2008 financial crisis exemplifies a black swan event that revealed critical vulnerabilities in risk management and regulatory frameworks within global markets. Lessons learned emphasize the importance of stress testing, transparency in derivatives, and the need for institutions to prepare for extreme market disruptions. Strengthening oversight and adopting adaptive risk assessment models can mitigate the impact of future financial black swan events.

example of black swan in event Infographic

samplerz.com

samplerz.com