A roll in ETFs refers to the process of replacing an expiring futures contract with a new one to maintain exposure to a specific asset or index. This practice is common in commodity ETFs, where futures contracts have fixed expiration dates and must be continuously updated to avoid delivery. The roll involves selling the near-expiration contract and purchasing a contract with a later expiration, ensuring that the fund's holdings remain aligned with the target asset. Data on roll yields can significantly impact ETF performance, especially in markets with contango or backwardation. Contango occurs when futures prices are higher than spot prices, leading to negative roll yields as contracts are rolled to more expensive ones. Conversely, backwardation presents positive roll yields, benefiting ETFs by allowing the fund to buy cheaper futures, thereby enhancing returns.

Table of Comparison

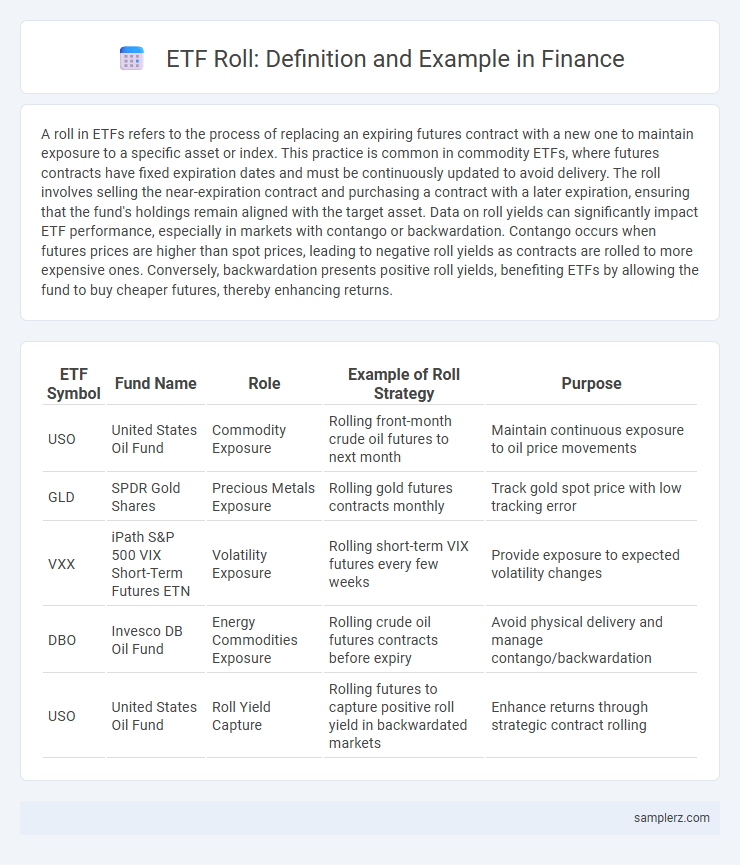

| ETF Symbol | Fund Name | Role | Example of Roll Strategy | Purpose |

|---|---|---|---|---|

| USO | United States Oil Fund | Commodity Exposure | Rolling front-month crude oil futures to next month | Maintain continuous exposure to oil price movements |

| GLD | SPDR Gold Shares | Precious Metals Exposure | Rolling gold futures contracts monthly | Track gold spot price with low tracking error |

| VXX | iPath S&P 500 VIX Short-Term Futures ETN | Volatility Exposure | Rolling short-term VIX futures every few weeks | Provide exposure to expected volatility changes |

| DBO | Invesco DB Oil Fund | Energy Commodities Exposure | Rolling crude oil futures contracts before expiry | Avoid physical delivery and manage contango/backwardation |

| USO | United States Oil Fund | Roll Yield Capture | Rolling futures to capture positive roll yield in backwardated markets | Enhance returns through strategic contract rolling |

Understanding Roll in ETFs: An Overview

Roll in ETFs refers to the process of selling expiring futures contracts and purchasing new ones to maintain exposure without taking physical delivery of the underlying asset. This mechanism is crucial for ETFs tracking commodities or indices with futures-based strategies, ensuring continuous market participation and price alignment. By effectively managing the roll, ETF managers minimize tracking errors and preserve the fund's investment objectives over time.

The Mechanics of Roll in ETF Investing

The mechanics of roll in ETF investing involve selling the near-month futures contract and simultaneously buying the next-month contract to maintain exposure without physical asset delivery. This process helps investors avoid contract expiration risks and manage liquidity efficiently within the ETF's investment strategy. Roll yield, the difference between expiring and new contract prices, directly impacts the ETF's performance and overall returns.

Why Roll Matters for ETF Performance

Roll in ETFs refers to the process of selling an expiring futures contract and buying a new one to maintain exposure to an underlying asset. Effective roll management is crucial because it impacts tracking error and total return, especially in commodity ETFs where contango and backwardation can lead to gains or losses during the roll. Understanding roll yield helps investors evaluate ETF performance beyond price changes, ensuring more accurate assessment of returns.

Example: Rolling Futures Contracts in Commodity ETFs

Rolling futures contracts in commodity ETFs involves selling near-expiry contracts and buying later-dated contracts to maintain exposure without taking physical delivery. For example, the United States Oil Fund (USO) rolls its WTI crude oil futures monthly by selling contracts expiring in the current month and purchasing contracts one month ahead to track oil prices continuously. This roll strategy helps mitigate the effects of contango and backwardation, which can significantly impact the ETF's performance and investor returns.

Roll Yield: Positive vs. Negative Scenarios

Roll yield in ETFs occurs when futures contracts approach expiration and are replaced by contracts with different prices, impacting returns. Positive roll yield arises when futures prices are in backwardation, allowing investors to sell high-expiring contracts and buy cheaper distant contracts, enhancing ETF performance. Negative roll yield happens during contango, where investors must sell low-expiring contracts and buy higher-priced distant contracts, eroding returns and increasing costs.

Real-World ETF Roll Examples in the Oil Market

ETF roll strategies in the oil market commonly involve shifting positions from near-month futures contracts to those with later expiration dates to maintain exposure and avoid delivery obligations. Notable examples include U.S. oil ETFs like the United States Oil Fund (USO), which regularly rolls contracts to manage contango and backwardation effects, directly impacting ETF performance and tracking accuracy. These roll transactions influence price dynamics and investor returns by addressing volatility and storage costs inherent in oil futures markets.

How ETF Providers Manage the Roll Process

ETF providers manage the roll process by strategically timing the sale of expiring futures contracts and the purchase of new contracts to minimize tracking error and reduce transaction costs. They employ systematic methodologies such as gradual unwinding and layering trades to maintain portfolio liquidity and market impact control. Utilizing advanced algorithms and market insights, providers optimize roll execution to preserve fund performance and align with index benchmarks.

Impact of Roll on ETF Costs and Returns

Roll in ETFs, particularly commodity-based ETFs, involves selling near-expiration futures contracts and buying longer-dated contracts, which can result in roll yield impacting overall returns. Negative roll yield, often occurring in contango markets, increases costs and reduces ETF performance by eroding returns through successive contract replacements. Conversely, a positive roll yield in backwardation markets can enhance returns, making roll strategy a critical factor in ETF cost efficiency and investment outcomes.

Comparing Roll Strategies Across Different ETFs

Roll strategies in ETFs vary significantly depending on the underlying asset class and market conditions, impacting tracking error and transaction costs. For commodity ETFs, such as those tracking oil or natural gas futures, calendar spreads and roll yield play crucial roles in performance differences, while equity ETFs primarily face challenges related to index rebalancing and liquidity. Comparing roll strategies across these ETFs reveals that active roll management can enhance returns and reduce tracking error, especially in markets with contango or backwardation.

Best Practices for Investors Regarding ETF Roll

Investors should monitor the roll period closely when managing ETF positions to minimize tracking error and tax implications. Utilizing limit orders during the roll can help avoid unfavorable price slippage often associated with high-volume adjustments. Employing a staggered roll strategy across multiple days reduces market impact and enhances overall execution efficiency.

example of roll in ETF Infographic

samplerz.com

samplerz.com