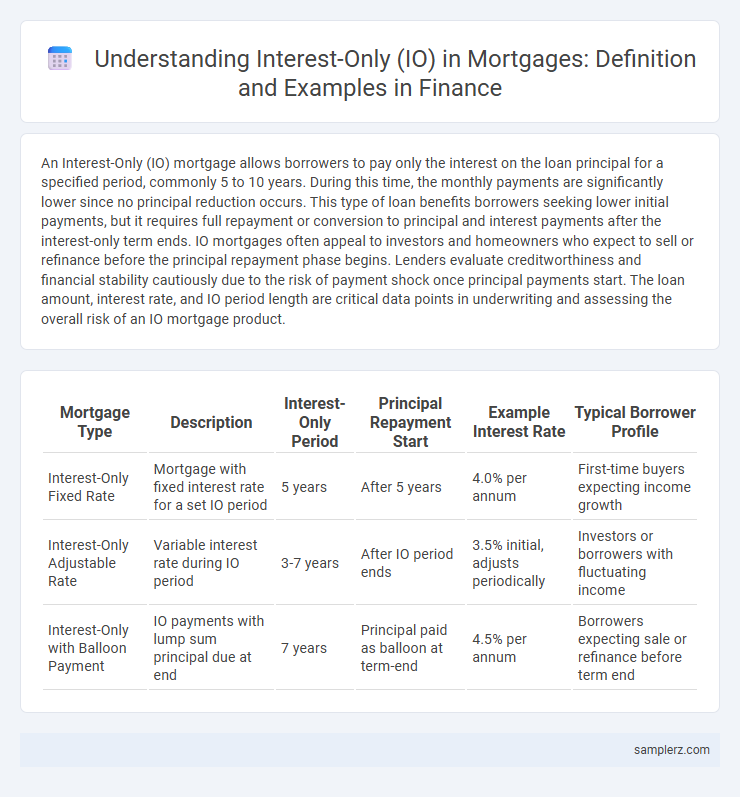

An Interest-Only (IO) mortgage allows borrowers to pay only the interest on the loan principal for a specified period, commonly 5 to 10 years. During this time, the monthly payments are significantly lower since no principal reduction occurs. This type of loan benefits borrowers seeking lower initial payments, but it requires full repayment or conversion to principal and interest payments after the interest-only term ends. IO mortgages often appeal to investors and homeowners who expect to sell or refinance before the principal repayment phase begins. Lenders evaluate creditworthiness and financial stability cautiously due to the risk of payment shock once principal payments start. The loan amount, interest rate, and IO period length are critical data points in underwriting and assessing the overall risk of an IO mortgage product.

Table of Comparison

| Mortgage Type | Description | Interest-Only Period | Principal Repayment Start | Example Interest Rate | Typical Borrower Profile |

|---|---|---|---|---|---|

| Interest-Only Fixed Rate | Mortgage with fixed interest rate for a set IO period | 5 years | After 5 years | 4.0% per annum | First-time buyers expecting income growth |

| Interest-Only Adjustable Rate | Variable interest rate during IO period | 3-7 years | After IO period ends | 3.5% initial, adjusts periodically | Investors or borrowers with fluctuating income |

| Interest-Only with Balloon Payment | IO payments with lump sum principal due at end | 7 years | Principal paid as balloon at term-end | 4.5% per annum | Borrowers expecting sale or refinance before term end |

Understanding Interest-Only (IO) Mortgages

Interest-only (IO) mortgages allow borrowers to pay only the interest on the loan for a set period, typically 5 to 10 years, without reducing the principal balance. This structure results in lower initial monthly payments, providing short-term cash flow flexibility but leading to higher payments when the principal repayment phase begins. Understanding the risks, such as potential payment shocks and no equity buildup during the interest-only period, is crucial for effective mortgage planning.

Key Features of IO Mortgage Structures

Interest-only (IO) mortgage structures allow borrowers to pay only the interest portion of the loan for a specified initial period, typically 5 to 10 years, resulting in lower monthly payments. Key features include a principal balance that remains unchanged during the interest-only term, requiring full amortization payments or refinancing thereafter, and a potential increase in payment amounts once the IO period ends. IO mortgages are often favored by investors or borrowers anticipating higher future income, but they carry the risk of payment shock and require careful qualification criteria to mitigate default risk.

Common Use Cases for IO Mortgages

Interest-only (IO) mortgages are commonly used by borrowers seeking lower initial monthly payments, often in real estate investment or when anticipating increased future income. These loans appeal to homeowners who expect to refinance or sell before the principal balance begins amortizing. IO mortgages also benefit those managing cash flow during variable income periods or planning to leverage equity growth without immediate principal repayment.

Example Scenario: First-Time Homebuyer with IO Loan

A first-time homebuyer chooses an interest-only (IO) mortgage to reduce initial monthly payments, paying only interest for the first 10 years on a $300,000 loan at a 4% interest rate. During this interest-only period, the monthly payment is approximately $1,000, allowing the borrower to save cash flow for other expenses. After 10 years, principal and interest payments increase significantly, reflecting amortization of the $300,000 principal over the remaining term.

IO Payment Calculation Methods Explained

Interest-only (IO) mortgage payment calculation methods typically involve multiplying the loan's principal balance by the interest rate, resulting in a fixed monthly payment that covers only the interest without reducing the principal. Common approaches include simple interest calculations based on the outstanding loan amount and adjustable rate formulas tied to benchmark indices like the LIBOR or SOFR. Understanding these calculation methods helps borrowers anticipate payment fluctuations during the interest-only period and prepare for the transition to principal-plus-interest payments.

Pros and Cons of IO Mortgages in Practice

Interest-only (IO) mortgages offer lower initial payments by requiring borrowers to pay only interest for a set period, which can improve short-term cash flow and affordability. However, IO loans carry the risk of payment shock when principal repayments begin, potentially leading to higher monthly costs and difficulty refinancing if property values decline. These mortgages suit borrowers with fluctuating incomes or plans to sell or refinance before principal payments start but may not be ideal for long-term homeowners seeking equity build-up.

IO in Investment Properties: Real-World Example

Interest-only (IO) loans for investment properties often allow investors to maximize cash flow by paying only the interest for a set period, typically 5 to 10 years. For example, an investor purchasing a rental property for $500,000 might take out an IO loan with a 4% interest rate, resulting in monthly payments of approximately $1,667 during the interest-only phase. This structure enables higher initial returns by reducing monthly expenses, but investors must plan for eventual principal repayments or refinance options once the IO period ends.

Comparing IO Loans to Traditional Mortgages

Interest-only (IO) loans allow borrowers to pay only the interest for a set period, typically 5 to 10 years, resulting in lower initial monthly payments compared to traditional mortgages that require principal and interest payments from the start. Traditional mortgages build equity more steadily through monthly principal repayment, while IO loans delay equity accumulation, potentially leading to higher payments later. Borrowers often choose IO loans for short-term cash flow flexibility, but they face increased risk of payment shock and slower home equity growth compared to conventional mortgages.

Risks Associated with IO Mortgage Examples

Interest-only (IO) mortgages pose significant risks such as payment shock, where borrowers face sudden principal and interest payments after the interest-only period ends, increasing default probability. Negative amortization can occur if the IO loan terms allow unpaid interest to be added to the principal, causing the loan balance to grow unchecked. Market fluctuations may also lead to negative equity, increasing the likelihood of foreclosure if property values decline during the IO period.

Tips for Managing IO Mortgage Payments

Managing interest-only (IO) mortgage payments effectively requires maintaining a strict budget to ensure timely interest payments and avoid principal balloon payments. Regularly reviewing loan terms and considering refinancing options can help mitigate future payment shocks when the principal repayment begins. Using automated payment systems and setting aside a dedicated savings fund also improves financial discipline throughout the IO period.

example of IO in mortgage Infographic

samplerz.com

samplerz.com