In economics, shadow price represents the implicit value of a resource that is not directly priced in the market, often used in constrained optimization problems. For example, in a production setting, if a factory is limited by a raw material supply, the shadow price quantifies the increase in profit obtained by acquiring one additional unit of that raw material. This value helps decision-makers understand the worth of scarce resources beyond their market price. Consider a manufacturing firm constrained by labor hours, with a maximum of 1,000 hours available. By applying constrained optimization techniques, the shadow price reflects the marginal profit increase for every additional labor hour acquired. This data guides resource allocation and investment decisions to enhance overall efficiency and profitability in economic planning.

Table of Comparison

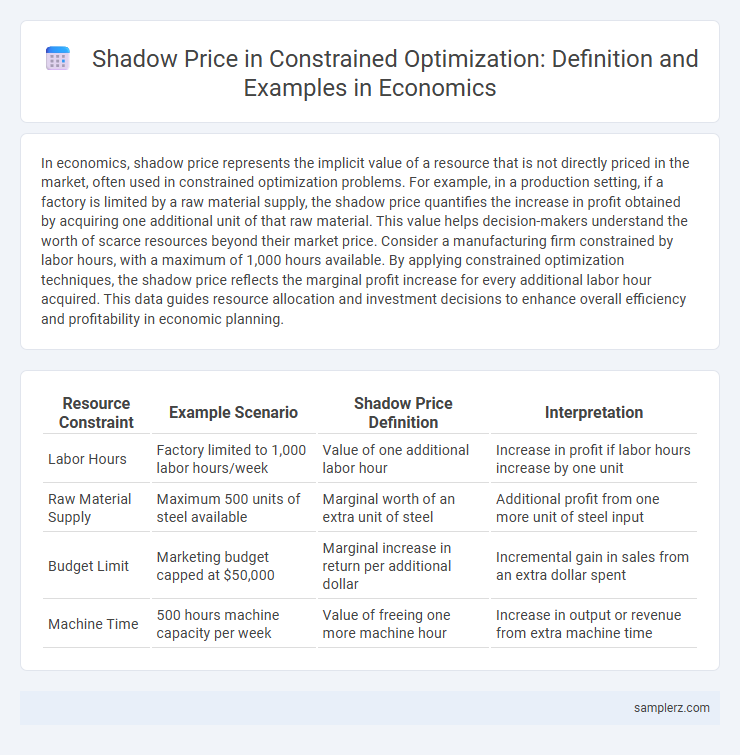

| Resource Constraint | Example Scenario | Shadow Price Definition | Interpretation |

|---|---|---|---|

| Labor Hours | Factory limited to 1,000 labor hours/week | Value of one additional labor hour | Increase in profit if labor hours increase by one unit |

| Raw Material Supply | Maximum 500 units of steel available | Marginal worth of an extra unit of steel | Additional profit from one more unit of steel input |

| Budget Limit | Marketing budget capped at $50,000 | Marginal increase in return per additional dollar | Incremental gain in sales from an extra dollar spent |

| Machine Time | 500 hours machine capacity per week | Value of freeing one more machine hour | Increase in output or revenue from extra machine time |

Understanding Shadow Price in Economic Optimization

Shadow price in economic optimization reflects the marginal value of relaxing a constraint in a resource-limited problem, such as maximizing profit or utility. For example, in production constrained by limited labor hours, the shadow price quantifies the increase in optimal profit per additional hour of labor available. This concept guides decision-makers in resource allocation by highlighting the economic value of scarce inputs within constrained optimization models.

The Role of Constraints in Shadow Pricing

In constrained optimization, shadow prices quantify the marginal value of relaxing a constraint, reflecting how changes in resource availability affect the optimal solution. For example, in a production problem, the shadow price of a labor hours constraint indicates the increase in profit per additional hour of labor. Understanding the role of constraints is crucial, as shadow prices highlight bottlenecks and guide resource allocation decisions in economic planning.

Classic Examples of Shadow Price in Resource Allocation

Shadow price in resource allocation often appears in constrained optimization problems such as production planning, where a factory maximizes output subject to limited raw materials. A classic example is the shadow price of labor hours in a manufacturing plant, indicating the value of an additional hour of labor when machine time is limited. This price reflects the marginal worth of scarce resources, guiding decisions to enhance overall profitability.

Shadow Price in Linear Programming: A Practical Illustration

In linear programming, the shadow price represents the change in the objective function's optimal value per unit increase in the right-hand side of a constraint. For example, in a production optimization problem, if increasing raw material by one unit raises profit by $5, the shadow price of that material constraint is $5. This value helps managers identify which constraints, when relaxed, yield the greatest economic benefit.

Case Study: Shadow Price in Production Planning

In production planning, the shadow price represents the increase in profit gained by relaxing a binding constraint, such as labor hours or raw material availability, by one unit. For example, if a factory's maximum steel supply limits output, the shadow price indicates the additional profit from acquiring one more ton of steel. This value helps managers prioritize resource allocation by quantifying the economic benefit of easing specific production constraints.

Shadow Price Application in Transportation Problems

Shadow price in transportation problems quantifies the change in total transportation cost resulting from a one-unit increase in the supply or demand constraint at a particular node. By analyzing shadow prices, businesses optimize logistics by identifying binding constraints and prioritizing resource allocation to minimize costs. This application of shadow price facilitates efficient decision-making in route planning and capacity expansion within constrained transportation networks.

Marginal Value of Resources: Shadow Price Explained

Shadow price represents the marginal value of one additional unit of a constrained resource in an optimization problem, indicating how much the objective function would improve if the resource availability increased. For example, in a production constraint where labor hours are limited, the shadow price quantifies the maximum additional profit achievable per extra labor hour. This metric helps decision-makers prioritize resource allocation by revealing the economic benefit of relaxing specific constraints.

Shadow Pricing and Budget Constraints in Economics

Shadow price in economics represents the implicit value of relaxing a binding budget constraint by one unit, reflecting the marginal worth of limited resources. In constrained optimization, this price quantifies how much the objective function, such as profit or utility, would improve if the budget constraint were loosened. Understanding shadow prices helps policymakers and businesses allocate scarce resources efficiently by revealing the opportunity cost of constraints within economic models.

Shadow Price Impact on Decision-Making

Shadow price represents the marginal value of relaxing a constraint in constrained optimization, guiding resource allocation decisions by quantifying the benefit of additional units. For example, in production planning, a shadow price on a labor hour constraint indicates the potential profit increase per extra hour, influencing whether to outsource or invest in workforce expansion. This quantitative insight enhances strategic decision-making by revealing the true economic cost or value of limited resources.

Real-World Examples: Shadow Price in Market Analysis

Shadow price in market analysis quantifies the marginal value of relaxing a constraint, such as production capacity limits or budget restrictions, in resource allocation models. For instance, in energy markets, the shadow price of emission permits reflects the cost savings per additional allowance, guiding firms' investment decisions in cleaner technologies. Similarly, in supply chain optimization, the shadow price of warehouse space constraints indicates the potential profit increase achievable by expanding storage capacity.

example of shadow price in constrained optimization Infographic

samplerz.com

samplerz.com