Hyperinflation is an economic crisis characterized by an extremely rapid and out-of-control increase in prices, often exceeding 50% per month. Zimbabwe experienced one of the most severe cases of hyperinflation in history during the late 2000s, where inflation rates soared to an estimated 79.6 billion percent month-on-month in November 2008. The hyperinflation in Zimbabwe decimated the value of its currency, leading to shortages of basic goods, collapse of savings, and widespread economic hardship. Venezuela presents another notable example of hyperinflation crisis in the 2010s, triggered by political instability and plummeting oil revenues. The inflation rate in Venezuela peaked at over 1,000,000% annually in 2018, according to the International Monetary Fund (IMF) data. This hyperinflation caused a dramatic loss of purchasing power, rampant unemployment, and mass migration, severely destabilizing the Venezuelan economy and social fabric.

Table of Comparison

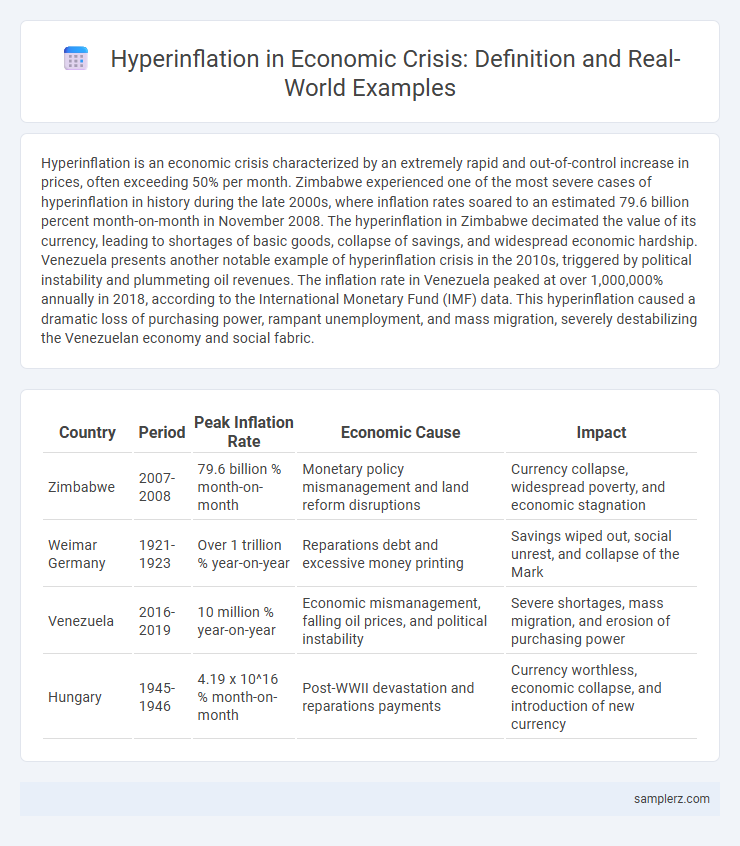

| Country | Period | Peak Inflation Rate | Economic Cause | Impact |

|---|---|---|---|---|

| Zimbabwe | 2007-2008 | 79.6 billion % month-on-month | Monetary policy mismanagement and land reform disruptions | Currency collapse, widespread poverty, and economic stagnation |

| Weimar Germany | 1921-1923 | Over 1 trillion % year-on-year | Reparations debt and excessive money printing | Savings wiped out, social unrest, and collapse of the Mark |

| Venezuela | 2016-2019 | 10 million % year-on-year | Economic mismanagement, falling oil prices, and political instability | Severe shortages, mass migration, and erosion of purchasing power |

| Hungary | 1945-1946 | 4.19 x 10^16 % month-on-month | Post-WWII devastation and reparations payments | Currency worthless, economic collapse, and introduction of new currency |

Zimbabwe’s Hyperinflation Crisis: A Case Study

Zimbabwe's Hyperinflation Crisis peaked in 2008, with inflation rates reaching an estimated 79.6 billion percent month-on-month, causing the collapse of the Zimbabwean dollar. The crisis was driven by uncontrolled money printing, land reform policies that disrupted agricultural output, and a significant decrease in investor confidence. Hyperinflation devastated the economy, leading to widespread shortages of basic goods and a shift to foreign currencies for everyday transactions.

The German Weimar Republic: Lessons from the 1920s Hyperinflation

The German Weimar Republic experienced one of the most severe instances of hyperinflation in history during the early 1920s, with prices doubling every few days and the currency losing almost all its value by 1923. This economic collapse, driven by war reparations, excessive money printing, and political instability, led to devastating social consequences including widespread poverty and loss of savings. The hyperinflation crisis underscores the critical importance of monetary discipline and effective fiscal policy in maintaining economic stability.

Venezuela’s Economic Meltdown and Hyperinflation

Venezuela experienced one of the most severe cases of hyperinflation, with inflation rates reaching over 1,000,000% between 2017 and 2019, devastating its economy and causing widespread shortages of basic goods. The collapse of oil prices and economic mismanagement led to the devaluation of the bolivar, eroding purchasing power and triggering a humanitarian crisis. This hyperinflation undermined investment confidence and severely disrupted both domestic markets and international trade relations.

Hungary’s 1946 Currency Collapse

Hungary's 1946 currency collapse stands as one of history's most extreme cases of hyperinflation, with prices doubling every 15 hours at its peak. The Hungarian pengo became virtually worthless, prompting the government to introduce the adopengo as a temporary measure before replacing it with the forint. This crisis exemplifies the devastating effects hyperinflation can have on economic stability, wiping out savings and disrupting markets.

The Yugoslav Dinar: Hyperinflation in the 1990s

The Yugoslav Dinar experienced one of the most severe cases of hyperinflation in the 1990s, with monthly inflation rates exceeding 300 million percent at its peak in January 1994. This economic crisis stemmed from political instability, war, and excessive money printing, causing the currency's value to plummet and prices to skyrocket daily. The hyperinflation devastated the Yugoslav economy, eroding savings and drastically reducing purchasing power for ordinary citizens.

Argentina’s Hyperinflation Episode of the Late 1980s

Argentina's hyperinflation in the late 1980s reached monthly rates exceeding 200%, severely eroding purchasing power and destabilizing the economy. The crisis was driven by excessive fiscal deficits, uncontrolled money printing, and declining industrial output, culminating in inflation rates surpassing 3,000% annually in 1989. This hyperinflation episode led to widespread poverty, a collapse in savings, and prompted urgent economic reforms including the introduction of the Austral Plan in 1985 and later the Convertibility Plan in 1991.

Greece: Hyperinflation During World War II

Greece experienced severe hyperinflation during World War II, with prices skyrocketing due to occupation-related economic collapse and relentless money printing. At its peak in 1944, monthly inflation rates reached an estimated 13,800%, obliterating savings and undermining economic stability. This crisis exemplifies how war and political instability can trigger hyperinflation, devastating a nation's economy.

Brazil’s Inflation Crisis Before the Real Plan

Brazil experienced severe hyperinflation in the late 1980s and early 1990s, with annual rates soaring above 2,000%, devastating the economy and eroding purchasing power. Price instability led to frequent currency changes and wage indexation, creating a vicious cycle of inflationary expectations. The crisis was ultimately stabilized by the Real Plan in 1994, which introduced a new currency and fiscal reforms to restore economic confidence.

Serbia’s Hyperinflation Shock in the Early 1990s

Serbia experienced one of the most severe cases of hyperinflation during the early 1990s, with monthly inflation rates peaking at 313 million percent in January 1994. This economic crisis was driven by the breakup of Yugoslavia, international sanctions, and political instability, causing the Serbian dinar's value to collapse. The hyperinflation decimated savings, disrupted markets, and forced the government to implement currency reforms to stabilize the economy.

Bolivia’s Struggle with Hyperinflation in the 1980s

Bolivia experienced one of the worst cases of hyperinflation in the 1980s, with inflation peaking at an estimated 20,000% in 1985. This economic crisis was driven by large fiscal deficits, excessive money printing, and declining commodity prices, which severely undermined the country's purchasing power and savings. The Bolivian government implemented structural adjustments and monetary reforms to stabilize the economy and restore investor confidence, ultimately leading to a reduction in inflation rates in the late 1980s.

example of hyperinflation in crisis Infographic

samplerz.com

samplerz.com