The paradox of thrift in a recession occurs when individuals increase their saving rates to protect against financial uncertainty. This collective behavior leads to decreased consumer spending, which reduces overall demand in the economy. Lower demand results in declining business revenues, prompting companies to cut back on investment and employment, further deepening the recession. Data from the 2008 financial crisis illustrates this effect, where household savings surged while GDP contracted sharply. The reduction in consumption contributed to a significant drop in retail sales and industrial production. Economic models highlight that while saving is beneficial at an individual level, increased savings during a downturn can suppress economic growth and delay recovery.

Table of Comparison

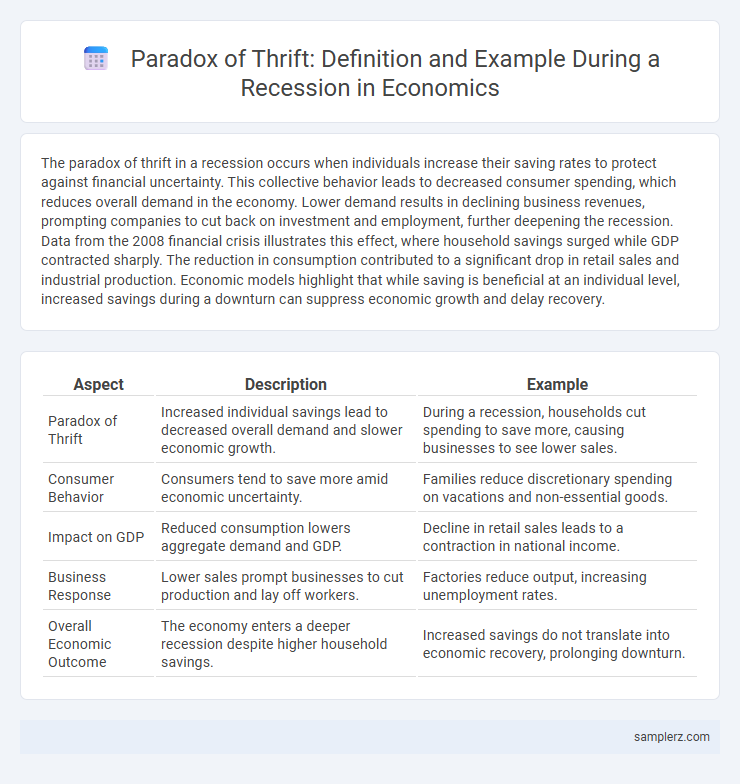

| Aspect | Description | Example |

|---|---|---|

| Paradox of Thrift | Increased individual savings lead to decreased overall demand and slower economic growth. | During a recession, households cut spending to save more, causing businesses to see lower sales. |

| Consumer Behavior | Consumers tend to save more amid economic uncertainty. | Families reduce discretionary spending on vacations and non-essential goods. |

| Impact on GDP | Reduced consumption lowers aggregate demand and GDP. | Decline in retail sales leads to a contraction in national income. |

| Business Response | Lower sales prompt businesses to cut production and lay off workers. | Factories reduce output, increasing unemployment rates. |

| Overall Economic Outcome | The economy enters a deeper recession despite higher household savings. | Increased savings do not translate into economic recovery, prolonging downturn. |

Understanding the Paradox of Thrift in Economic Downturns

During economic recessions, higher individual savings reduce overall consumption, which decreases aggregate demand and slows economic growth. This phenomenon, known as the paradox of thrift, illustrates how increased saving during downturns can exacerbate unemployment and prolong recovery. Empirical studies from the 2008 financial crisis highlight how widespread saving behavior contributed to a deeper and more persistent recession.

How Increased Savings Deepen Recessionary Pressures

During a recession, increased savings reduce consumer spending, leading to lower aggregate demand and further economic contraction. Businesses face declining revenue, resulting in layoffs and decreased investment, which intensify unemployment and slow GDP growth. This paradox of thrift creates a cycle where higher individual savings inadvertently worsen overall economic conditions.

The Double-Edged Sword of Household Thrift During Recessions

Household thrift surges during recessions as families prioritize saving over spending, aiming to secure financial stability amidst uncertainty. This collective increase in savings reduces aggregate demand, causing businesses to cut back on production and employment, thereby deepening the economic downturn. The paradox of thrift illustrates how individual efforts to save can inadvertently weaken the overall economy, turning prudent financial behavior into a double-edged sword during recessions.

Case Study: Paradox of Thrift in the 2008 Financial Crisis

During the 2008 financial crisis, widespread increases in household savings rates led to a significant reduction in consumer spending, exacerbating the economic downturn. As millions cut back on expenditures to build financial security, aggregate demand plummeted, resulting in deeper recessions and higher unemployment rates. This case exemplifies the paradox of thrift, where individual efforts to save more collectively reduce overall economic growth and delay recovery.

Government Response to Thrift-Induced Recessions

During a recession triggered by the paradox of thrift, increased household saving reduces overall demand, deepening economic contraction. Government response typically involves expansionary fiscal policies, such as increased public spending or tax cuts, to stimulate aggregate demand and offset private sector retrenchment. Targeted stimulus programs and infrastructure investments help restore consumer confidence and promote economic recovery.

The Role of Consumer Confidence and Spending Behavior

During a recession, declining consumer confidence leads households to increase savings and reduce spending, exemplifying the paradox of thrift. This collective behavior decreases aggregate demand, further slowing economic growth and deepening the downturn. Businesses face lower revenues and may cut investment or employment, perpetuating the negative cycle fueled by cautious consumer spending.

Real-World Examples of Paradox of Thrift in Action

During the 2008 global financial crisis, widespread increases in household savings contributed to decreased consumer spending, further deepening the recession. In Greece's debt crisis, austerity measures prompted higher household savings but led to reduced aggregate demand, worsening the economic downturn. These real-world instances exemplify the paradox of thrift, where collective saving during recessions can contract economic growth.

Impacts on Employment and Business Revenues During High Savings

During a recession, the paradox of thrift manifests as increased household savings lead to reduced consumer spending, causing a decline in business revenues and prompting layoffs that raise unemployment rates. Lower consumer demand forces companies to cut costs by downsizing their workforce, which further depresses overall economic activity. This cycle of high savings and reduced spending exacerbates the recession's impact on employment and business profitability.

Policy Solutions to Counteract the Paradox of Thrift

During a recession, increased household savings can reduce aggregate demand, deepening the economic downturn--a classic example of the paradox of thrift. To counteract this, government fiscal policies such as increased public spending and targeted tax cuts stimulate consumption and investment, offsetting reduced private expenditure. Monetary policies that lower interest rates also encourage borrowing and spending, helping to restore economic growth and break the cycle of excessive saving.

Lessons for Future Economic Stability and Growth

During a recession, the paradox of thrift demonstrates how increased individual saving reduces overall demand, leading to deeper economic contraction and higher unemployment. This highlights the importance of balanced fiscal policies that encourage strategic consumer spending and targeted government investment to sustain aggregate demand. Future economic stability relies on coordinated efforts to prevent excessive saving behaviors that can hinder growth while fostering environments conducive to confidence and prudent consumption.

example of paradox of thrift in recession Infographic

samplerz.com

samplerz.com