The Keynesian multiplier demonstrates how an initial increase in government spending can lead to a greater overall increase in national income. For example, if the government invests $1 billion in infrastructure projects, this direct spending creates jobs and income for workers. These workers then spend their earnings on goods and services, generating further economic activity and increasing GDP by more than the original $1 billion. Data from fiscal stimulus programs reveal the power of the Keynesian multiplier in practice. During the 2009 American Recovery and Reinvestment Act, government expenditure aimed to boost consumption and investment, resulting in estimated multipliers ranging from 1.5 to 2. This means that each dollar spent by the government translated into $1.50 to $2.00 in total economic output, highlighting the efficiency of fiscal stimulus in supporting economic growth.

Table of Comparison

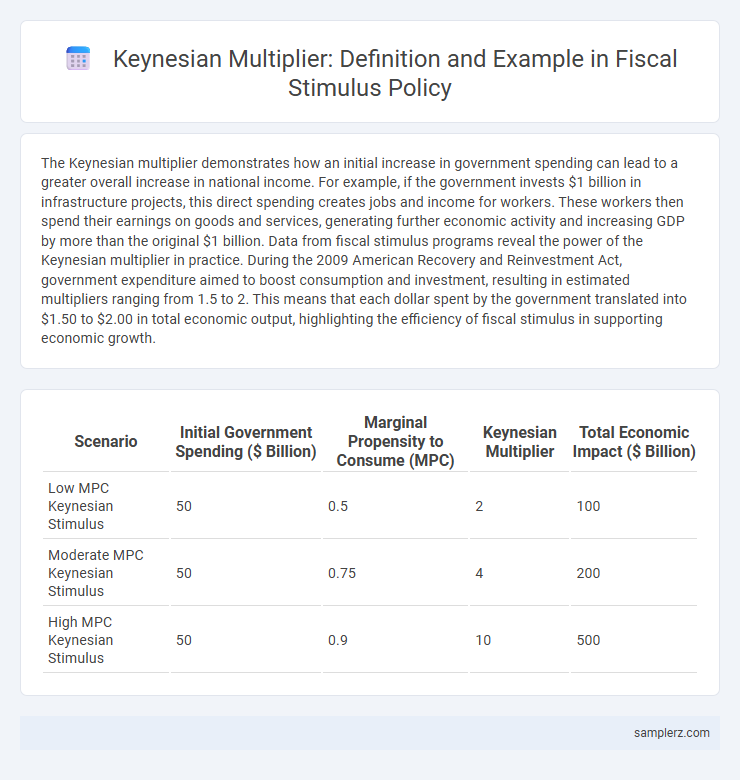

| Scenario | Initial Government Spending ($ Billion) | Marginal Propensity to Consume (MPC) | Keynesian Multiplier | Total Economic Impact ($ Billion) |

|---|---|---|---|---|

| Low MPC Keynesian Stimulus | 50 | 0.5 | 2 | 100 |

| Moderate MPC Keynesian Stimulus | 50 | 0.75 | 4 | 200 |

| High MPC Keynesian Stimulus | 50 | 0.9 | 10 | 500 |

Understanding the Keynesian Multiplier Effect

The Keynesian multiplier effect explains how an initial fiscal stimulus, such as government spending on infrastructure, can lead to a larger overall increase in national income. For example, a $1 billion investment in public projects can generate more than $1 billion in total economic output as increased earnings lead to higher consumer spending and business investment. This multiplier varies depending on factors like marginal propensity to consume and the economy's slack.

Fiscal Stimulus: A Practical Application

Fiscal stimulus exemplifies the Keynesian multiplier through increased government spending that boosts aggregate demand, leading to higher output and employment. When the government injects $100 billion into infrastructure projects, the total economic impact can exceed the initial amount due to induced consumer spending and business investment. Empirical studies show multipliers ranging from 1.5 to 2.5, highlighting the effectiveness of targeted fiscal stimulus in revitalizing economic activity.

Real-World Case: The US ARRA 2009 Stimulus

The US ARRA 2009 stimulus package exemplifies the Keynesian multiplier effect, where an initial government spending injection of approximately $831 billion aimed to boost aggregate demand during the Great Recession. Empirical analyses suggest that every dollar spent generated up to $1.5 in economic output, demonstrating significant fiscal multipliers through increased employment and consumer spending. This real-world case underscores the impact of well-targeted fiscal stimulus on accelerating GDP growth and reducing unemployment rates.

Government Spending and Aggregate Demand

Government spending increases during fiscal stimulus directly raise aggregate demand, exemplifying the Keynesian multiplier effect whereby each dollar spent generates more than one dollar in economic output. This multiplier operates as initial government expenditures lead to higher incomes, which in turn boost consumption and investment across various sectors. Empirical studies estimate the fiscal multiplier ranges from 1.2 to 1.8, highlighting the significant impact of targeted government spending on stimulating economic growth.

How Tax Cuts Amplify the Multiplier

Tax cuts increase household disposable income, leading to higher consumer spending that amplifies the Keynesian multiplier effect in fiscal stimulus. When governments reduce taxes, the immediate rise in consumption generates increased demand for goods and services, stimulating aggregate output. This amplified spending cycle ultimately boosts GDP growth and employment levels more than the initial tax reduction alone.

Infrastructure Investments as Multiplier Drivers

Infrastructure investments amplify the Keynesian multiplier by boosting aggregate demand through large-scale government spending on roads, bridges, and public transit, leading to increased employment and higher incomes. These projects stimulate supply chains and private sector activity, magnifying the initial fiscal outlay's impact on GDP growth. Empirical studies show that each dollar invested in infrastructure can generate up to $1.50 in economic output, highlighting its effectiveness as a fiscal stimulus driver.

The Multiplier in Developing Economies

The Keynesian multiplier in developing economies often exceeds that in developed countries due to higher marginal propensities to consume, which amplifies fiscal stimulus effects on aggregate demand. Empirical studies indicate multipliers can range from 1.5 to 2.5 in these regions, reflecting increased income circulation and employment generation. Effective government spending on infrastructure and social programs further enhances the multiplier by boosting long-term productive capacity.

Consumption Patterns and Multiplier Impact

Fiscal stimulus leveraging the Keynesian multiplier significantly boosts consumption patterns by increasing disposable income, which in turn elevates aggregate demand. For instance, a government spending injection of $1 billion can lead to a total economic output exceeding initial expenditure due to successive rounds of consumer spending. This multiplier impact varies with the marginal propensity to consume, where higher consumption rates amplify the overall effect on GDP growth.

Limitations in Measuring Fiscal Multipliers

Estimating the Keynesian multiplier in fiscal stimulus faces challenges due to varying economic conditions, data limitations, and model assumptions that impact accuracy. Structural differences across regions and time periods cause fluctuations in multiplier effects, complicating uniform measurement. External factors like monetary policy responses and private sector behavior further limit the precision of fiscal multiplier estimates.

Policy Lessons from Multiplier Case Studies

Keynesian multiplier effects from fiscal stimulus reveal that government spending on infrastructure projects often generates a multiplier ranging from 1.5 to 2.5, significantly boosting aggregate demand and employment. Case studies from the 2009 American Recovery and Reinvestment Act demonstrate that targeted fiscal interventions in labor-intensive sectors maximize output and consumption increases. These policy lessons emphasize the importance of timely, well-directed spending to optimize economic recovery and fiscal multipliers.

example of Keynesian multiplier in fiscal stimulus Infographic

samplerz.com

samplerz.com