Fiscal drag occurs when taxpayers are pushed into higher tax brackets due to inflation or wage growth, even though their real income has not increased. For example, if an individual's salary rises from $48,000 to $52,000 due to cost-of-living adjustments, they may move from a 20% tax bracket to a 25% tax bracket. This shift results in higher tax payments without a corresponding increase in purchasing power, effectively reducing disposable income. In many economies, fiscal drag can dampen consumer spending by increasing the tax burden automatically as incomes adjust for inflation. Governments experience increased tax revenues without legislative changes because more taxpayers fall into higher brackets. This phenomenon highlights the importance of regular tax bracket adjustments to align with inflation rates and maintain economic balance.

Table of Comparison

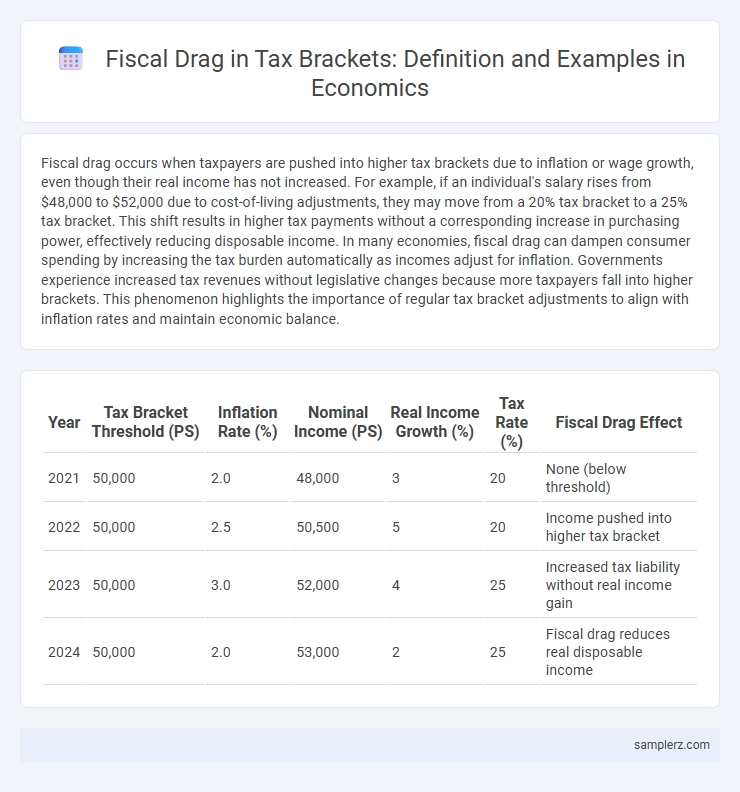

| Year | Tax Bracket Threshold (PS) | Inflation Rate (%) | Nominal Income (PS) | Real Income Growth (%) | Tax Rate (%) | Fiscal Drag Effect |

|---|---|---|---|---|---|---|

| 2021 | 50,000 | 2.0 | 48,000 | 3 | 20 | None (below threshold) |

| 2022 | 50,000 | 2.5 | 50,500 | 5 | 20 | Income pushed into higher tax bracket |

| 2023 | 50,000 | 3.0 | 52,000 | 4 | 25 | Increased tax liability without real income gain |

| 2024 | 50,000 | 2.0 | 53,000 | 2 | 25 | Fiscal drag reduces real disposable income |

Understanding Fiscal Drag: Definition and Importance

Fiscal drag occurs when inflation pushes taxpayers into higher tax brackets, increasing their tax burden without a real increase in income. This phenomenon reduces disposable income and can slow economic growth by decreasing consumer spending. Understanding fiscal drag is crucial for policymakers to adjust tax brackets and maintain equitable tax systems.

How Fiscal Drag Manifests in Progressive Tax Systems

Fiscal drag manifests in progressive tax systems when inflation and nominal wage increases push taxpayers into higher tax brackets, increasing their average tax rates without real income growth. This bracket creep effectively raises government revenues while potentially reducing individuals' disposable income and purchasing power. Over time, fiscal drag can lead to a hidden tax increase that dampens economic incentives and slows consumer spending.

Real-World Examples of Fiscal Drag in Tax Brackets

Fiscal drag occurs when inflation pushes taxpayers into higher tax brackets despite no increase in real income, effectively increasing their tax burden. A real-world example is the United Kingdom during the 1970s and early 1980s, where high inflation rates caused many middle-income earners to be taxed at higher marginal rates, reducing their disposable income. Similarly, Australia experienced fiscal drag in the 2000s before implementing bracket indexation, demonstrating how unadjusted tax brackets can erode taxpayers' purchasing power over time.

The Mechanics of Bracket Creep Explained

Bracket creep occurs when inflation pushes taxpayers into higher income tax brackets despite their real income remaining constant, effectively increasing their tax burden without an increase in purchasing power. This fiscal drag reduces disposable income and can dampen consumer spending, slowing economic growth. Governments may face unintended revenue boosts, complicating fiscal policy and budget planning.

Inflation and Its Role in Fiscal Drag

Inflation increases nominal incomes, pushing taxpayers into higher tax brackets without a real increase in purchasing power, exemplifying fiscal drag. This bracket creep reduces disposable income and can dampen consumer spending, slowing economic growth. Government revenues rise automatically through inflation-driven fiscal drag, complicating fiscal policy adjustments.

Impact of Fiscal Drag on Middle-Income Earners

Fiscal drag occurs when inflation pushes middle-income earners into higher tax brackets without an actual increase in real income, leading to higher tax liabilities. This phenomenon reduces disposable income, decreasing consumer spending power and potentially slowing economic growth. Middle-income households experience a stealth tax increase, which can contribute to widening income inequality and decreased economic mobility.

Fiscal Drag vs. Government Revenue Growth

Fiscal drag occurs when inflation and wage growth push taxpayers into higher tax brackets without changes in tax rates, increasing average tax rates and government revenue. This effect can lead to automatic revenue growth, even if real incomes remain constant, as nominal income rises. Understanding fiscal drag is crucial for evaluating government revenue trends and the true progressivity of the tax system.

Policy Responses to Mitigate Fiscal Drag

Governments implement indexation of tax brackets to inflation as an effective policy response to mitigate fiscal drag, preventing taxpayers from being pushed into higher tax brackets due to nominal income growth. Another approach involves adjusting personal allowances and tax thresholds annually based on wage growth or consumer price indices to maintain taxpayers' real tax burdens. Targeted tax relief or credits are also introduced to alleviate the disproportionate impact of fiscal drag on low- and middle-income households, ensuring equitable tax burden distribution.

International Cases: Fiscal Drag Across Countries

Fiscal drag occurs when taxpayers are pushed into higher tax brackets due to inflation or income growth without corresponding bracket adjustments, reducing real income. In countries like the UK and Australia, fiscal drag has led to increased tax revenues despite no legislative changes, highlighting the automatic rise in tax liabilities. This phenomenon is also observed in Germany and Canada, where progressive tax systems amplify the fiscal drag effect during periods of steady wage inflation.

Long-Term Economic Consequences of Unchecked Fiscal Drag

Unchecked fiscal drag occurs when inflation pushes taxpayers into higher tax brackets without an increase in real income, resulting in higher average tax rates over time. This phenomenon leads to reduced consumer spending power, slower economic growth, and diminished incentives for productivity and investment. Long-term consequences include increased income inequality and fiscal imbalances that can strain government budgets and undermine economic stability.

example of fiscal drag in tax bracket Infographic

samplerz.com

samplerz.com