Okun's law quantifies the relationship between unemployment rates and GDP output gaps. When the unemployment rate rises by 1%, the output gap typically widens by approximately 2% below potential GDP. This empirical relationship helps economists estimate the economic loss associated with labor market slack during recessions or recoveries. For instance, if a country experiences a 3% increase in unemployment above its natural rate, its output gap may increase by about 6%. This means actual GDP falls 6% short of potential GDP, signaling underutilized resources in the economy. Analysts use Okun's coefficient to forecast GDP growth based on changes in employment metrics and to guide policy interventions aimed at closing the output gap.

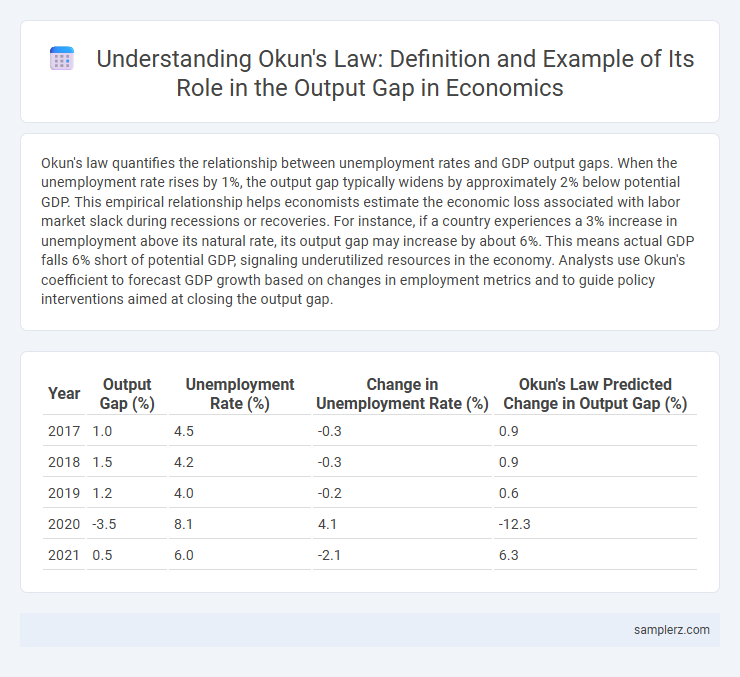

Table of Comparison

| Year | Output Gap (%) | Unemployment Rate (%) | Change in Unemployment Rate (%) | Okun's Law Predicted Change in Output Gap (%) |

|---|---|---|---|---|

| 2017 | 1.0 | 4.5 | -0.3 | 0.9 |

| 2018 | 1.5 | 4.2 | -0.3 | 0.9 |

| 2019 | 1.2 | 4.0 | -0.2 | 0.6 |

| 2020 | -3.5 | 8.1 | 4.1 | -12.3 |

| 2021 | 0.5 | 6.0 | -2.1 | 6.3 |

Understanding Okun’s Law: A Brief Overview

Okun's Law quantifies the relationship between unemployment and output gap, showing that for every 1% increase in unemployment, GDP typically falls by about 2% relative to its potential. This empirical relationship helps economists estimate output loss caused by labor market slack during recessions. By analyzing historical data, policymakers use Okun's coefficient to gauge economic health and guide stimulus measures.

What Is the Output Gap in Economics?

The output gap measures the difference between an economy's actual Gross Domestic Product (GDP) and its potential GDP, reflecting underutilized or overstrained resources. According to Okun's law, a negative output gap correlates with higher unemployment rates, indicating that when actual output falls below potential, joblessness rises. Policymakers use this relationship to estimate the necessary economic stimulus to close the output gap and reduce unemployment.

The Mathematical Relationship Behind Okun’s Law

Okun's Law quantifies the inverse relationship between unemployment and output gap, typically expressed as a 2% increase in GDP growth reducing unemployment by 1 percentage point. The mathematical relationship is often modeled as \( \Delta u = -\beta (g - \bar{g}) \), where \( \Delta u \) represents the change in unemployment, \( g \) is actual GDP growth, \( \bar{g} \) is potential GDP growth, and \( \beta \) is Okun's coefficient. This formula highlights how deviations in economic output from its potential level directly impact labor market conditions.

Historical Examples of Okun’s Law in Action

During the 2008 financial crisis, the U.S. economy experienced a significant output gap as GDP contracted sharply while unemployment rates surged, illustrating Okun's law principle. Historical data showed that for every 1% increase in unemployment, GDP fell by approximately 2%, aligning closely with Okun's empirical relationship. This pattern reappeared in the early 1980s recession, confirming the consistent correlation between output gaps and labor market conditions.

Case Study: Output Gap During the 2008 Financial Crisis

The 2008 Financial Crisis exemplified Okun's law through a significant output gap, where the U.S. economy's actual GDP fell sharply below its potential GDP, reflecting widespread unemployment and underutilized resources. The output gap during this period reached nearly -6%, correlating with a steep rise in the unemployment rate from 4.7% in 2007 to 10% in 2009. This case study underscores the inverse relationship quantified by Okun's coefficient, demonstrating how declines in economic output directly correspond to increases in unemployment during severe recessions.

Okun’s Law Across Different Economies

Okun's Law demonstrates a consistent inverse relationship between unemployment rates and output gaps across diverse economies, with estimated coefficients varying from -1.5 in advanced economies like the US and Germany to -2.0 in emerging markets like India and Brazil. This variation reflects structural differences including labor market rigidities and productivity growth rates, affecting how output responds to changes in unemployment. Empirical studies reveal that countries with more flexible labor markets tend to exhibit a smaller output gap for a given change in unemployment, underscoring the importance of institutional factors in the law's application.

Output Gap and Unemployment: Empirical Evidence

Okun's law empirically demonstrates a robust inverse relationship between the output gap and unemployment rate, showing that a 1% increase in unemployment typically corresponds to a 2% negative output gap in GDP. Studies analyzing post-recession periods reveal that economies with higher cyclical unemployment experience significantly larger output gaps, confirming the predictive power of Okun's coefficient across different countries and timeframes. This empirical evidence supports policymakers in estimating GDP losses from labor market slack and designing targeted stimulus measures.

Limitations of Okun’s Law in Measuring the Output Gap

Okun's Law, which estimates the relationship between unemployment rate changes and output gap, faces limitations due to structural shifts in the labor market that distort its predictive accuracy. Variations in labor force participation, technological advancements, and underemployment lead to discrepancies between actual and estimated output gaps. Consequently, reliance solely on Okun's coefficient may result in inaccurate assessments of economic slack, necessitating complementary measures for robust output gap analysis.

Policy Implications: Using Okun’s Law to Address Output Gap

Policymakers utilize Okun's Law to quantify the relationship between unemployment and GDP, enabling targeted fiscal and monetary interventions to close the output gap. By monitoring unemployment fluctuations, central banks adjust interest rates to stimulate economic growth or cool inflationary pressures, optimizing output levels. Strategic government spending and tax policies are designed to reduce unemployment, thereby minimizing the output gap and promoting sustained economic stability.

Future Trends: Okun’s Law and Output Gap Forecasting

Okun's Law illustrates the inverse relationship between unemployment rates and GDP growth, providing a critical framework for forecasting output gaps in future economic cycles. Advanced econometric models incorporating real-time labor market data and productivity trends enhance the precision of output gap predictions, guiding policymakers in stimulus calibration. Emerging technologies, such as AI-driven analytics, are expected to refine Okun's Law applications, enabling more accurate and timely identification of economic slack and growth potential.

example of Okun's law in output gap Infographic

samplerz.com

samplerz.com