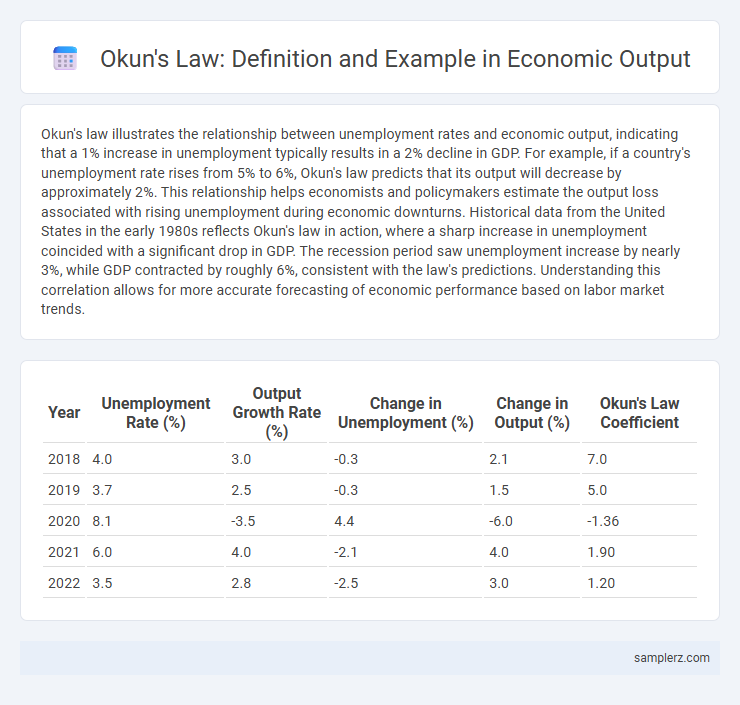

Okun's law illustrates the relationship between unemployment rates and economic output, indicating that a 1% increase in unemployment typically results in a 2% decline in GDP. For example, if a country's unemployment rate rises from 5% to 6%, Okun's law predicts that its output will decrease by approximately 2%. This relationship helps economists and policymakers estimate the output loss associated with rising unemployment during economic downturns. Historical data from the United States in the early 1980s reflects Okun's law in action, where a sharp increase in unemployment coincided with a significant drop in GDP. The recession period saw unemployment increase by nearly 3%, while GDP contracted by roughly 6%, consistent with the law's predictions. Understanding this correlation allows for more accurate forecasting of economic performance based on labor market trends.

Table of Comparison

| Year | Unemployment Rate (%) | Output Growth Rate (%) | Change in Unemployment (%) | Change in Output (%) | Okun's Law Coefficient |

|---|---|---|---|---|---|

| 2018 | 4.0 | 3.0 | -0.3 | 2.1 | 7.0 |

| 2019 | 3.7 | 2.5 | -0.3 | 1.5 | 5.0 |

| 2020 | 8.1 | -3.5 | 4.4 | -6.0 | -1.36 |

| 2021 | 6.0 | 4.0 | -2.1 | 4.0 | 1.90 |

| 2022 | 3.5 | 2.8 | -2.5 | 3.0 | 1.20 |

Real-World Applications of Okun's Law in Economic Output

Okun's law demonstrates a consistent inverse relationship between unemployment rates and real GDP output, where a 1% increase in unemployment typically corresponds to a 2% decline in output. Real-world applications include evaluating the impact of labor market shifts on national productivity during recessions, such as the 2008 financial crisis when U.S. GDP contracted significantly alongside rising unemployment. Policymakers use this empirical relationship to forecast economic output changes and calibrate fiscal or monetary interventions to stabilize employment levels and growth.

Case Studies Illustrating Okun’s Law Across Different Economies

Case studies of Okun's Law reveal that a 1% increase in unemployment in the United States typically corresponds to a 2% decrease in GDP growth, highlighting the law's predictive power in advanced economies. In emerging markets like Brazil, the relationship is less stable due to informal labor sectors and economic volatility, demonstrating variability in Okun's coefficient. Japan's post-bubble economy also exhibits a weaker link between output and unemployment fluctuations, emphasizing the influence of structural factors on Okun's Law.

Okun’s Law and Output Fluctuations During Recessions

Okun's Law quantifies the relationship between unemployment rates and output fluctuations, demonstrating that a 1% increase in unemployment typically leads to a 2% decrease in GDP output during recessions. This empirical relationship helps economists predict economic contractions by linking labor market inefficiencies directly to declines in national production. Understanding Okun's Law enables policymakers to implement targeted interventions aimed at stabilizing output and mitigating the effects of rising unemployment in economic downturns.

Historical Output Trends Validating Okun’s Law

Historical output trends during the post-World War II era in the United States provide strong empirical validation of Okun's Law, which quantifies the inverse relationship between unemployment rates and GDP growth. For instance, the 1980s recession saw unemployment rise sharply while real GDP contracted, reflecting Okun's coefficient of approximately -2, indicating a 2% decrease in output for every 1% increase in unemployment. Similar patterns emerged during the early 2000s and 2008 financial crisis, reinforcing the robustness of Okun's Law in capturing cyclical fluctuations in economic output.

How Output Gaps Reflect Okun’s Law in Practice

Output gaps quantify the difference between actual and potential GDP, directly illustrating Okun's Law by linking deviations in unemployment rates to changes in economic output. When unemployment rises, the output gap typically widens as actual GDP falls below potential GDP, demonstrating the inverse relationship Okun's Law predicts. This relationship enables policymakers to estimate the economic impact of labor market fluctuations on national output and guide fiscal or monetary interventions.

Examples of GDP Variations Explained by Okun’s Law

Okun's law quantifies the relationship between unemployment changes and GDP fluctuations, typically stating that a 1% increase in unemployment corresponds to a roughly 2% decrease in GDP. For instance, during the 2008 financial crisis, U.S. unemployment rose by about 5 percentage points, correlating with a GDP contraction close to 10% in real terms. This empirical relationship helps economists predict the output gap based on labor market shifts and informs policy decisions during recessions.

Okun’s Law in Developed vs. Developing Economies: Output Perspective

Okun's Law demonstrates a stronger correlation between unemployment changes and output gaps in developed economies, where established labor markets and stable production patterns allow for more predictable GDP responses. In developing economies, the law's parameters often vary due to informal employment sectors and volatility in output, leading to less consistent relationships between unemployment rates and output fluctuations. Empirical data from OECD countries show a typical Okun coefficient around -2, while in emerging markets, coefficients range widely, reflecting structural differences in labor market flexibility and economic diversification.

Output Growth and Unemployment: Instances of Okun’s Law in Action

Okun's Law illustrates the inverse relationship between output growth and unemployment rates, where a 2% increase in GDP growth typically corresponds with a 1% decrease in unemployment. For instance, during the economic expansion of the 1990s in the United States, robust output growth consistently led to significant declines in joblessness. Similarly, the post-2009 recovery period demonstrated this dynamic, with steady GDP increases reducing unemployment levels across major economies.

Sectoral Analysis: Applying Okun’s Law to Industrial Output

Okun's Law reveals a negative relationship between unemployment rates and industrial output, where a 1% decrease in unemployment typically results in a 2% increase in sectoral industrial output. Sectoral analysis highlights key industries such as manufacturing, mining, and utilities, demonstrating varied sensitivities to changes in labor market conditions. Empirical data from the Bureau of Labor Statistics confirms that manufacturing output growth strongly correlates with declining unemployment, reflecting the law's practical application in industrial economic forecasting.

Reinterpreting Output Shocks Through the Lens of Okun’s Law

Output shocks can be reinterpreted through Okun's Law by quantifying the relationship between changes in unemployment rates and GDP fluctuations, demonstrating that a 1% increase in unemployment typically corresponds to a 2% decrease in output. This empirical relationship helps economists analyze economic downturns, such as recessions triggered by supply chain disruptions or demand shocks, through shifts in labor market dynamics. Understanding these output shocks under Okun's framework enables more accurate forecasting of economic recovery paths and policy interventions targeting employment stabilization.

example of Okun’s law in output Infographic

samplerz.com

samplerz.com