An example of an automatic stabilizer in the economy is unemployment insurance. This program provides financial support to individuals who have lost their jobs, helping to maintain consumer spending during economic downturns. By automatically increasing government payments as unemployment rises, it helps to stabilize aggregate demand without requiring new legislative action. Another key automatic stabilizer is the progressive income tax system. As individuals' incomes fall during recessions, they pay less in taxes, leaving more disposable income to support consumption. This built-in fiscal mechanism reduces the severity of economic fluctuations by adjusting tax burdens in response to changes in economic activity.

Table of Comparison

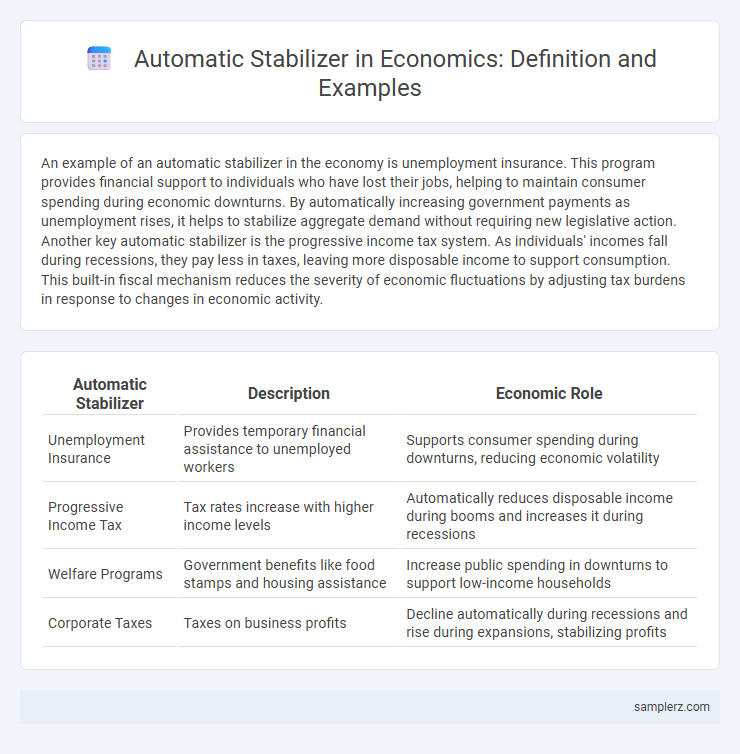

| Automatic Stabilizer | Description | Economic Role |

|---|---|---|

| Unemployment Insurance | Provides temporary financial assistance to unemployed workers | Supports consumer spending during downturns, reducing economic volatility |

| Progressive Income Tax | Tax rates increase with higher income levels | Automatically reduces disposable income during booms and increases it during recessions |

| Welfare Programs | Government benefits like food stamps and housing assistance | Increase public spending in downturns to support low-income households |

| Corporate Taxes | Taxes on business profits | Decline automatically during recessions and rise during expansions, stabilizing profits |

Understanding Automatic Stabilizers in the Economy

Unemployment insurance serves as a key automatic stabilizer by providing temporary financial support to laid-off workers, helping to maintain consumer spending during economic downturns. Progressive income taxes automatically reduce tax burdens when incomes fall, increasing disposable income and supporting demand. These mechanisms work without new government intervention, smoothing fluctuations in the business cycle and stabilizing the economy.

Key Examples of Automatic Stabilizers

Unemployment insurance serves as a key automatic stabilizer by providing temporary income support to workers during economic downturns, thereby sustaining consumer spending and mitigating recessions. Progressive income taxes automatically adjust tax burdens based on earnings, reducing disposable income during expansions and increasing it during contractions, which helps stabilize demand. Social welfare programs such as food assistance and Medicaid expand eligibility during economic slumps, cushioning vulnerable populations and supporting overall economic stability.

Unemployment Benefits as Automatic Stabilizers

Unemployment benefits act as automatic stabilizers by providing income support to individuals who lose their jobs, thereby maintaining consumer spending during economic downturns. These benefits help stabilize aggregate demand by offsetting declines in household income, reducing the severity of recessions. Empirical studies show that countries with robust unemployment insurance systems experience less volatile GDP fluctuations due to this cushioning effect.

Progressive Taxation and Economic Stability

Progressive taxation functions as an automatic stabilizer by increasing tax rates as individual incomes rise, thereby reducing disposable income during economic expansions and tempering demand-pull inflation. During economic downturns, lower incomes lead to reduced tax liabilities, effectively increasing disposable income and supporting consumer spending. This dynamic helps maintain economic stability by moderating fluctuations in aggregate demand without requiring direct government intervention.

Welfare Programs and Income Support

Welfare programs such as unemployment benefits and income support act as automatic stabilizers by providing financial assistance to individuals during economic downturns, which helps maintain consumer demand and reduce the severity of recessions. These programs increase government spending without new legislation when incomes fall, cushioning the impact on households and sustaining aggregate consumption. As a result, automatic stabilizers in welfare systems contribute to stabilizing economic fluctuations and promoting overall economic resilience.

Corporate Tax Systems as Automatic Stabilizers

Corporate tax systems act as automatic stabilizers by adjusting tax revenues in response to fluctuations in economic activity. During economic downturns, corporate profits decline, resulting in reduced tax liabilities and increased after-tax income for businesses, which helps cushion the economy. Conversely, in periods of growth, higher profits lead to increased tax payments, moderating overheating and stabilizing economic cycles.

Social Security Payments During Economic Fluctuations

Social Security payments act as a critical automatic stabilizer by providing consistent income to retirees and disabled individuals, thereby sustaining consumer spending during economic downturns. When the economy contracts, these payments help cushion the decline in aggregate demand, mitigating the depth of recessions. Empirical studies show that sustained Social Security disbursements contribute to economic stability by supporting household consumption patterns.

Food Assistance Programs in Economic Downturns

Food assistance programs act as automatic stabilizers during economic downturns by providing immediate support to households facing income loss, helping to maintain consumer demand. These programs, such as Supplemental Nutrition Assistance Program (SNAP), reduce poverty rates and stabilize food consumption without requiring new legislation. By increasing benefits when unemployment rises, they mitigate the negative impacts of recessions on vulnerable populations and overall economic activity.

Automatic Stabilizers vs. Discretionary Fiscal Policy

Automatic stabilizers such as unemployment insurance and progressive income taxes adjust government spending and revenue automatically in response to economic fluctuations, dampening output volatility without new legislative action. Unlike discretionary fiscal policy, which requires active decisions by policymakers to change taxation or spending levels, automatic stabilizers provide timely and predictable counter-cyclical support. These mechanisms help stabilize aggregate demand, reducing the severity of recessions and overheating during expansions without implementation delays or political debates.

Real-World Case Studies of Automatic Stabilizers

Unemployment insurance acts as a key automatic stabilizer by providing income support during economic downturns, as seen in the 2008 Global Financial Crisis when benefit claims surged, cushioning household spending. Progressive tax systems also function effectively; for example, during the 2020 COVID-19 recession, reduced incomes led to lower tax liabilities, preserving disposable income and stabilizing consumption. Social welfare programs like food assistance in the United States expanded in response to increased demand during recessions, thereby mitigating poverty and sustaining aggregate demand.

example of automatic stabilizer in economy Infographic

samplerz.com

samplerz.com