Adjustment cost in capital refers to the expenses incurred when a firm changes its level of capital stock. These costs include installation fees, downtime during equipment replacement, and expenses related to training employees on new machinery. Companies often face adjustment costs when expanding production capacity or upgrading technology to maintain competitiveness. Such costs directly impact investment decisions and capital allocation strategies. High adjustment costs can delay capital expansion, affecting overall productivity and economic growth. Understanding these costs is essential for firms to optimize their capital budgeting and maximize returns on investment.

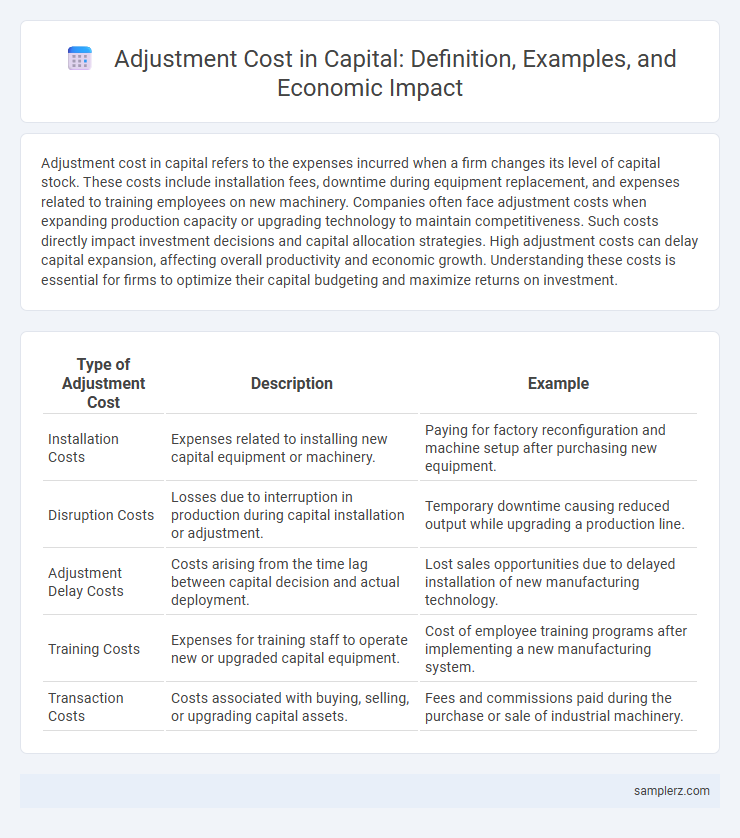

Table of Comparison

| Type of Adjustment Cost | Description | Example |

|---|---|---|

| Installation Costs | Expenses related to installing new capital equipment or machinery. | Paying for factory reconfiguration and machine setup after purchasing new equipment. |

| Disruption Costs | Losses due to interruption in production during capital installation or adjustment. | Temporary downtime causing reduced output while upgrading a production line. |

| Adjustment Delay Costs | Costs arising from the time lag between capital decision and actual deployment. | Lost sales opportunities due to delayed installation of new manufacturing technology. |

| Training Costs | Expenses for training staff to operate new or upgraded capital equipment. | Cost of employee training programs after implementing a new manufacturing system. |

| Transaction Costs | Costs associated with buying, selling, or upgrading capital assets. | Fees and commissions paid during the purchase or sale of industrial machinery. |

Understanding Adjustment Costs in Capital Investment

Adjustment costs in capital investment refer to the expenses firms incur when modifying their capital stock, such as installing new machinery or restructuring production facilities. These costs include installation fees, downtime losses, and resource reallocation, which can hinder rapid changes in capital levels. Understanding these costs is crucial for optimizing investment decisions and improving long-term efficiency in capital allocation.

The Role of Adjustment Costs in Economic Decision-Making

Adjustment costs in capital represent the expenses firms face when altering their investment levels, such as installation fees, downtime, and reconfiguration expenses. These costs influence economic decision-making by causing firms to delay or smooth out investment over time, thereby affecting capital accumulation rates and productivity growth. Understanding adjustment costs is crucial for modeling investment behavior and predicting responses to economic policies or shocks.

Real-World Examples of Capital Adjustment Costs

Real-world examples of capital adjustment costs include costs incurred during the installation of new machinery, such as downtime and labor expenses, which reduce overall productivity. Firms face expenses when upgrading technology, including training workers and modifying production processes to integrate new equipment. These costs reflect frictions in adjusting physical capital, impacting investment decisions and firm profitability.

Short-Term vs Long-Term Capital Adjustment Costs

Short-term capital adjustment costs often include expenses related to rapid reallocations such as transaction fees, temporary production inefficiencies, and liquidity constraints. In contrast, long-term capital adjustment costs encompass expenditures on new infrastructure, technology upgrades, and employee retraining necessary for sustainable growth. Firms weigh these cost differences carefully when deciding between immediate capital shifts and gradual investments to optimize economic outcomes.

Financial Implications of Capital Adjustments

Adjustment costs in capital often manifest as significant financial implications, including transaction fees, installation expenses, and downtime losses. Firms must budget for both explicit costs, such as purchasing new machinery, and implicit costs like reduced production during transition periods. These financial burdens influence investment decisions and capital allocation strategies within the economy.

Impact of Adjustment Costs on Firm Productivity

Adjustment costs in capital, such as expenses related to installation, reconfiguration, or downtime during machinery upgrades, significantly influence firm productivity by delaying the effective utilization of assets. These costs reduce the speed at which firms can adapt to changing market conditions, leading to suboptimal capital use and diminished output efficiency. Empirical studies show that higher adjustment costs correlate with slower capital accumulation and lower total factor productivity growth within industries.

Adjustment Costs in Manufacturing: Case Studies

Adjustment costs in manufacturing often arise from expenses related to installing new machinery, training workers, and reconfiguring production lines, which can temporarily reduce output efficiency. Case studies in automotive and semiconductor industries reveal that these costs significantly delay return on investment and affect production schedules. Firms facing high adjustment costs typically implement phased capital upgrades to mitigate operational disruptions and manage cash flow more effectively.

Technological Upgrades and Capital Adjustment Expenses

Technological upgrades in capital involve significant adjustment costs, including expenses for purchasing new machinery, installing advanced software systems, and training employees on updated technologies. These capital adjustment expenses often encompass maintenance downtime, reconfiguration of production lines, and integration challenges that delay output. Firms face trade-offs between immediate adjustment costs and long-term productivity gains when implementing cutting-edge technological innovations in their capital stock.

Structural Changes and Their Associated Adjustment Costs

Structural changes in the economy, such as technological advancements or shifts in consumer preferences, lead to significant adjustment costs in capital due to the need to reallocate and retrofit existing assets. Firms face expenses related to dismantling obsolete machinery, investing in new equipment, and retraining workers to operate advanced technologies, which can slow down production and reduce profitability in the short term. These capital adjustment costs impact investment decisions and aggregate economic growth as firms balance the immediate costs against long-term efficiency gains.

Policy Perspectives on Reducing Capital Adjustment Costs

Policy perspectives on reducing capital adjustment costs emphasize streamlining regulatory procedures to facilitate quicker investment decisions and lower compliance expenses for businesses. Implementing flexible tax incentives and subsidies targeting capital upgrades reduces the financial burden firms face when adjusting their capital stock. Encouraging innovation in financial instruments and enhancing access to credit markets also play critical roles in minimizing frictions associated with capital reallocation.

example of adjustment cost in capital Infographic

samplerz.com

samplerz.com