The stagflation of the 1970s was a significant economic event characterized by the simultaneous occurrence of high inflation, stagnant economic growth, and rising unemployment. This period was marked by a sharp increase in oil prices due to the 1973 oil embargo imposed by OPEC, which drastically raised production costs and contributed to inflation. The U.S. economy experienced a decline in industrial output, persistent inflation rates exceeding 10%, and unemployment rates climbing above 8%, reflecting the complex challenges faced. This economic phenomenon defied traditional Keynesian economic theory, which typically sees inflation and unemployment as inversely related. Policymakers struggled to address the crisis as measures to curb inflation often worsened unemployment, and efforts to stimulate growth risked increasing inflation further. The stagflation of the 1970s led to significant changes in economic policy, including a focus on controlling inflation through monetary policy and a reevaluation of supply-side factors influencing economic stability.

Table of Comparison

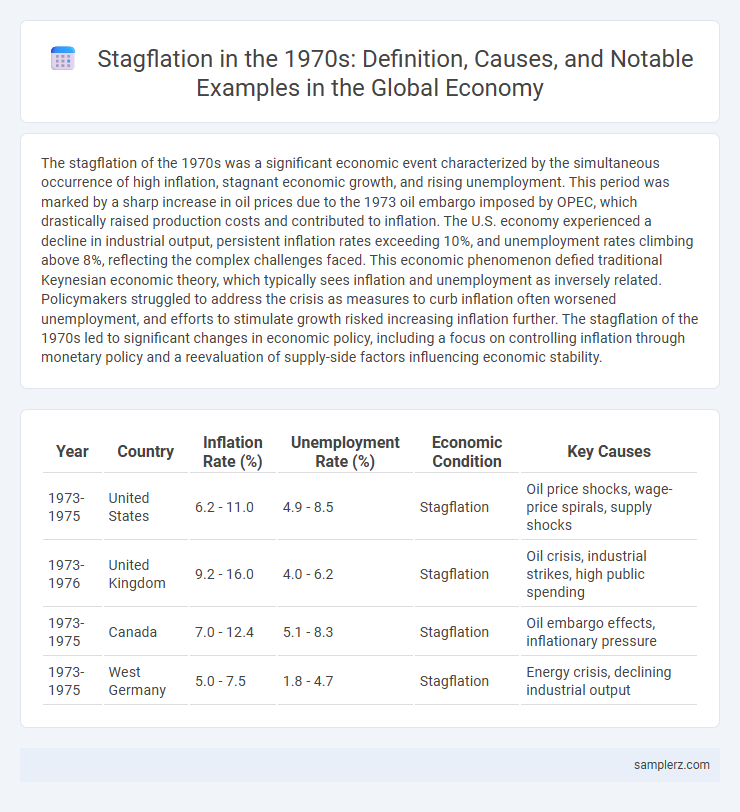

| Year | Country | Inflation Rate (%) | Unemployment Rate (%) | Economic Condition | Key Causes |

|---|---|---|---|---|---|

| 1973-1975 | United States | 6.2 - 11.0 | 4.9 - 8.5 | Stagflation | Oil price shocks, wage-price spirals, supply shocks |

| 1973-1976 | United Kingdom | 9.2 - 16.0 | 4.0 - 6.2 | Stagflation | Oil crisis, industrial strikes, high public spending |

| 1973-1975 | Canada | 7.0 - 12.4 | 5.1 - 8.3 | Stagflation | Oil embargo effects, inflationary pressure |

| 1973-1975 | West Germany | 5.0 - 7.5 | 1.8 - 4.7 | Stagflation | Energy crisis, declining industrial output |

Overview of 1970s Stagflation

The 1970s stagflation was characterized by a simultaneous rise in inflation and unemployment rates, defying traditional economic theories. Key factors included oil price shocks from OPEC, supply chain disruptions, and expansive monetary policies. This period challenged policymakers by demonstrating that inflation and stagnation could co-occur, leading to a reevaluation of macroeconomic strategies.

Defining Stagflation: Key Characteristics

Stagflation in the 1970s was characterized by the unusual coexistence of high inflation rates, stagnant economic growth, and rising unemployment, defying traditional economic theories that linked inflation to economic expansion. The U.S. experienced double-digit inflation alongside GDP stagnation, leading to eroded consumer purchasing power and increased cost of living. This period highlighted the challenges of tackling inflation without exacerbating unemployment, marking a critical case study in macroeconomic policy.

Causes of the 1970s Economic Crisis

The stagflation of the 1970s was primarily caused by a combination of supply shocks and monetary policy missteps, including the 1973 oil embargo imposed by OPEC members, which quadrupled oil prices and triggered widespread cost-push inflation. Persistent inflationary pressures were exacerbated by expansive fiscal policies and loose monetary policy that failed to control money supply growth. Structural factors such as diminished productivity growth and labor market rigidities further deepened the economic crisis, resulting in stagnant growth coupled with high inflation and unemployment.

The Oil Shock and Its Impact

The 1970s stagflation was largely driven by the 1973 Oil Shock, when OPEC's oil embargo caused crude prices to quadruple, severely disrupting global markets. This sudden surge in energy costs led to skyrocketing inflation rates alongside stagnant economic growth and rising unemployment. The oil crisis exposed vulnerabilities in energy-dependent economies, triggering policy challenges that defined the decade's economic malaise.

Wage-Price Spirals in the 1970s

The 1970s stagflation was marked by persistent wage-price spirals, where rising wages led to higher production costs that businesses passed on as increased prices, fueling further wage demands. This cycle intensified inflation while unemployment remained high, undermining traditional economic policies aimed at stabilizing the economy. Key contributing factors included oil price shocks and expansive fiscal policies that amplified cost-push inflation effects during that decade.

U.S. GDP and Unemployment Trends

The U.S. economy during the 1970s stagflation experienced a significant slowdown in GDP growth, with real GDP growth rates averaging below 2%, contrasting sharply with the robust post-war expansion. Unemployment rates surged from around 4% in 1970 to over 9% by 1975, reflecting severe labor market distress despite rising inflation. This combination of stagnant economic output and high unemployment was unprecedented and challenged traditional economic policy frameworks.

Government Policy Responses

Government policy responses to stagflation in the 1970s included tightening monetary policy to curb inflation by increasing interest rates and reducing money supply. Fiscal measures involved cutting government spending and implementing wage and price controls to stabilize the economy. These policies aimed to balance inflation control with unemployment reduction, yet often resulted in prolonged economic stagnation.

Global Spread of Stagflation

The 1970s stagflation crisis, marked by simultaneous high inflation and unemployment, spread globally due to oil price shocks and supply chain disruptions. Major economies including the United States, United Kingdom, Japan, and Western Europe experienced prolonged periods of stagnant growth and rising inflation, challenging conventional economic policies. Central banks worldwide struggled to balance monetary tightening with unemployment concerns, leading to significant shifts in economic theory and policy frameworks.

Long-Term Effects on Economic Policy

The stagflation of the 1970s, marked by high inflation and stagnant growth, led to a fundamental shift in economic policy frameworks worldwide. Central banks adopted more aggressive inflation-targeting regimes and emphasized controlling money supply to prevent recurring stagflation. This period also prompted governments to reassess fiscal policies, balancing intervention with market-oriented reforms to foster sustainable long-term growth.

Lessons Learned from 1970s Stagflation

Stagflation in the 1970s demonstrated the risks of simultaneous high inflation and stagnant economic growth caused largely by oil price shocks and ineffective monetary policies. Central banks learned the importance of controlling inflation expectations through tight monetary measures, even at the cost of short-term unemployment increases. Policymakers also recognized the need for diversified energy sources and supply chain resilience to prevent future supply-driven inflation.

example of stagflation in 1970s Infographic

samplerz.com

samplerz.com