Okun's Law quantifies the relationship between unemployment and economic growth, stating that for every 1% decrease in unemployment, GDP grows approximately 2% above its potential rate. This empirical rule helps economists estimate the economic output needed to reduce joblessness. For example, if a country's unemployment rate falls from 6% to 5%, GDP is expected to increase by about 2%, signaling stronger economic performance. In practical terms, Okun's Law guides policymakers in setting growth targets to achieve desired labor market outcomes. During a recovery phase, if GDP growth reaches 3%, unemployment may drop by around 1.5% based on the law's typical coefficients. This linkage between growth data and unemployment figures provides a benchmark for assessing the effectiveness of fiscal and monetary policies.

Table of Comparison

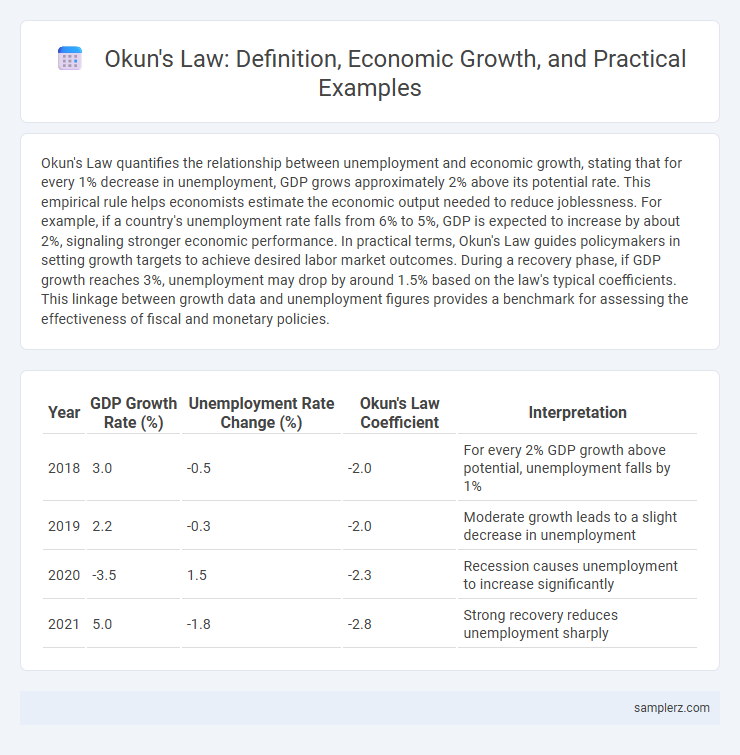

| Year | GDP Growth Rate (%) | Unemployment Rate Change (%) | Okun's Law Coefficient | Interpretation |

|---|---|---|---|---|

| 2018 | 3.0 | -0.5 | -2.0 | For every 2% GDP growth above potential, unemployment falls by 1% |

| 2019 | 2.2 | -0.3 | -2.0 | Moderate growth leads to a slight decrease in unemployment |

| 2020 | -3.5 | 1.5 | -2.3 | Recession causes unemployment to increase significantly |

| 2021 | 5.0 | -1.8 | -2.8 | Strong recovery reduces unemployment sharply |

Understanding Okun’s Law: Definition and Significance

Okun's Law illustrates the inverse relationship between unemployment and economic growth, typically indicating that a 1% decrease in unemployment corresponds to approximately a 2-3% increase in GDP. This empirical correlation helps policymakers estimate the level of GDP growth needed to reduce unemployment in a given economy. Understanding Okun's Law is crucial for setting realistic macroeconomic targets and assessing labor market dynamics during economic expansions and contractions.

Historical Background of Okun’s Law in Economic Growth

Okun's law, formulated by economist Arthur Okun in the 1960s, empirically illustrates the inverse relationship between unemployment rates and GDP growth in the United States. Historical analysis reveals that a 1% decrease in unemployment typically corresponded to a 2%-3% increase in real GDP, highlighting the law's predictive power during post-World War II economic expansions. This empirical correlation has been foundational in macroeconomic policy design, emphasizing labor market dynamics as key drivers of economic growth.

Mathematical Representation of Okun’s Law

Okun's Law quantifies the inverse relationship between unemployment rate changes and GDP growth through its mathematical representation: Y = k - cU, where Y represents GDP growth rate, U is the change in unemployment rate, k is the potential GDP growth, and c is Okun's coefficient, typically estimated around 2 to 3. This formula implies that a one-percentage point decrease in unemployment correlates with approximately a 2 to 3 percent increase in GDP growth. Economists use this linear relationship to predict economic performance and guide policy decisions during periods of fluctuating labor market conditions.

Real-World Example: Post-Recession Economic Recovery

Following the 2008 financial crisis, U.S. economic data exemplified Okun's law as GDP growth consistently correlated with declining unemployment rates. Between 2010 and 2015, the U.S. economy expanded at an average annual rate of about 2.3%, while unemployment fell from 9.6% to 5.3%. This real-world recovery illustrates the inverse relationship where higher output growth reduces labor market slack.

Case Study: Okun’s Law in the United States

In the United States, Okun's Law demonstrates a clear inverse relationship between unemployment rates and GDP growth, where a 1% decrease in unemployment typically correlates with a 2-3% increase in real GDP. During the 2009 recovery period, the U.S. economy showed this trend, as GDP growth accelerated alongside falling unemployment from 10% to under 6%. Policymakers use this empirical relationship to forecast economic performance and design labor market interventions that stimulate growth.

Variations of Okun’s Law Across Countries

Okun's Law demonstrates a negative relationship between unemployment rates and GDP growth, but variations occur across countries due to differences in labor market flexibility, productivity, and economic structure. For instance, the United States typically exhibits a coefficient of around -2, indicating a 2% increase in GDP growth reduces unemployment by 1%, whereas European countries often show smaller or less stable coefficients reflecting rigid labor markets. Emerging economies may experience divergent Okun's coefficients influenced by informal sectors and cyclical volatility, highlighting the importance of country-specific factors in interpreting the law's applicability.

Okun’s Law During Economic Expansions

Okun's Law illustrates the inverse relationship between unemployment rates and economic growth, showing that a 1% decrease in unemployment typically corresponds to a 2% increase in GDP. During economic expansions, rising GDP leads to job creation and lower unemployment rates, reinforcing this negative correlation. Empirical data from the U.S. economy consistently confirms Okun's coefficient, highlighting its predictive value in assessing labor market recovery amid growth phases.

Factors Influencing the Okun Coefficient

Okun's law demonstrates a quantifiable inverse relationship between unemployment rates and GDP growth, with the Okun coefficient representing this sensitivity. Factors influencing the Okun coefficient include labor market flexibility, productivity growth, and demographic changes such as workforce participation rates. Variations in these elements can cause shifts in the coefficient, affecting how closely unemployment responds to economic expansion or contraction.

Policy Implications of Okun’s Law for Growth Strategies

Okun's law, illustrating the inverse relationship between unemployment and GDP growth, guides policymakers in setting growth targets to optimize employment levels. By recognizing that a 1% decrease in unemployment typically correlates with a 2-3% increase in GDP, governments can design fiscal and monetary policies that stimulate economic expansion while minimizing joblessness. Strategic investments in labor market programs and innovation also leverage Okun's framework to sustain long-term growth and reduce cyclical unemployment.

Limitations and Critiques of Okun’s Law in Modern Economies

Okun's Law, which describes the inverse relationship between unemployment and GDP growth, faces limitations in modern economies due to structural changes like automation and the gig economy that decouple job creation from output growth. The law's empirical variability across countries and economic cycles highlights difficulties in capturing dynamic labor market conditions and productivity shifts. Critics emphasize its reduced predictive power amid technological advancements and labor market flexibility, requiring more comprehensive models for accurate economic forecasting.

example of Okun’s law in growth Infographic

samplerz.com

samplerz.com