Seigniorage in the economy refers to the profit made by a government when it issues currency, especially when the face value of money exceeds the cost of production. A common example is when a central bank prints new banknotes; the difference between the nominal value of these notes and the cost to produce them represents seigniorage revenue. This process effectively allows governments to finance spending without raising taxes or borrowing. Another example can be seen during periods of inflation when the real value of currency falls, and governments can increase nominal money supply to cover budget deficits. Countries experiencing hyperinflation often rely heavily on seigniorage, as newly printed money helps fund government expenditures despite eroding currency value. Data show that seigniorage typically forms a small but significant part of fiscal revenue, with higher reliance in economies facing financial pressures.

Table of Comparison

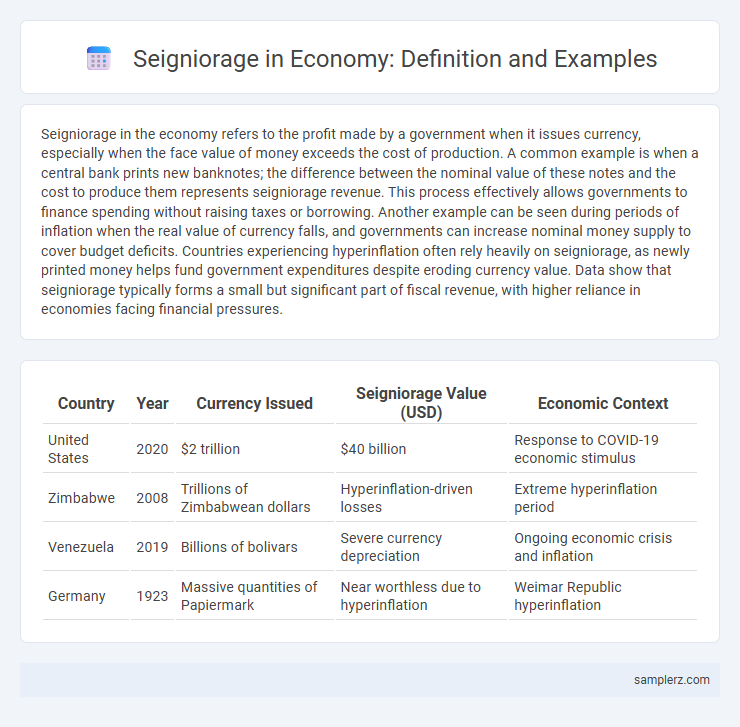

| Country | Year | Currency Issued | Seigniorage Value (USD) | Economic Context |

|---|---|---|---|---|

| United States | 2020 | $2 trillion | $40 billion | Response to COVID-19 economic stimulus |

| Zimbabwe | 2008 | Trillions of Zimbabwean dollars | Hyperinflation-driven losses | Extreme hyperinflation period |

| Venezuela | 2019 | Billions of bolivars | Severe currency depreciation | Ongoing economic crisis and inflation |

| Germany | 1923 | Massive quantities of Papiermark | Near worthless due to hyperinflation | Weimar Republic hyperinflation |

Introduction to Seigniorage in Modern Economies

Seigniorage in modern economies refers to the profit governments earn by issuing currency, specifically the difference between the face value of money and the production cost. Central banks, such as the Federal Reserve or the European Central Bank, generate seigniorage when they create new money to finance government spending or manage liquidity. This mechanism provides a non-tax revenue source that influences inflation, monetary policy, and economic stability.

Historical Examples of Seigniorage Practices

Ancient Rome's use of coinage debasement serves as a notable historical example of seigniorage, where emperors reduced silver content to finance military campaigns and public expenditures. During the Weimar Republic's hyperinflation in the early 1920s, the government printed excessive amounts of currency, generating seigniorage revenue but causing severe currency devaluation. Another instance occurred in Zimbabwe in the 2000s, where massive money printing led to hyperinflation, demonstrating the risks associated with relying heavily on seigniorage for state revenue.

Seigniorage Revenue: How Governments Profit

Seigniorage revenue represents the profit governments earn by issuing currency, calculated as the difference between the face value of money and the cost of production. Central banks generate significant seigniorage by printing money, which helps fund public expenditures without raising taxes or borrowing. In countries facing high inflation, excessive reliance on seigniorage often leads to currency depreciation and economic instability.

Case Study: Seigniorage during Hyperinflation

During the Zimbabwean hyperinflation in the late 2000s, the government heavily relied on seigniorage by printing money to finance budget deficits, causing inflation rates to soar to an unprecedented 79.6 billion percent month-on-month in November 2008. This excessive issuance of currency eroded real value, leading to a collapse in economic stability and the eventual abandonment of the Zimbabwean dollar. The case exemplifies how seigniorage can temporarily fund state expenditures but risks devastating economic consequences during hyperinflationary periods.

Seigniorage in Developed vs. Developing Countries

Seigniorage revenue in developed countries typically arises from moderate inflation and well-established monetary systems, allowing central banks to generate income with minimal economic disruption. In contrast, developing countries often experience higher seigniorage due to reliance on currency emission to finance fiscal deficits, leading to inflationary pressures and economic instability. The disparity in seigniorage impact reflects differing institutional frameworks, inflation targets, and fiscal discipline between developed and developing economies.

The Role of Central Banks in Seigniorage

Central banks play a crucial role in seigniorage by issuing national currency, which allows them to finance government spending without immediate taxation. When a central bank creates new money, it generates revenue from the difference between the face value of the currency and the cost of producing it, effectively funding public expenditures. This process can influence inflation rates and monetary policy, making central bank management of seigniorage vital for economic stability.

Economic Impacts of Seigniorage on Inflation

Seigniorage, the profit made by a government through the issuance of currency, often leads to increased money supply, which can cause inflationary pressures in the economy. When central banks finance budget deficits by creating new money, consumer prices tend to rise as the real value of money decreases. This inflation erodes purchasing power, distorts price signals, and can reduce economic growth if not managed properly.

Seigniorage and Digital Currencies

Seigniorage refers to the profit governments earn by issuing currency, typically the difference between the face value of money and its production cost. In the context of digital currencies, central banks exploring Central Bank Digital Currencies (CBDCs) can generate seigniorage by controlling digital money issuance, reducing reliance on physical currency and its associated costs. This shift enhances monetary policy efficiency while potentially increasing government revenues through digital currency seigniorage.

Comparing Seigniorage: Fiat Money vs. Commodity Money

Seigniorage from fiat money arises when governments issue currency without intrinsic value, profiting from the difference between face value and production cost, enabling flexible monetary policy but risking inflation. In contrast, commodity money like gold generates seigniorage through mining and minting costs, with limited issuance tied to physical reserves, restricting inflationary potential. The comparative advantage of fiat seigniorage lies in its scalability and control over money supply, whereas commodity seigniorage offers stability and intrinsic value backing.

Policy Implications of Seigniorage in Fiscal Management

Seigniorage, the revenue generated by a government through currency issuance, plays a critical role in fiscal management by providing a non-tax source of income that can finance budget deficits. Excessive reliance on seigniorage often leads to inflationary pressures, requiring central banks to carefully balance money supply growth and inflation control to maintain economic stability. Policy implications include the need for coordinated monetary and fiscal policies to prevent hyperinflation and preserve the credibility of government debt management strategies.

example of seigniorage in economy Infographic

samplerz.com

samplerz.com