Zimbabwe experienced hyperinflation during the late 2000s, marked by an annual inflation rate that peaked at an estimated 79.6 billion percent in November 2008. The Reserve Bank of Zimbabwe issued increasingly large denominations of currency, including a 100 trillion Zimbabwean dollar note, reflecting the dramatic collapse in the value of money. Economic output contracted sharply, unemployment soared, and basic goods became scarce as prices spiraled uncontrollably. The hyperinflation crisis was driven by excessive money printing, land reform policies that disrupted agricultural production, and declining investor confidence. In 2009, Zimbabwe abandoned its own currency, adopting the US dollar and South African rand to stabilize the economy. This dollarization helped to halt hyperinflation, restore some market stability, and improve conditions for trade and investment.

Table of Comparison

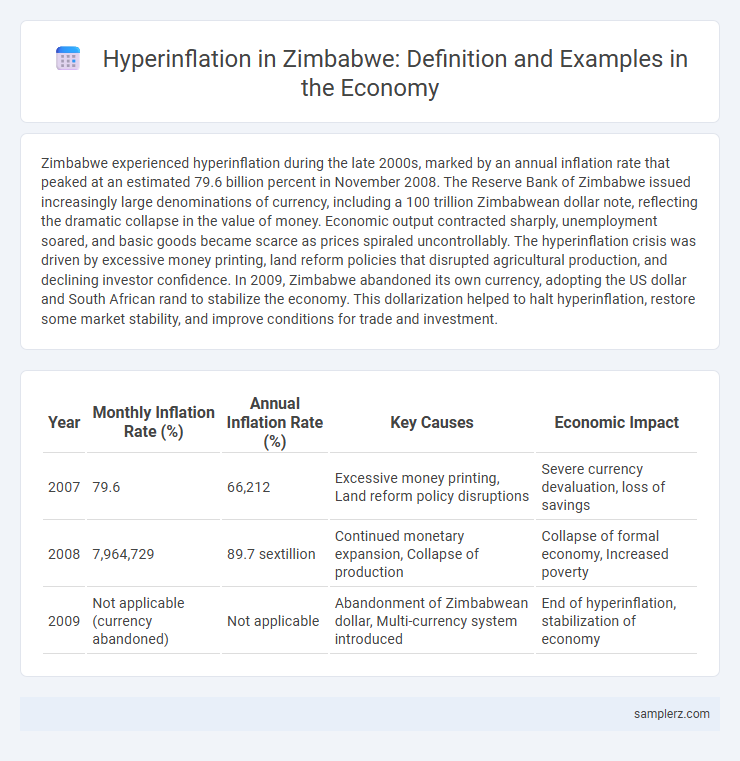

| Year | Monthly Inflation Rate (%) | Annual Inflation Rate (%) | Key Causes | Economic Impact |

|---|---|---|---|---|

| 2007 | 79.6 | 66,212 | Excessive money printing, Land reform policy disruptions | Severe currency devaluation, loss of savings |

| 2008 | 7,964,729 | 89.7 sextillion | Continued monetary expansion, Collapse of production | Collapse of formal economy, Increased poverty |

| 2009 | Not applicable (currency abandoned) | Not applicable | Abandonment of Zimbabwean dollar, Multi-currency system introduced | End of hyperinflation, stabilization of economy |

Introduction to Hyperinflation: The Zimbabwean Case

Hyperinflation in Zimbabwe peaked in November 2008, with an estimated rate of 79.6 billion percent month-on-month, making it one of the most extreme cases globally. The rapid devaluation of the Zimbabwean dollar resulted from excessive money printing, declining agricultural output, and economic mismanagement. This crisis led to the abandonment of the local currency in favor of foreign currencies like the US dollar and South African rand to stabilize the economy.

Causes of Hyperinflation in Zimbabwe

Zimbabwe's hyperinflation was primarily caused by excessive money printing to finance government deficits amid declining agricultural output and economic mismanagement. Land reform policies disrupted commercial farming, reducing exports and foreign currency inflows, which intensified currency devaluation. The loss of investor confidence and collapse of industrial production further fueled the hyperinflationary spiral.

Timeline of Zimbabwe’s Hyperinflation Crisis

Zimbabwe's hyperinflation crisis escalated rapidly from 2007 to 2008, with inflation rates surging from 69% in 2006 to an estimated 79.6 billion percent month-on-month by November 2008. The Reserve Bank of Zimbabwe introduced successive currency redenominations, removing zeros multiple times between 2006 and 2009 to manage the collapsing Zimbabwean dollar. In 2009, Zimbabwe abandoned its currency, officially adopting foreign currencies like the US dollar and South African rand to stabilize its economy and curb hyperinflation.

Currency Devaluation and Its Impact

Zimbabwe experienced hyperinflation reaching 79.6 billion percent month-on-month in November 2008, causing the Zimbabwean dollar to lose nearly all its value. Currency devaluation led to severe price instability, eroding savings and purchasing power for millions of Zimbabweans. The collapse of the local currency forced reliance on foreign currencies, disrupting economic activities and investment confidence across the country.

Daily Life during Zimbabwe’s Hyperinflation

During Zimbabwe's hyperinflation between 2007 and 2008, daily life was severely impacted as prices doubled almost every 24 hours, eroding the value of the Zimbabwean dollar. Basic goods like bread and fuel became scarce, forcing citizens to rely on foreign currencies such as the US dollar and South African rand for everyday transactions. The rampant inflation caused widespread economic instability, making it difficult for families to afford necessities and maintain a stable standard of living.

Role of Government Policies in Exacerbating Inflation

Zimbabwe's hyperinflation in the late 2000s was significantly worsened by government policies that included excessive printing of money to finance budget deficits, undermining currency stability. The Land Reform Program disrupted agricultural productivity, reducing export revenues and leading to severe supply shortages. Price controls and foreign exchange restrictions distorted market mechanisms, further exacerbating inflationary pressures.

The Collapse of Zimbabwean Dollar

Zimbabwe experienced one of the most severe cases of hyperinflation in history, with the Zimbabwean dollar collapsing between 2007 and 2009. Inflation rates peaked at an estimated 79.6 billion percent month-on-month in November 2008, rendering the currency virtually worthless. The government eventually abandoned the Zimbabwean dollar in 2009, adopting multiple foreign currencies to stabilize the economy.

Economic Consequences for Businesses and Citizens

Zimbabwe's hyperinflation peaked at an estimated 79.6 billion percent month-on-month inflation in November 2008, drastically eroding consumer purchasing power and destabilizing the economy. Businesses faced severe challenges including supply chain disruptions, skyrocketing input costs, and the collapse of domestic credit markets, leading to widespread closures and unemployment. Citizens experienced acute hardships as savings became worthless, real wages plummeted, and access to basic goods and services diminished significantly, deepening poverty and economic insecurity.

Lessons from Zimbabwe’s Hyperinflation for Other Economies

Zimbabwe's hyperinflation, peaking at an estimated 79.6 billion percent month-on-month in 2008, highlights the catastrophic effects of unchecked money supply growth and loss of monetary policy credibility. Other economies can learn the crucial importance of maintaining central bank independence, enforcing fiscal discipline, and ensuring currency stability to prevent similar economic collapse. The failure to address structural economic weaknesses alongside inflation control measures exacerbated Zimbabwe's crisis, underscoring the need for comprehensive economic reforms.

Recovery Efforts and Path to Stabilization

Zimbabwe's recovery efforts from hyperinflation included the adoption of a multi-currency system in 2009, which helped stabilize prices and restore public confidence in the economy. The Reserve Bank of Zimbabwe implemented monetary reforms and tightened fiscal policies to control inflation and encourage investment. International support and structural adjustments paved the path to gradual economic stabilization and renewed growth.

example of hyperinflation in Zimbabwe Infographic

samplerz.com

samplerz.com