In the context of a firm's economy, a common example of the principal-agent relationship occurs between shareholders and company executives. Shareholders, as principals, delegate decision-making authority to executives, who act as agents managing the firm's daily operations. This relationship often involves challenges such as information asymmetry, where executives possess more detailed knowledge about the company's performance than shareholders. Principal-agent problems arise when executives prioritize personal goals over shareholder interests, potentially leading to inefficiencies or reduced firm value. Companies implement mechanisms like performance-based compensation and monitoring systems to align the objectives of agents with those of the principals. Efficient resolution of principal-agent issues is critical for improving corporate governance and enhancing overall economic performance of the firm.

Table of Comparison

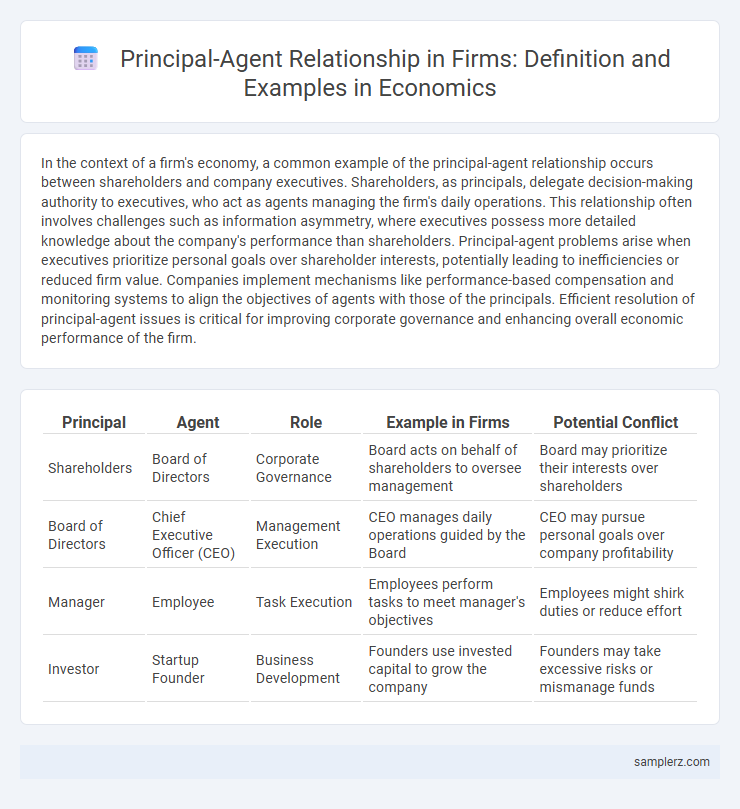

| Principal | Agent | Role | Example in Firms | Potential Conflict |

|---|---|---|---|---|

| Shareholders | Board of Directors | Corporate Governance | Board acts on behalf of shareholders to oversee management | Board may prioritize their interests over shareholders |

| Board of Directors | Chief Executive Officer (CEO) | Management Execution | CEO manages daily operations guided by the Board | CEO may pursue personal goals over company profitability |

| Manager | Employee | Task Execution | Employees perform tasks to meet manager's objectives | Employees might shirk duties or reduce effort |

| Investor | Startup Founder | Business Development | Founders use invested capital to grow the company | Founders may take excessive risks or mismanage funds |

Defining the Principal-Agent Relationship in Firms

The principal-agent relationship in firms occurs when owners (principals) delegate decision-making authority to managers (agents) to run daily operations. This delegation creates potential conflicts due to information asymmetry and differing incentives, prompting mechanisms like performance-based contracts and monitoring systems. Efficient alignment of interests between principals and agents is crucial for maximizing firm value and minimizing agency costs.

Classic Examples of Principal-Agent Problems in Corporations

In corporations, a classic principal-agent problem arises when shareholders (principals) hire managers (agents) to run the company but these managers pursue personal goals that do not align with shareholder wealth maximization. For instance, managers might engage in empire-building by expanding the firm's size beyond optimal levels to increase their power or compensation instead of focusing on profitability. Another example includes information asymmetry where managers possess more company knowledge than shareholders, potentially leading to decisions that benefit managers at the expense of investors.

CEOs and Shareholders: A Core Principal-Agent Dynamic

The principal-agent problem in firms often manifests between shareholders (principals) and CEOs (agents), where shareholders delegate decision-making authority but face challenges in aligning CEOs' actions with their interests. CEOs may pursue personal goals, such as empire-building or excessive risk-taking, rather than maximizing shareholder value, creating agency costs. Effective governance mechanisms, including performance-based compensation and board oversight, are critical to mitigating these conflicts and ensuring optimal firm performance.

Management vs. Employee Incentives: Addressing Misalignment

In firms, principal-agent problems arise when management's objectives diverge from employee incentives, leading to potential inefficiencies. Performance-based compensation and stock options align employee goals with shareholder interests, mitigating agency costs. Transparent communication and robust monitoring systems enhance alignment, fostering productivity and firm value.

Board of Directors as Principals: Monitoring Executive Decisions

The Board of Directors acts as the principal by monitoring executive decisions to align management actions with shareholder interests, reducing agency costs. Through mechanisms like performance evaluations, incentive structures, and regular reporting, the board ensures executives prioritize long-term firm value over personal gains. Effective oversight by the board mitigates information asymmetry and curbs managerial opportunism within corporate governance.

Agency Issues in Franchise Business Models

In franchise business models, agency issues arise when franchisors and franchisees have divergent goals, leading to conflicts over operational control and profit allocation. Franchisees might prioritize local market responsiveness, while franchisors focus on brand consistency and long-term growth, creating principal-agent problems. Effective contract design and monitoring mitigate these agency costs by aligning incentives and reducing information asymmetry.

External Auditors: Reducing Principal-Agent Conflicts

External auditors play a crucial role in mitigating principal-agent conflicts by providing independent assessments of a firm's financial statements, enhancing transparency and trust between management (agents) and shareholders (principals). Their objective evaluations reduce information asymmetry and help align management's actions with shareholder interests, thereby lowering the risk of opportunistic behavior. This external oversight strengthens corporate governance and supports efficient capital allocation within the economy.

Ownership Structure and Agency Costs in Firms

In firms with dispersed ownership structures, principal-agent problems arise due to the separation of ownership and control, leading to increased agency costs as managers may pursue their own interests over shareholders' value. Concentrated ownership, such as family ownership or major institutional investors, often reduces these agency costs by aligning managerial incentives with owners' objectives. Effective corporate governance mechanisms, including performance-based compensation and monitoring by the board, are critical to mitigating agency conflicts and optimizing firm performance.

Performance-Based Compensation as Agency Solution

Performance-based compensation aligns the interests of principals and agents by directly linking executives' pay to measurable firm outcomes such as profit margins, stock performance, and revenue growth. This incentivizes managers to act in shareholders' best interests, mitigating agency problems like moral hazard and adverse selection. Empirical studies demonstrate firms with structured performance-based pay experience higher operational efficiency and shareholder value creation.

Corporate Governance Mechanisms to Mitigate Agency Problems

Corporate governance mechanisms such as independent board directors, performance-based executive compensation, and rigorous financial auditing serve as principal-agent solutions to mitigate agency problems within firms. These tools align the interests of managers (agents) with those of shareholders (principals), reducing information asymmetry and minimizing managerial opportunism. By enhancing transparency and accountability, firms strengthen investor confidence and promote long-term value creation.

example of principal-agent in firm Infographic

samplerz.com

samplerz.com