During a recession, a common example of a liquidity trap occurs when central banks lower interest rates to near zero, yet businesses and consumers avoid borrowing and spending. This scenario is evident in the 2008 financial crisis, where despite aggressive monetary easing, economic activity remained stagnant. Quantitative easing was implemented to increase money supply, but the demand for loans stayed weak, illustrating the liquidity trap. In this situation, the velocity of money declines as people hoard cash instead of investing or consuming, causing economic growth to stall. Inflation expectations fall, pushing interest rates down but failing to stimulate demand. Data from the period shows that even with excess reserves in banks, lending did not pick up, reflecting the deep-rooted uncertainty and lack of confidence in the economy.

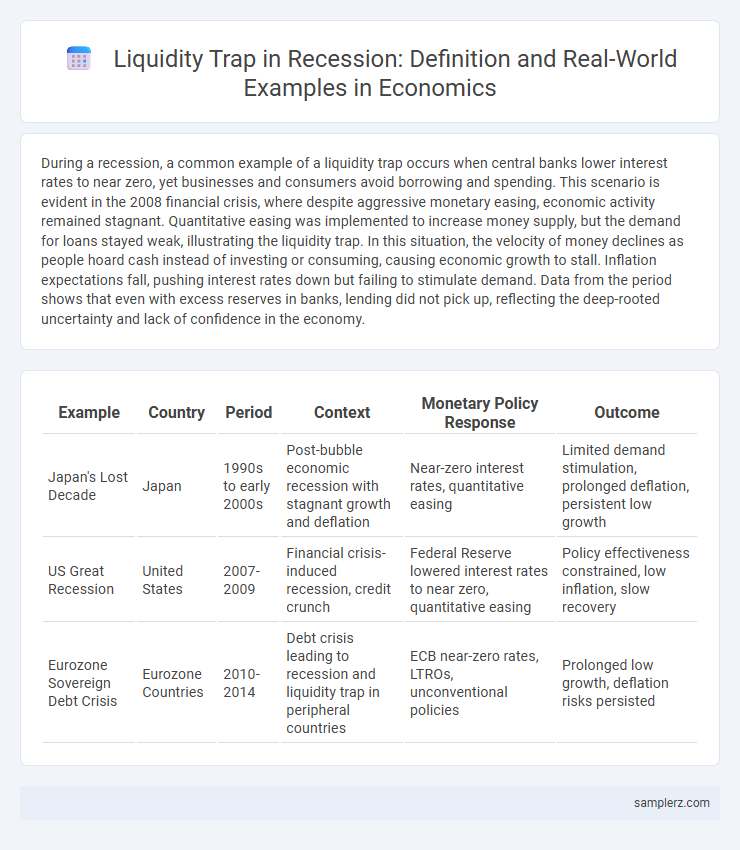

Table of Comparison

| Example | Country | Period | Context | Monetary Policy Response | Outcome |

|---|---|---|---|---|---|

| Japan's Lost Decade | Japan | 1990s to early 2000s | Post-bubble economic recession with stagnant growth and deflation | Near-zero interest rates, quantitative easing | Limited demand stimulation, prolonged deflation, persistent low growth |

| US Great Recession | United States | 2007-2009 | Financial crisis-induced recession, credit crunch | Federal Reserve lowered interest rates to near zero, quantitative easing | Policy effectiveness constrained, low inflation, slow recovery |

| Eurozone Sovereign Debt Crisis | Eurozone Countries | 2010-2014 | Debt crisis leading to recession and liquidity trap in peripheral countries | ECB near-zero rates, LTROs, unconventional policies | Prolonged low growth, deflation risks persisted |

Understanding the Liquidity Trap: Definition and Economic Impact

A liquidity trap occurs when interest rates approach zero, and monetary policy becomes ineffective in stimulating economic growth despite increased money supply. During recessions, consumers and businesses hoard cash instead of spending or investing, leading to stagnant demand and prolonged economic downturns. This phenomenon limits central banks' ability to combat deflation and unemployment, deepening the recessionary impact on the economy.

Historical Examples of Liquidity Traps During Recessions

During the Great Depression of the 1930s, the U.S. economy experienced a classic liquidity trap where interest rates approached zero but investment remained stagnant. Japan faced a prolonged liquidity trap in the 1990s and 2000s, with near-zero interest rates failing to stimulate economic growth despite aggressive monetary policy. More recently, the 2008 global financial crisis led to liquidity trap conditions in several advanced economies, where central banks lowered interest rates to nearly zero without triggering significant increases in lending or spending.

The Great Depression: A Classic Case of Liquidity Trap

During the Great Depression, the U.S. economy experienced a severe liquidity trap as interest rates approached zero, rendering monetary policy ineffective in stimulating demand. Despite the Federal Reserve's attempts to increase the money supply, consumers and businesses hoarded cash due to economic uncertainty and deflation expectations. This stagnation in spending and investment prolonged the recession, highlighting the challenges of escaping a liquidity trap without coordinated fiscal intervention.

Japan’s Lost Decade: Persistent Liquidity Trap in the 1990s

Japan's Lost Decade in the 1990s exemplifies a persistent liquidity trap, where near-zero interest rates failed to stimulate borrowing or investment despite aggressive monetary policy. The Bank of Japan's efforts to spur economic growth through quantitative easing and maintaining ultra-low rates were ineffective due to deflationary expectations and consumer reluctance to spend. This prolonged stagnation highlights the challenges central banks face in overcoming liquidity traps during recessions when traditional tools lose potency.

Liquidity Trap During the 2008 Global Financial Crisis

During the 2008 Global Financial Crisis, central banks, including the Federal Reserve, lowered interest rates near zero yet economic activity remained stagnant, exemplifying a liquidity trap. Despite aggressive monetary easing and quantitative easing measures, consumers and businesses hoarded cash instead of increasing spending or investment. This phenomenon hindered economic recovery by neutralizing traditional monetary policy tools, prolonging the recessionary period.

Central Banks’ Struggles: Low Interest Rates and Ineffective Monetary Policy

During a liquidity trap in recession, central banks face profound challenges as interest rates approach the zero lower bound, rendering traditional monetary policy tools ineffective. Quantitative easing and other unconventional measures often fail to stimulate borrowing and spending, as businesses and consumers prefer holding cash despite low returns. This limits central banks' ability to boost economic activity and prolongs economic stagnation.

Quantitative Easing: Attempts to Escape the Liquidity Trap

Quantitative Easing (QE) emerged as a critical policy tool during recession-induced liquidity traps when conventional monetary policy failed to stimulate demand. Central banks purchased long-term securities to inject liquidity directly into the financial system, aiming to lower interest rates and encourage lending despite near-zero policy rates. Japan's prolonged stagnation in the 1990s and the global response to the 2008 financial crisis highlight QE's role in overcoming liquidity traps by expanding the monetary base and restoring economic activity.

Keynesian Perspectives on Liquidity Traps in Recession

Keynesian perspectives on liquidity traps during recessions highlight situations where interest rates approach zero, rendering monetary policy ineffective in stimulating investment and consumption. In such scenarios, despite central banks increasing money supply, demand for liquidity remains high as consumers and businesses prefer holding cash over spending or investing. This phenomenon was evident during the Great Depression and Japan's "Lost Decade," where liquidity traps prolonged economic stagnation despite aggressive monetary easing.

Consequences for Unemployment and Deflationary Pressures

Liquidity traps during recessions significantly increase unemployment as businesses face reduced consumer spending and investment stagnates despite low interest rates. This environment generates deflationary pressures, where falling prices discourage consumption and wages, further deepening economic stagnation. Prolonged liquidity traps challenge monetary policy effectiveness, leading to persistent joblessness and suppressed inflation.

Policy Solutions and Lessons from Previous Liquidity Trap Episodes

During a liquidity trap in recession, conventional monetary policy loses effectiveness as interest rates approach zero, prompting central banks to adopt unconventional measures such as quantitative easing and negative interest rates. Historical instances like Japan's Lost Decade and the 2008 Global Financial Crisis demonstrate the importance of coordinated fiscal stimulus and clear forward guidance to restore confidence and stimulate demand. Lessons emphasize the critical role of government intervention in fiscal policy and the need for timely, bold policy actions to escape prolonged economic stagnation.

example of liquidity trap in recession Infographic

samplerz.com

samplerz.com