The Tobin tax is a financial transaction tax aimed at reducing short-term currency speculation. An example of this tax in action can be seen when countries impose a small levy, such as 0.1%, on foreign exchange trades. This tax discourages rapid, high-volume trading and encourages more stable, long-term investments in the currency markets. Data from countries that have experimented with Tobin tax show a measurable decrease in speculative transactions. For instance, Sweden implemented a financial transaction tax in the 1980s, which led to a significant drop in stock market trading volumes. Economic analyses suggest that such taxes can increase market stability while generating additional government revenue.

Table of Comparison

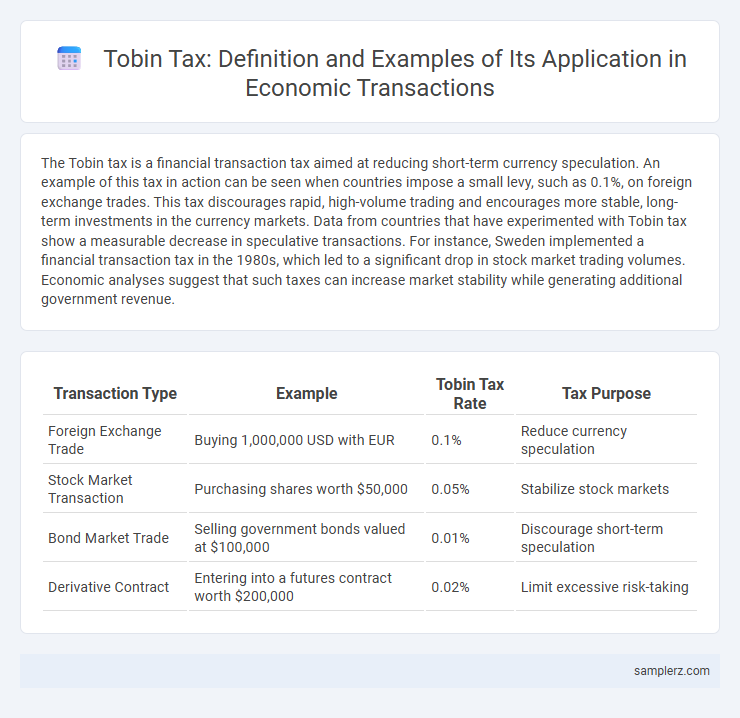

| Transaction Type | Example | Tobin Tax Rate | Tax Purpose |

|---|---|---|---|

| Foreign Exchange Trade | Buying 1,000,000 USD with EUR | 0.1% | Reduce currency speculation |

| Stock Market Transaction | Purchasing shares worth $50,000 | 0.05% | Stabilize stock markets |

| Bond Market Trade | Selling government bonds valued at $100,000 | 0.01% | Discourage short-term speculation |

| Derivative Contract | Entering into a futures contract worth $200,000 | 0.02% | Limit excessive risk-taking |

Introduction to the Tobin Tax Concept

The Tobin tax is a small levy imposed on currency transactions to reduce short-term speculation and increase market stability. Named after economist James Tobin, the tax targets foreign exchange trades to discourage excessive volatility and promote long-term investment. Implementation aims to generate government revenue while curbing destabilizing financial flows in the global economy.

Historical Roots and Development of the Tobin Tax

The Tobin tax, proposed by economist James Tobin in 1972, was designed to curb excessive speculation in foreign exchange markets by imposing a small levy on all currency transactions. Originating during a period of significant volatility following the collapse of the Bretton Woods system, this tax aimed to stabilize exchange rates and reduce short-term market fluctuations. Over time, the Tobin tax concept influenced modern financial transaction taxes implemented in various countries to promote economic stability and discourage high-frequency trading.

Key Objectives of Implementing Tobin Tax

The implementation of the Tobin tax aims to reduce excessive currency speculation by imposing a small levy on foreign exchange transactions, stabilizing exchange rates and curbing market volatility. Key objectives include generating government revenue while discouraging short-term speculative trading that can destabilize economies. By promoting financial market stability, the Tobin tax supports sustainable economic growth and reduces systemic risk in global financial systems.

Real-World Examples of Tobin Tax Application

The Tobin tax has been implemented in Chile since the 1990s, targeting foreign exchange transactions to curb speculative trading and stabilize the peso. The European Union proposed a Financial Transaction Tax inspired by the Tobin tax to apply a small levy on stock, bond, and derivatives trades, aiming to reduce market volatility and generate public revenue. Sweden experimented with a financial transaction tax in the 1980s but repealed it due to capital flight and decreased trading volume, illustrating challenges in Tobin tax application.

Case Study: Sweden’s Financial Transaction Tax Experience

Sweden implemented a financial transaction tax in the 1980s targeting stock trades to curb speculative trading and stabilize the market. The tax led to a significant decline in trading volume on Swedish exchanges, with investors shifting activities to untaxed foreign markets, ultimately resulting in a loss of market liquidity. This case study highlights the impact of Tobin tax-like measures on market behavior and the challenges of implementing financial transaction taxes in integrated global markets.

Example: The European Union’s Proposed Tobin Tax

The European Union's proposed Tobin tax targets financial transactions, imposing a small levy on trades such as stocks, bonds, and derivatives to reduce market volatility and discourage speculative trading. This tax aims to generate substantial revenue while stabilizing financial markets by making short-term transactions more costly. By applying a rate of approximately 0.1% on stock trades and 0.01% on derivatives, the EU intends to mitigate financial risks without significantly hindering long-term investment flows.

The Tobin Tax in Emerging Markets: Practical Insights

The Tobin Tax, a small levy on currency transactions, aims to reduce excessive volatility in emerging markets by discouraging speculative short-term trading. In practice, countries like Brazil and South Korea have implemented versions of this tax to stabilize their forex markets, resulting in reduced speculative inflows and increased revenue for public spending. Empirical studies highlight that even low rates--around 0.1%--can significantly temper currency fluctuations and promote long-term investment stability.

Economic Impacts Observed from Tobin Tax Implementation

The Tobin tax, a small levy on currency transactions, aims to reduce speculative trading and stabilize financial markets. Countries implementing the Tobin tax have observed decreased volatility in foreign exchange markets and increased government revenues from transaction fees. However, some studies indicate potential downsides, such as reduced market liquidity and possible shifts of trading activities to untaxed markets.

Challenges and Criticisms of Tobin Tax in Practice

Implementing the Tobin tax faces challenges such as difficulty in global coordination, leading to tax evasion through offshore transactions. Critics argue the tax may reduce market liquidity and increase volatility by discouraging legitimate short-term trades. Empirical studies suggest the administrative costs and potential for unintended economic distortions limit the effectiveness of Tobin tax in real-world financial markets.

Future Prospects for Tobin Tax in Global Transactions

The Tobin tax, initially designed to curb excessive currency speculation, holds promising future prospects in stabilizing global financial markets by reducing volatility in international transactions. Implementing a small levy on cross-border currency exchanges can generate significant revenue for governments while discouraging high-frequency trading that often leads to market disruptions. Emerging digital transaction platforms and growing international cooperation signal potential for broader adoption of the Tobin tax, enhancing economic stability and funding development initiatives worldwide.

example of Tobin tax in transaction Infographic

samplerz.com

samplerz.com