Inflation targeting is a monetary policy strategy where central banks set explicit inflation rate goals to maintain price stability. The Reserve Bank of New Zealand pioneered this approach in 1990, aiming for an inflation target of 1-3% annually. By using interest rate adjustments, the central bank influences economic activity to keep inflation within the desired range. This policy framework relies on transparent communication and data-driven decisions to anchor inflation expectations. The Bank of England adopted inflation targeting in 1992 with a 2% target, enhancing accountability and policy effectiveness. Empirical evidence shows countries employing inflation targeting often experience stable inflation and steady economic growth.

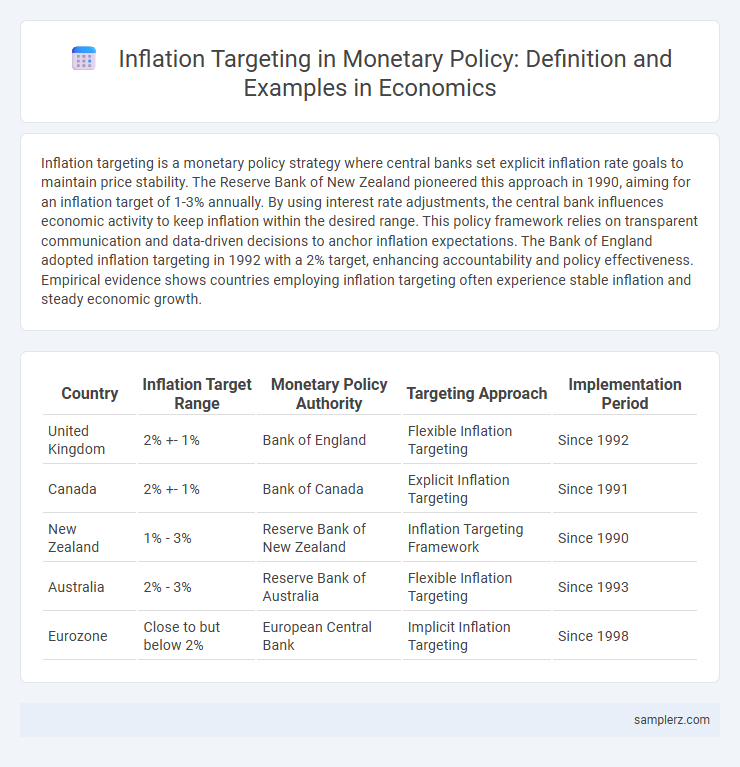

Table of Comparison

| Country | Inflation Target Range | Monetary Policy Authority | Targeting Approach | Implementation Period |

|---|---|---|---|---|

| United Kingdom | 2% +- 1% | Bank of England | Flexible Inflation Targeting | Since 1992 |

| Canada | 2% +- 1% | Bank of Canada | Explicit Inflation Targeting | Since 1991 |

| New Zealand | 1% - 3% | Reserve Bank of New Zealand | Inflation Targeting Framework | Since 1990 |

| Australia | 2% - 3% | Reserve Bank of Australia | Flexible Inflation Targeting | Since 1993 |

| Eurozone | Close to but below 2% | European Central Bank | Implicit Inflation Targeting | Since 1998 |

Definition and Principles of Inflation Targeting

Inflation targeting is a monetary policy strategy where central banks set a specific inflation rate as the primary goal to maintain price stability and foster economic growth. Key principles include the transparency of inflation targets, accountability of the central bank, and the use of interest rate adjustments to keep inflation within the predefined range, typically around 2%. This approach helps anchor inflation expectations, reduces uncertainty, and guides economic decision-making in both financial markets and the broader economy.

Historical Background of Inflation Targeting

Inflation targeting as a monetary policy framework originated in New Zealand in 1990, pioneering the practice of explicitly setting and publicly announcing an inflation target to guide expectations and improve economic stability. This approach gained traction in the 1990s as central banks in countries such as Canada, the United Kingdom, and Sweden adopted similar frameworks to anchor inflation expectations and enhance transparency. Empirical studies suggest that inflation targeting contributed to lower and more stable inflation rates, fostering improved credibility and predictability in monetary policy across diverse economies.

Key Components of Inflation Targeting Framework

The inflation targeting framework primarily relies on setting a clear numerical inflation rate target, typically around 2%, to stabilize prices and anchor public expectations. Central banks utilize transparent communication and forward-looking monetary policy instruments, such as interest rate adjustments, to achieve and maintain this target. Crucial components include a well-defined target, credible commitment by policymakers, flexible response to economic shocks, and regular public reporting to reinforce accountability and guide market behavior.

Successful Global Examples of Inflation Targeting

New Zealand pioneered inflation targeting in the early 1990s, achieving price stability by setting explicit inflation rate targets between 1% and 3%. The Bank of England adopted a similar framework in 1992, which has since contributed to maintaining inflation close to the 2% goal and supporting economic growth. Canada's inflation targeting approach, established in 1991, has enhanced transparency and anchored inflation expectations, fostering a stable microeconomic environment.

Case Study: Inflation Targeting in the United Kingdom

The United Kingdom implemented inflation targeting in 1992, setting a target inflation rate of 2% as measured by the Consumer Price Index (CPI). The Bank of England gained operational independence in 1997, allowing it to adjust interest rates to maintain price stability and anchor inflation expectations. This monetary policy framework contributed to reduced inflation volatility and supported economic growth over the following decades.

Inflation Targeting Experience in New Zealand

New Zealand pioneered inflation targeting in 1990 by setting an explicit 1-3% annual inflation rate goal to stabilize prices and anchor expectations. The Reserve Bank of New Zealand's transparent policy framework and flexible inflation targeting approach contributed to sustained low inflation and economic stability. This experience has influenced central banks worldwide to adopt inflation targeting as a credible and effective monetary policy strategy.

Adoption of Inflation Targeting in Emerging Markets

Emerging markets such as Brazil, South Africa, and Indonesia have adopted inflation targeting frameworks to stabilize price levels and anchor inflation expectations. Central banks in these countries typically set explicit inflation targets, often around 3-5%, using interest rate adjustments as their primary policy tool. This approach has improved macroeconomic stability and enhanced the credibility of monetary policy in economies with historically volatile inflation rates.

Challenges in Implementing Inflation Targeting

Inflation targeting in monetary policy faces challenges such as accurately forecasting inflation amid volatile economic conditions and external shocks like commodity price fluctuations. Central banks must balance between stabilizing prices and supporting economic growth, often encountering lag effects in policy implementation. Maintaining credibility and managing public expectations remain critical to the success of inflation targeting frameworks.

Impact of Inflation Targeting on Economic Stability

Inflation targeting, as implemented by central banks like the Federal Reserve and the Bank of England, helps anchor inflation expectations and reduces uncertainty in the economy. By maintaining inflation rates within a predetermined range, this monetary policy framework fosters stable prices, which supports sustained economic growth and employment. Empirical studies show countries with clear inflation targets experience lower inflation volatility and improved macroeconomic stability compared to those without explicit targets.

Future Trends in Inflation Targeting Policies

Central banks worldwide are increasingly integrating flexible inflation targeting frameworks, allowing for temporary deviations to support economic growth and employment. Technological advancements in data analytics enable more precise inflation forecasts, enhancing policy responsiveness and effectiveness. Emerging trends also emphasize incorporating climate-related risks and digital currencies into inflation targeting to address future economic challenges.

example of Inflation targeting in monetary policy Infographic

samplerz.com

samplerz.com